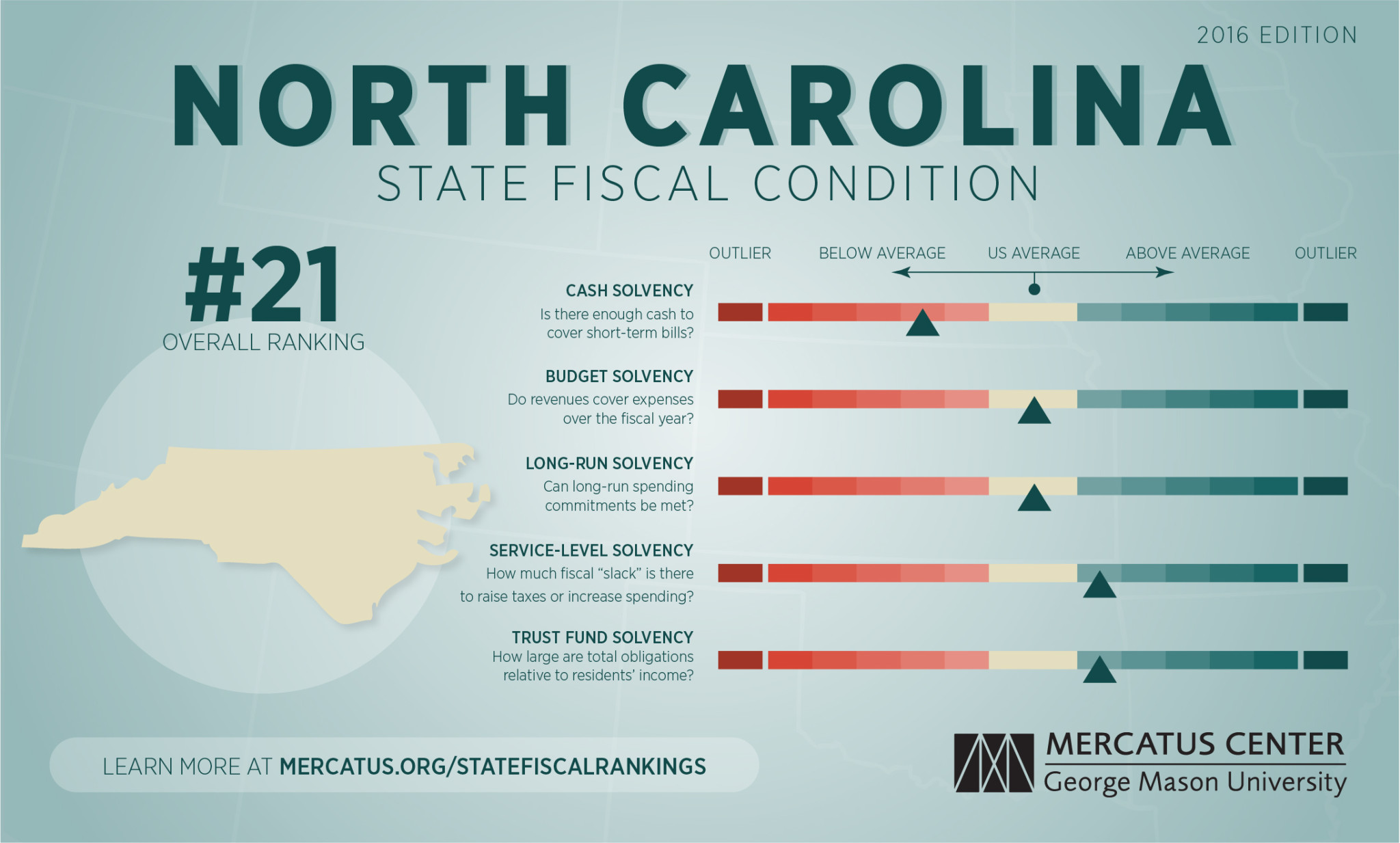

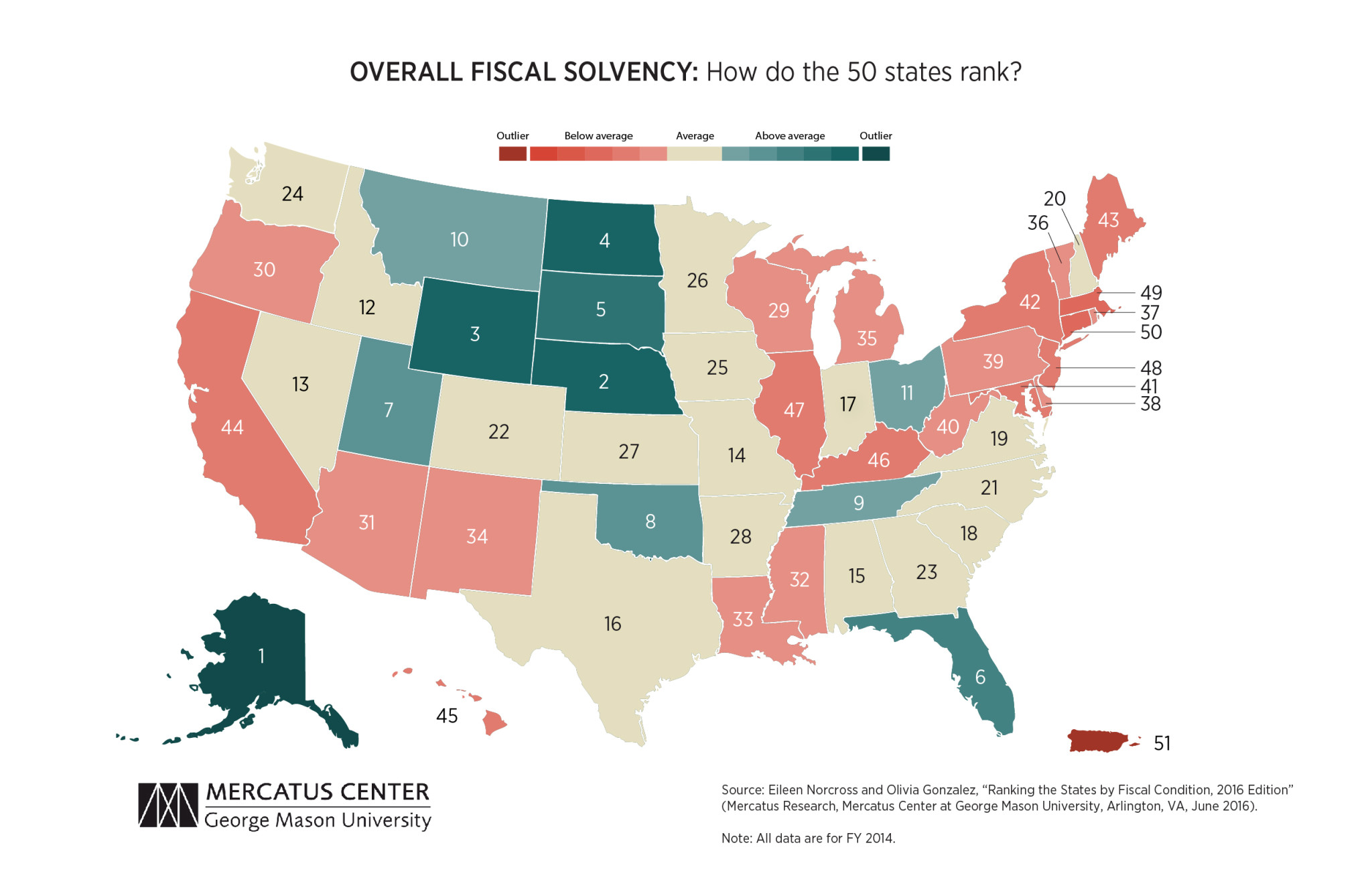

North Carolina ranks just above the middle of the pack among the states — at No. 21 — when it comes to fiscal solvency. That’s according to a new report from the Mercatus Center at George Mason University.

North Carolina ranks just above the middle of the pack among the states — at No. 21 — when it comes to fiscal solvency. That’s according to a new report from the Mercatus Center at George Mason University.

On a cash basis, North Carolina has between 0.93 and 2.09 times the cash needed to cover short-term liabilities. Revenues exceed expenses by 10 percent, producing a surplus of $401 per capita. On a long-run basis, North Carolina has no assets remaining after paying for debts. It also has a low long-term liability ratio, with total liabilities accounting for 19 percent of total assets. Total debt is $8.59 billion. Unfunded pension liabilities are $72.50 billion on a guaranteed-to-be-paid basis, and other postemployment benefits (OPEB) are $25.64 billion. These three liabilities are equal to 28 percent of state personal income.