- The pandemic prompted people to move, accelerating migration to low-tax states

- In recent years, states have been emphasizing tax relief to their benefit

- High-tax states should take note of the loss of workers and businesses and enact tax reform to improve their competitiveness

Covid As a Catalyst

The Covid-19 pandemic underscored the ongoing trend of migration from high- to low-tax states.

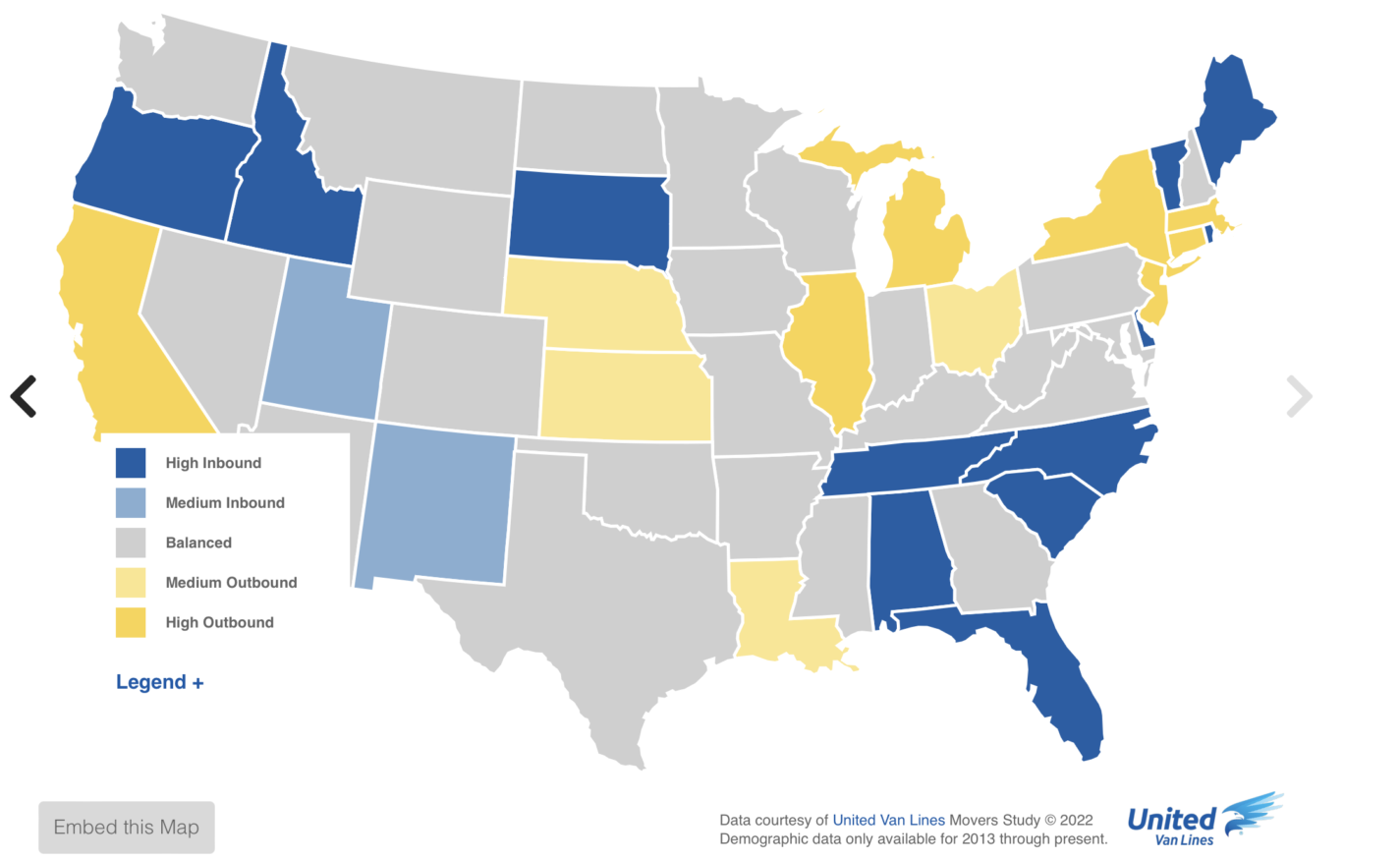

Moving companies like Pods, HireAHelper, and United Van Lines provided detailed analyses of these trends that parallel data from the Census Bureau. The National Movers Study from United Van Lines ranked the states with the highest share of in-migration and those with the most out-migration.

