Just how are disaster damage estimates prepared? Lawmakers as well as ordinary citizens have reason to be skeptical. A previous Spotlight provided evidence of many mathematical and conceptual errors in the Hunt administration’s request for federal emergency funds. There was “no particular mathematical formula” was the answer from state officials when asked to explain a $21 million request for federal emergency child-care aid. Funds for damaged airports and grants for newly poor college students seem to have similar, shaky foundations. Overall, the state’s request to Washington was unreasonably inflated by hundreds of millions of dollars.

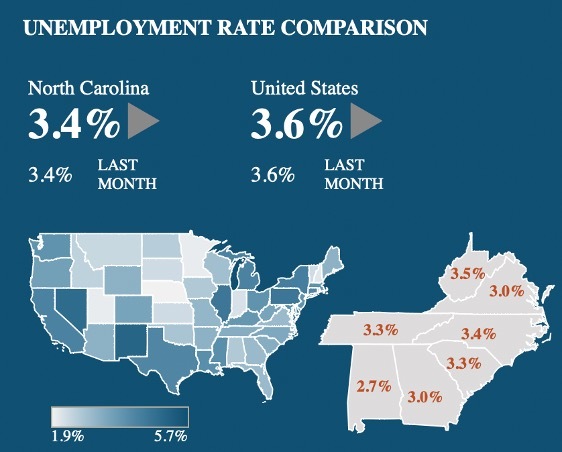

Other key forecasts have also proven to be off the mark. Unemployment has not risen significantly, and serious health problems due to contaminated wells have not materialized. Numerous federal, state, and local officials have been working on the relief process for three months, and while estimating the damage may be a challenging task, these and other overstated estimates have not yet been revised.

The $830 million package currently being presented to the legislature also has problems. Does the governor believe that homeowners in the flood plain should actually receive 163 percent of the average value of their homes? His plan for supplementing the Federal Hazard Mitigation Grant Program (HMGP) would establish this precedent. What about the environment? A $245 million request to Congress has now become a $28 million state program. Should environmental needs be a higher priority than aid for businesses already qualified for a Small Business Administration loan?

If legislators were to trim the package to a more reasonable amount, they could use the rainy day fund to repay $240 million in illegal intangibles taxes. What follows is a point-by-point analysis of the Hunt proposal and a Locke Foundation alternative.

Other key forecasts have also proven to be off the mark. Unemployment has not risen significantly, and serious health problems due to contaminated wells have not materialized. Numerous federal, state, and local officials have been working on the relief process for three months, and while estimating the damage may be a challenging task, these and other overstated estimates have not yet been revised.

The $830 million package currently being presented to the legislature also has problems. Does the governor believe that homeowners in the flood plain should actually receive 163 percent of the average value of their homes? His plan for supplementing the Federal Hazard Mitigation Grant Program (HMGP) would establish this precedent. What about the environment? A $245 million request to Congress has now become a $28 million state program. Should environmental needs be a higher priority than aid for businesses already qualified for a Small Business Administration loan?

If legislators were to trim the package to a more reasonable amount, they could use the rainy day fund to repay $240 million in illegal intangibles taxes. What follows is a point-by-point analysis of the Hunt proposal and a Locke Foundation alternative.

- State Acquisition & Relocation Fund Approximately 5,573 homeowners with damaged homes are eligible for a federal buyout (with a state match of 25 percent). The average pre-flood market value of the homes is $40,000. The Hunt plan calls for giving these homeowners an additional supplement of $25,000, or 63 percent of the value. This is far too much money and will inflate aid expectations from other victims. An average state supplement of 25 percent would be more reasonable.

- Grants to Successful SBA Loan Applicants The federal government has already determined eligibility for loans based on income and risk of repayment. The state has no proper or necessary role in second-guessing the terms of these loans.

- Replacement and Repair Grants for Low-Income Families Helping the 11,127 poor families in this category with an average grant of $5,385 is a reasonable state expenditure to relieve immediate suffering from the disaster.

- Rental Assistance An estimated 5,427 damaged rental units will be bought by Washington with the state paying 25 percent of the market value. The administration proposes a $3,000 grant for “relocation assistance” for each of these renters. But there is ample lead time for owners and renters to prepare for orderly lease terminations. The state role should be to provide only low-income renters with a far smaller grant of $1,000 for moving expenses and damaged personal property.

- Infrastructure Hunt proposes state aid to hook up new homes to water, sewer, and roads. Infrastructure connections are normally the responsibility of builders and are included in the price of a new home. There is no proper state role here.

- Aid to Local Governments: Housing Inspectors This is a reasonable temporary assistance to local governments.

- Land Acquisition/Capacity Building These grants for localities and nonprofits would be unnecessary and easily abused.

- Housing Counselors One year, not 30 months, of aid to coordinate flood aid should be more than adequate.

- Housing Recovery Council One year, not 39 months, of aid to coordinate flood aid should be more than adequate.

- Small Business Disaster Assistance The administration proposes that state taxpayer dollars be used to provide deferred-payment, no-interest, three-year loans to small and medium-sized businesses ineligible for SBA loans. But these firms are obviously risky propositions at best. If the state insists on aid, they should do it by guaranteeing private loans only.

- State-Paid Interest for SBA Loan Recipients Unnecessary since the SBA has already evaluated their financial condition.

- Grants to Farmers, Crop Loss, and Farm Structures Agricultural subsidy and finance has evolved into a federal program. While this trend is questionable, the result has been hundreds of millions of dollars in grants and loans in the wake of the hurricane. The state has no proper role in propping up marginal farming enterprises with additional aid.

- Emergency Conservation Program Cost Share This is an environmental concern that is a reasonable state responsibility.

- Peanut, Cotton Quality; Growers Association Assessment A special provision outside the proper scope of state relief. Growers are already eligible for federal aid.

- Grants to Commercial Fishers to Offset Fishing Harvest Loss While many commercial fishing operations may have been temporarily affected by the storm, so were many other businesses. Fish inventories were not permanently reduced.

- Tourism Marketing Funds Little evidence exists of a widespread threat to tourism due to the storms.

Conclusion

All together, the legitimate needs total just over $400 million, which is easily affordable using existing state budget savings without tapping the rainy day fund (see table). Past experience argues for skepticism and due diligence in considering “emergency relief” requests.

Don Carrington, Vice President