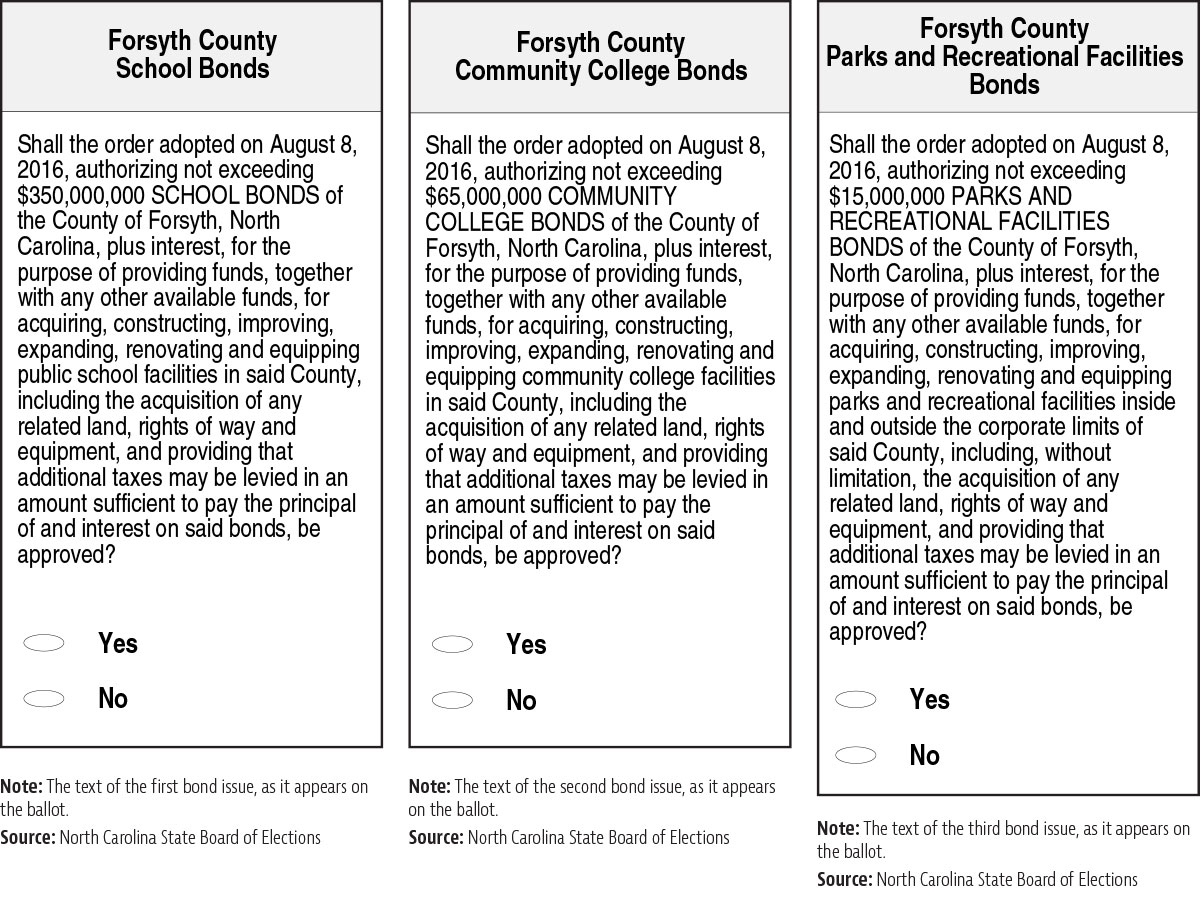

Forsyth County residents will be voting next week on a set of bond issues totaling $430 million. The largest one is $350 million for local schools, but there are two others as well: $65 million for the community college and $15 million for county parks and recreational facilities.

Bonds are debt. Essentially, they’re loans taken out by the county to finance projects for which the county doesn’t currently have sufficient cash. Of course, this means that the bonds have to be repaid with interest, so bonds are usually accompanied by some sort of tax increase. This set of Forsyth County bond issues is no exception.