The bottom line: people moved to more affordable areas. Migration patterns indicate people also moved to less dense areas, which are generally more affordable.

Affordability is linked to a state’s tax climate.

Of course, taxes are not the only contributing factor to a move. But affordable regions are often a direct result of low taxes, especially low business taxes, which foster faster increases in jobs and wages. Other related factors might include education opportunities, family, weather, state culture, and crime rates. United Van Lines found proximity to family to be a major factor contributing to moves.

Moves in 2021 were also likely affected by varying degrees of lockdowns in a given area. Lockdowns in cities and many high-tax states were much more dictatorial, expensive, and evidently unpopular.

Migration among the states in 2021

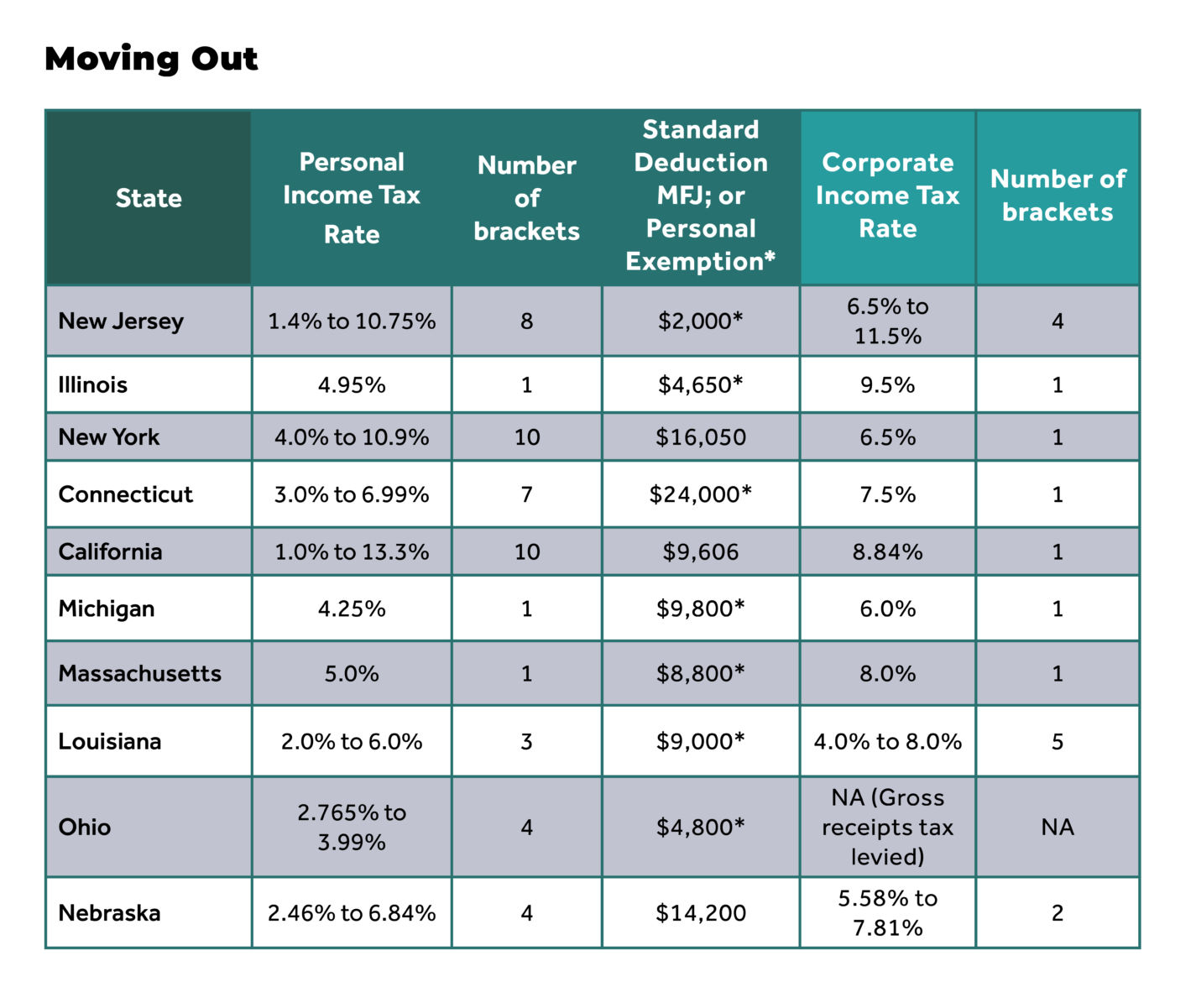

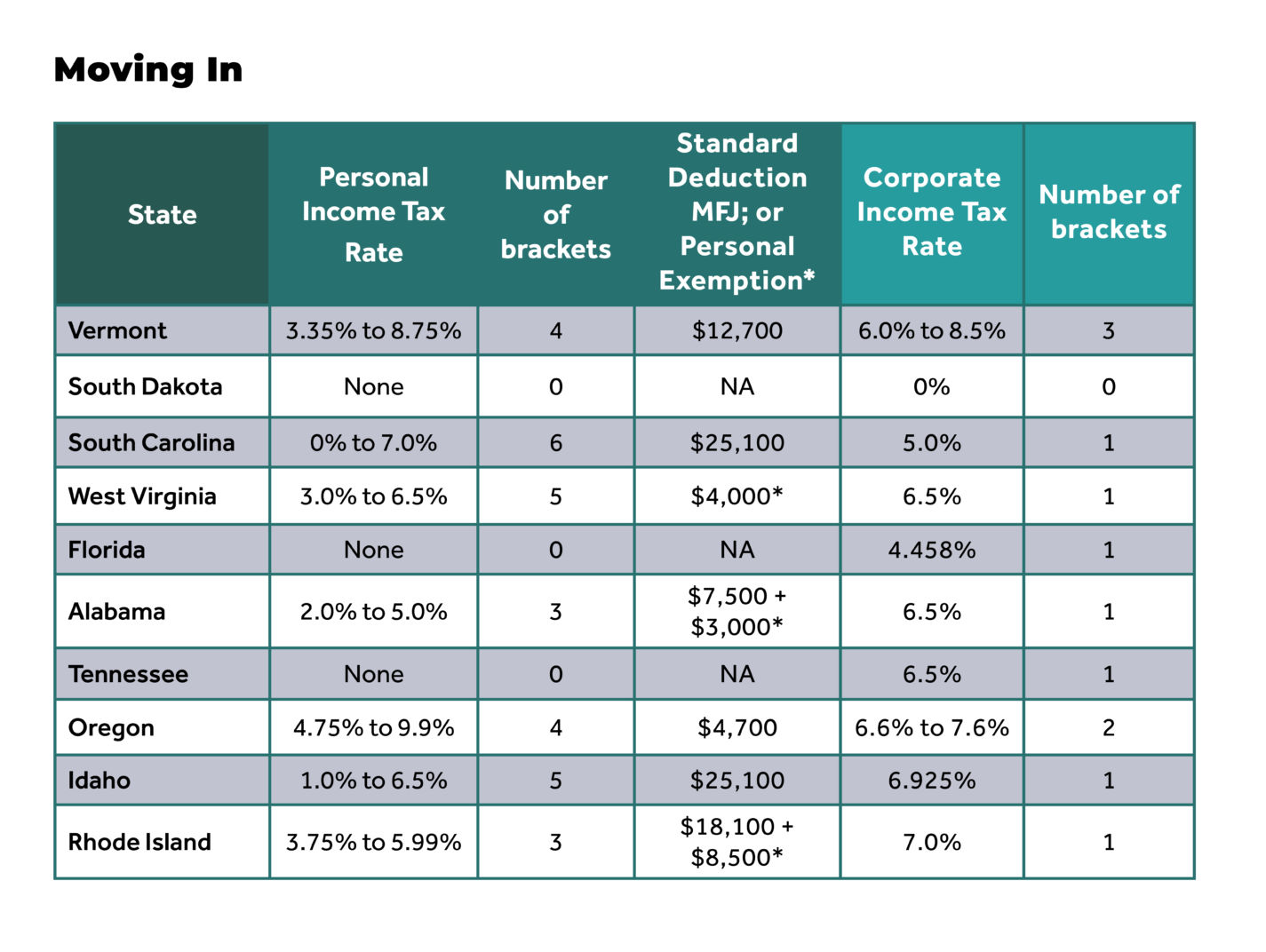

Even so, the above map from United Van Lines shows people are leaving high-tax states. Using their 2021 tax information, the below tables show the tax climates for the ten highest inbound and ten highest outbound states from the United Van Lines survey.

Tax climates for the top 10 highest outbound and inbound states

Tax Reform Momentum

State taxes are far from static. Thankfully for taxpayers, competition among states is heating up. In 2022, ten states enacted reductions in their personal income taxes.

