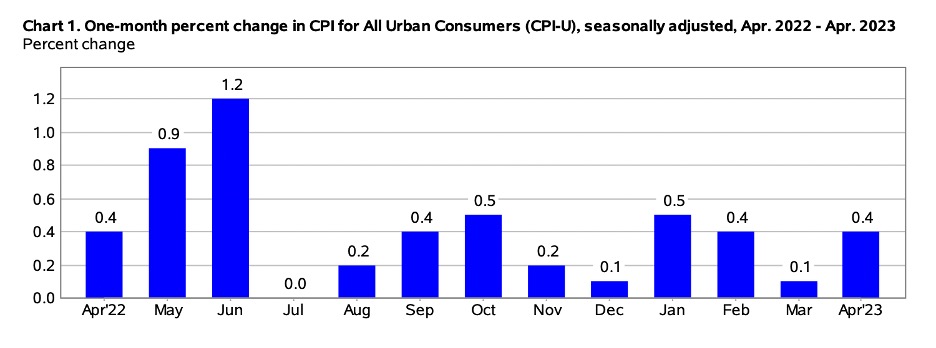

The Consumer Price Index (CPI) rose 0.4% in April after increasing 0.1% in March according to the latest release from the Bureau of Labor Statistics.

CPI has increased each month of the last year with the exception of July when the rate remained flat.

On an annual basis, inflation increased 4.9%, before seasonal adjustment. Some news outlets were quick to claim inflation is cooling “to levels not seen in two years.” Though this is nominally true that the annual rate is decreasing, we are still experiencing high inflation by historical standards. Moreover, the 4.9% annual increase is compared to last April’s elevated baseline. The April 2022 CPI report showed an annual increase of 8.3%.

Core inflation, which excludes volatile food and energy prices, rose 0.4% in April, matching the increase last month. Core inflation rose 5.5% over the year.

The food index did not change over the month, but is still up 7.7% over the year. Food away from home increased 0.4% over the month and is 8.6% higher than last year. The shelter index increased 0.4% over the month and 8.1% over the year.

The gasoline index increased 3.0% over the month but is down 12.2% over the year. National gas prices are currently $3.53 per gallon for regular gas, whereas last year’s average was $4.37 according to AAA. In 2019, average gas prices in May were $2.82.

Since President Biden took office less than two and a half years ago, purchasing power has decreased by roughly 15%. If you spent $500 in January 2020, you’d have to spend $589 today for the same basket of goods. Moreover, real average hourly earnings increased 0.1% over the month but are still down 0.5% on an annual basis. Wages are not keeping up with inflation.

Last week the Federal Reserve increased interest rates for the 10th time since March of 2022. Though the recent rate hikes have become smaller, future actions by the Fed remain unclear. The Fed’s stated goal is to return to 2% inflation.

Solving inflation was never going to be easy or painless. Our government’s massive fiscal response to the Covid pandemic resulted in an economy bloated with cheap money. American families are poorer today than when President Biden took office – a direct result of the reckless government spending and money printing that caused inflation.