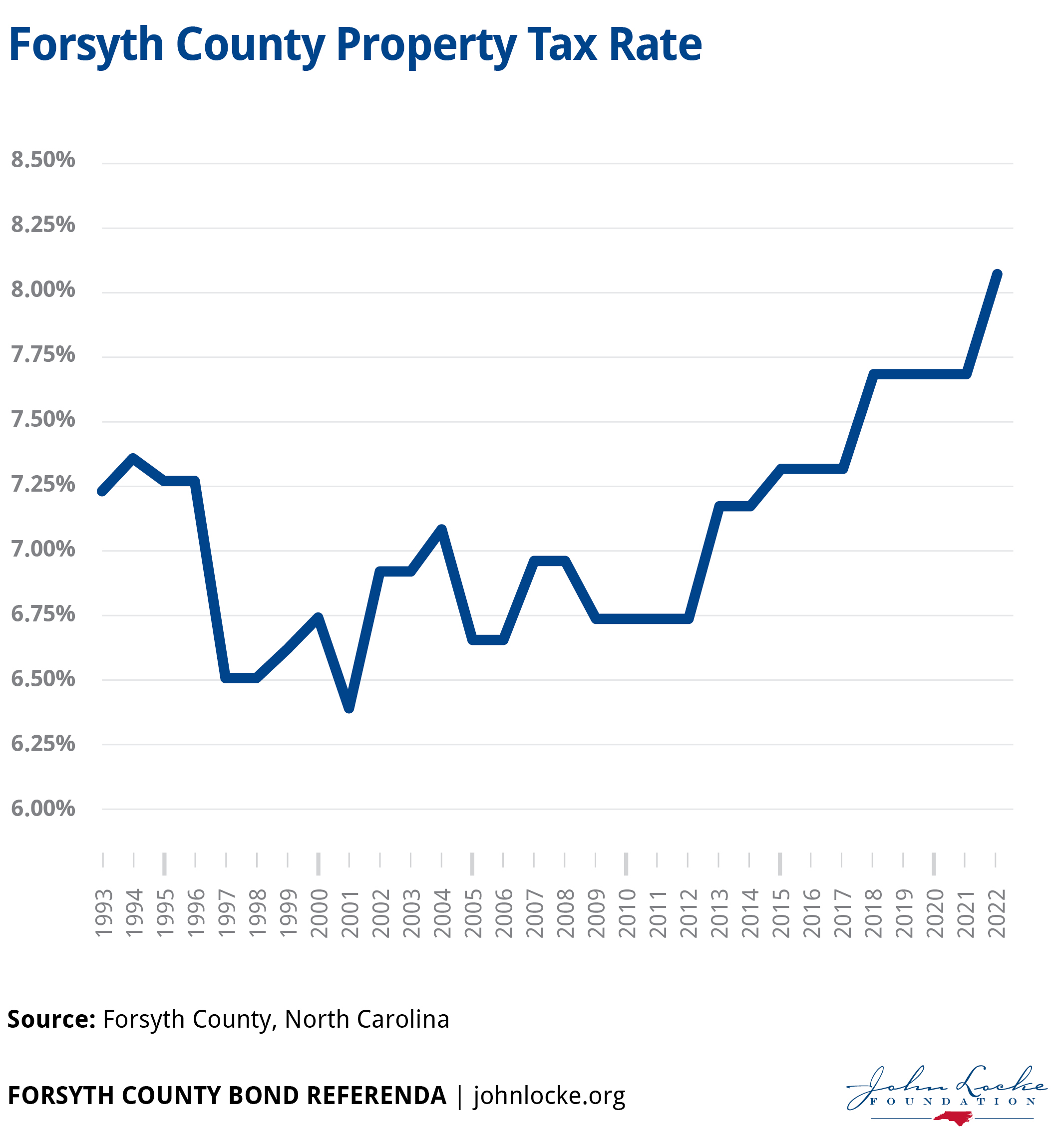

The county is planning on imposing significant property tax increases to cover the $430 million in new debt. Currently, Forsyth County property taxes are $0.731 on each $100 of property valuation.1 If the bond referenda all pass, that rate would jump to $0.767 in 2018 and again to $0.805 in 2022. And that’s just the county rate. Municipalities within Forsyth County assess their own property taxes, so the total paid by most families will be higher.

