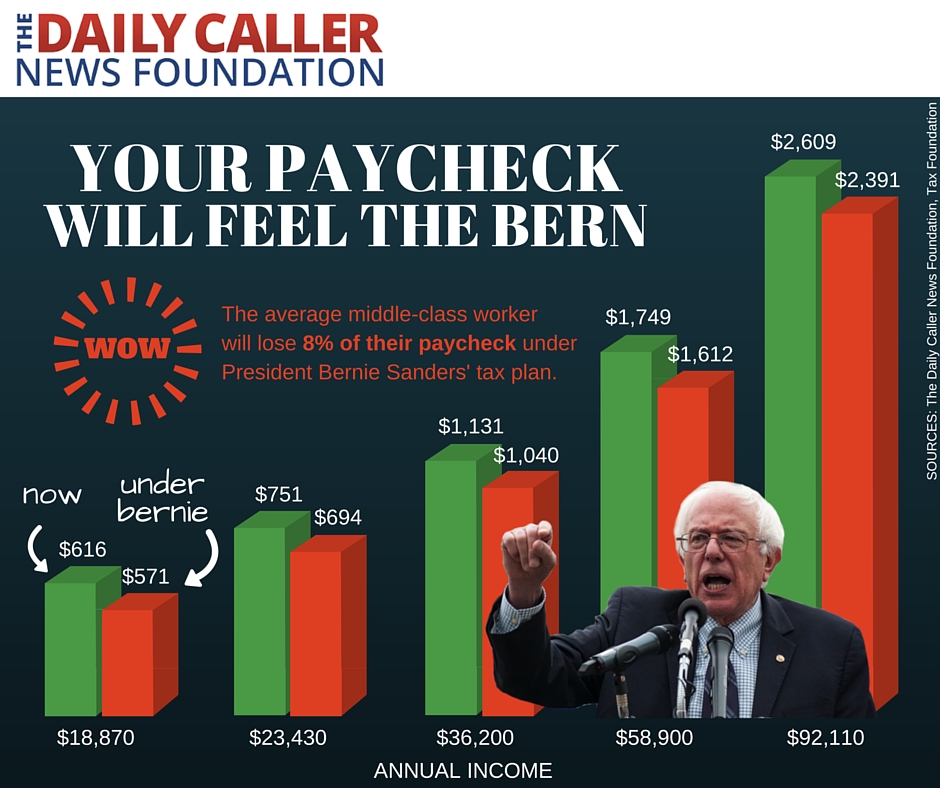

Juliegrace Brufke of the Daily Caller spotlights a new chart that shows how Democratic presidential candidate Bernie Sanders’ policies would affect your paychecks.

While the self-described Democratic socialist said his economic proposals would provide free college, Medicare for all and a slew of other new welfare programs, the cost of the expansion of government is far steeper than he is letting on.

Sanders, who has said moving people out of poverty is critical for the success of the country, would tax Americans from top to bottom to carry out his plan. Indeed, with Sanders in the White House, every income bracket – including the lowest bracket – would lose at least 7 percent off what they take home.

Scott Greenberg, an analyst at the Tax Foundation, a nonpartisan Washington, D.C.-based think tank, took a look, focusing on a hypothetical single filer with no children using the standard deduction. In the bottom 10 percent of earners, an American making $18,870 a year would see a $45 drop – or, 7.3 percent reduction – bringing their paycheck from from $616 down to $571 every other week.

An individual in the lower-middle income range taking in $23,430 would take a 7.6 percent hit, with their checks falling from $751 to $694.

A middle-income earner now taking in $36,200 a year – placing them in 50th percentile, when looking at 2015’s wage data – would see an 8 percent reduction, with their bi-weekly income slumping from $1,131 down to $1,040. Someone in the 75th percentile, with an annual salary of $58,900, would be hit with a 7.9 percent reduction.