Lowering personal income taxes puts more money back in workers’ pockets and protects small businesses. Reducing income brackets to a single-rate structure is good for simplicity’s sake, but it also protects against unnecessary tax increases on rising incomes and makes for more stable revenues. Reducing corporate taxes benefits workers. Companies don’t pay taxes — people do in the form of lower wages and fewer jobs or hours worked.

Six states reduced their corporate income taxes in 2022. State governments are flush with cash due to immense federal aid to address the Covid-19 pandemic, inflation, and an economy emerging from lockdown. Returning at least part of this money to the taxpayer via tax cuts is smart reform.

Among those enacting reform, four of the high net outbound states reduced income taxes, perhaps in an effort to stem the tide of population loss:

- New York accelerated its personal income tax rate cuts originally passed in 2016.

- Nebraska reduced its top personal and corporate income tax rates.

- Ohio eliminated two personal income tax brackets and decreased the rates by 3% across the board.

- Louisiana lowered each of its personal income tax rates and consolidated and reduced its corporate income tax rates.

Of the highest inbound migration states, four also reduced income taxes.

- Idaho reduced the rate of its top two personal income tax rates and consolidated its brackets from five to four. Idaho also reduced its corporate income tax.

- Tennessee became the eighth state with no personal income tax in 2021.

- Florida lowered its corporate income tax rate.

- South Carolina lowered the state’s top personal income tax rate and consolidated its brackets from six to three.

North Carolina, one of the states with a high net in-migration, has made incredible efforts to transform its tax code. The conservative leadership of the past decade has saved taxpayers billions. Once complex and high, our tax code is now simple and low.

This trend should warn high tax states: reform your tax code or risk an exodus of workers.

An increase in remote-work options has also made some, primarily higher-income, workers more mobile. High-tax states risk losing these mobile workers to states with more affordable options.

Conclusion

Covid was undoubtedly a catalyst for migration. People moved closer to families and away from cities. Taxes are just one reason a state might attract people, but they’re a big one. And high taxes are a deterrent.

Workers respond to a competitive tax environment. And if taxes are levied to raise revenue for only the proper functions of government, the government will be inherently small. A proper government is limited, stays out of people’s business, and requires less revenue from the public.

As a downstream effect, people vote with their feet. They will create businesses and start families in states that better respect their hard work.