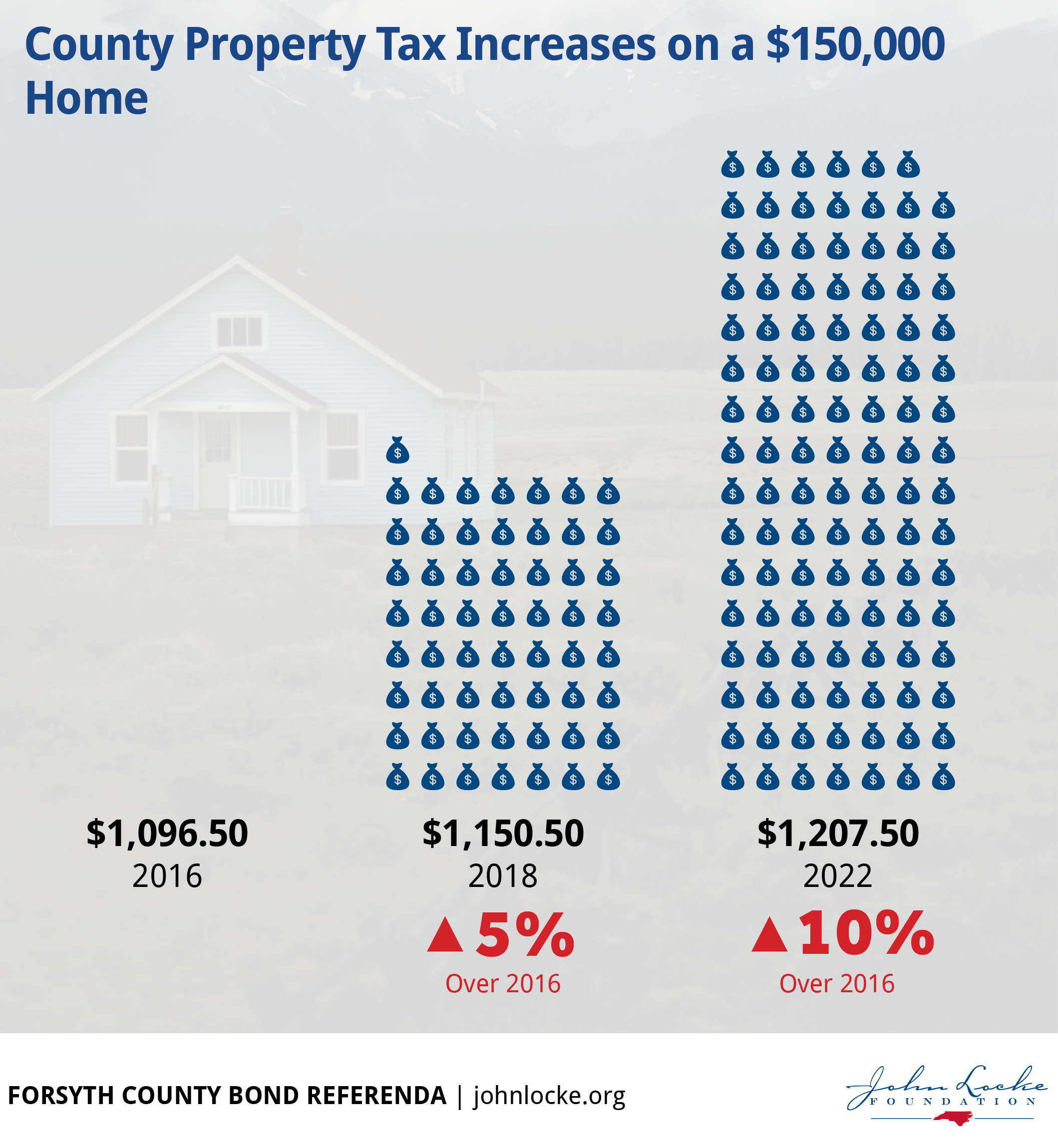

To put that in terms of actual numbers, according to the county’s own flier on the referenda, “For a house valued at $150,000 this means a tax increase in 2018-19 of $54 per year. … In 2022-23, that same $150,000 home would see an additional tax of $57 per year.”2 That’s additional taxation. Currently, the owner of that $150,000 home pays $1,096.50 in property taxes. In 2018, that would go up to $1,150.50, and in 2022, to $1,207.50. That’s an increase of $111 – almost 10 percent – over the next six years. Tenants will pay their share in the form of higher rents imposed by rental property owners and landlords.

But what are the proposed projects? It’s a long list. Yet, taxpayers should be aware that none of the proposed expenditures are binding. County commissions may modify the list as they see fit.

$350 million for schools

The school bond would set aside $87.5 million to Winston-Salem Forsyth County Schools every other year for the next eight years. Those millions will go toward a long laundry list of projects. Some of the money is for new schools or expanding capacity at existing schools. Some projects address general maintenance – replacing roofs, renovating gyms, updating kitchens, or improving bathrooms. And some of it will be used to upgrade or purchase technology.

Forsyth County taxpayers are already pretty generous with their schools. Local per pupil expenditure is around $2,3003, which places Forsyth in the top third among North Carolina counties. Capital expenditures, debt service, and total spending per student are higher than the state average.

Of course, schools have needs. As communities grow, new schools will need to be built, and existing facilities will need to be expanded. There will be updates and renovations that need to be brought to existing schools. But the bond still raises several questions.

Many of the proposed projects seem to be routine maintenance. For example, one elementary school “would receive $4.1 million to replace the roof on the front building, gym and auditorium and replace windows, doors, floors, ceilings, lights, HVAC systems and controls” while another would “receive $3 million to repair its stadium.” Still another school “would receive $900,000 to pay for design plans” for a future school4.

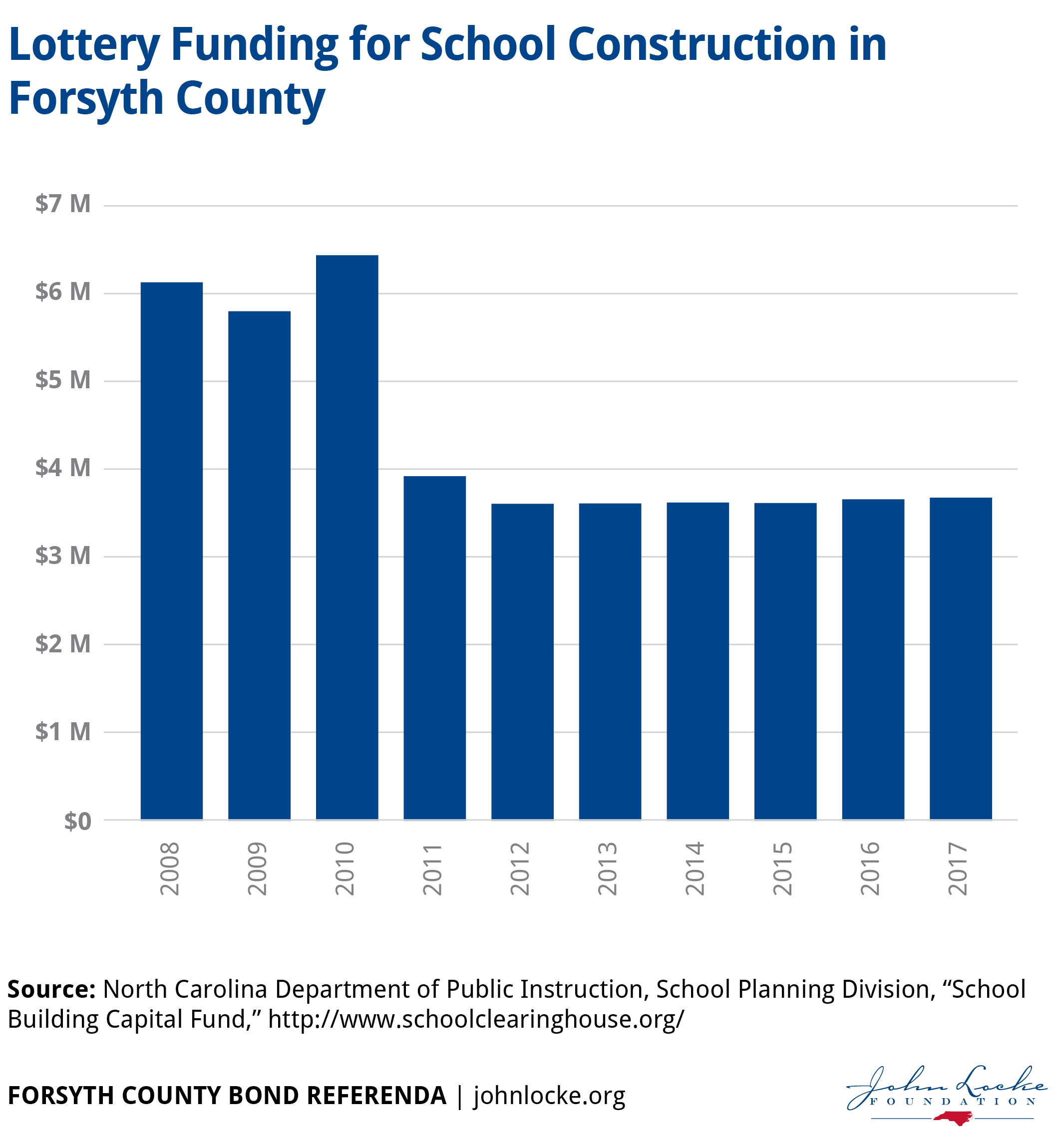

While some of these projects attend to legitimate needs, it begs the question of why existing county resources and annual revenues from the North Carolina Education Lottery have not been used to address them as they arose. Since the lottery began, Forsyth County has received $42,863,643 in lottery revenue earmarked for school construction5.

All of these proposed projects add up to significant spending and significant property tax increases. Voters should be careful to examine the individual projects and their merits before imposing a tax increase that will last for many years and take money out of the hands of hard-working families.

Longer term, county commissioners and school board members must consider how these routine, easily anticipated sorts of maintenance should be funded. Are there ways that the school system could budget differently for them so that property taxes don’t have to go up every time an HVAC system needs an upgrade or a kitchen needs to be refurbished? Steadily increasing property taxes aren’t good for families or the local economy. The county should consider alternatives.

Finally, the North Carolina Department of Public Instruction estimates that the Winston-Salem Forsyth County Schools will have 2,000 fewer students enrolled by 2026.6 This does not account for the increasing number of students who will leave the system to attend charter, virtual, private, and home schools. As the student population declines, the school district will need to be increasingly strategic in its approach to addressing capital needs, including a greater collaboration with the nonprofit and private sectors.

$65 million for Forsyth Tech

The second referendum on the ballot will be $65 million for Forsyth Technical Community College. Forsyth Tech wants to spend the money on renovations to its main campus, technology upgrades, a new library, an aviation center at the airport, and expansion of its existing transportation center.7 This is in addition to money from the Connect NC bond that allocates a little over $5 million to Forsyth Tech.

Community colleges do tremendous work and fulfill an important role in training people for the work force. But the ability of taxpayers to pay for programs and facilities is limited. Voters should carefully consider whether higher taxes to pay for these programs is really the best use of their money. Will the new centers and facilities bring sufficient economic benefit to justify higher property taxes across the county, even though many Forsyth County residents will never step foot on a community college campus?

$15 million for parks and recreation

Finally, there’s a $15 million bond for Forsyth County’s parks and recreation department. Like the other two bonds, this one would fund a variety of projects, many of which are updates and renovations at parks around the county. There’s also a plan to construct a new agricultural center and initiate renovations to the Tanglewood golf course.8

Of the three, this is the smallest, and yet it raises some of the most significant questions. Should Forsyth County taxpayers vote themselves a property tax increase to pay for parks that only a limited number of residents use? These aren’t essential services. Are there other ways these needs could be met? What about looking at user fees for some locations or activities? In particular, should something like the Tanglewood golf course really be funded through taxing all property owners, most of whom will never use the facilities? The golfers who use the course are the primary beneficiaries of any renovations and should be the ones to foot the bill, not young families in their first homes who are working hard to provide well for their children.

And yet, should this bond pass, all property owners will see their property taxes go up, whether or not they use these recreational facilities.

Why all together?

The fact that all three bond issues have been put on the ballot together next week is another cause for concern. It’s hard enough to get good information about one bond issue – figure out how the money will be spent, consider the merits of projects, and assess the impact on individual taxes. But these are all being thrown in together. It’s even harder to make these judgments when the bonds are sold as a package. What happens if just one bond passes? What will the impact on property taxes be then? If that information is available, I’ve not been able to find it.

Increasing property taxes for years to come is a big decision with long-term impact that we can’t fully anticipate. Likewise, the projects that are being considered will take many years to complete. Voters should be careful, and really take some time to think through these referenda. There are few items on the ballot that will as immediately or directly affect taxpayers as these three tax hikes.

Endnotes

[1] https://www.co.forsyth.nc.us/Tax/taxRates.aspx

[2] http://www.co.forsyth.nc.us/documents/BondHandout.pdf

[3] North Carolina Department of Public Instruction, “Statistical Profile,” [online database], http://apps.schools.nc.gov/pls/apex- /f?p=1:35:0::NO:::

[4] 2016 Bond Referendum, Winston-Salem Forsyth County Schools, http://www.wsfcs.k12.nc.us/2016bond

[5] North Carolina EduYcaetison Lottery, http://www.nc-educationlottery. org/county.aspx?county=Forsyth

[6] North Carolina Department of Public Instruction, School Planning Division, “ADM Growth Analysis,” http://www.schoolclearinghouse. org

[7] http://www.forsythtechbond.com

[8] http://www.journalnow.com/sponsored/forsyth-county-bonds/vote- yes-for-forsyth-county-bonds-in-november/article_7ba8992a-9abd- 11e6-b648-0f084f0c231b.html