Is the the idea of a “progressive flat tax” an oxymoron?

The typical argument for a broad-based flat-rate income tax, also called a single rate or proportional tax, is that it promotes economic growth. The idea is that a flat tax system, where the statutory tax rate does not increase as incomes increase, does not penalize increases in productivity on the part of businesses and increased work effort on the part of employees.

Economists are quick to point out that a progressive rate structure characterized by separate income brackets, with each bracket being taxed at a higher rate as incomes rise, penalizes people for getting ahead, being more productive, and therefore earning higher incomes. This, by its nature, is detrimental to economic growth. On the other hand, it is also typically argued that this growth must be at the expense of progressivity in the tax code, that is, the idea that as a person’s income rises, he or she should shoulder an increasing tax burden by paying a greater share of that income.

Progressivity is typically supported on the basis of an egalitarian notion of “fairness,” which suggests that policymakers should consider the distribution of incomes when formulating tax rates. This would be in contrast to a rights-based concept of fairness centered on the idea that people have an inherent right to keep what they earn, what the North Carolina Constitution calls the “enjoyment of the fruits of their own labor,” regardless of the level of those earnings. In this paper, I will not deliberate on the merits of these opposing concepts of fairness, but, rather, take as given the idea that as incomes rise so should the proportion of that income that goes to taxes.

Marginal vs. Average Tax Rates

Typically, when progressivity is discussed, the focus is on what are called marginal tax rates. Technically, the marginal rate is the rate that is paid on each additional dollar of income earned. A progressive rate structure will, by definition, have tiered marginal rates with distinct tax brackets and rates rising as the taxpayer’s income rises through the defined brackets. For example, until 2013 North Carolina had a tiered system with three rates. For incomes up to $12,750, the marginal rate, that is, the rate paid on each additional dollar earned, was 6 percent. For income amounts between $12,750 and $60,000, the marginal rate was 7 percent. For additions to income above $60,000, the rate was 7.75 percent. Under such a system the statutory rate does not, as is sometimes mistakenly asserted, represent the percentage of one’s income that is paid in taxes. It only represents, under a system with no special tax breaks, the percentage of income above the breaking point of the previous tax bracket that is paid in taxes.

The average tax rate, also referred to as the effective rate, is not typically visible in any statutory rate. It is the total amount paid in taxes divided by the taxpayer’s total income. Under a progressive rate structure, the average rate, not including any deductions and excepting those in the lowest tax bracket, will be less than the marginal rate. For example, under a system like the one described above, a person earning $70,000 would have an average tax rate of about 6.9 percent with a statutory marginal tax rate of 7.75 percent.

The Flat Tax and Progressivity

A flat-rate income tax is one in which a single rate is applied to all taxable income. In other words, the tiered system described above is eliminated in favor of a single rate applied to everyone regardless of income level. Of course, this does not mean that everyone pays the same amount in taxes. People who earn more pay more. Under a pure flat tax, if person A earns twice as much as person B, he will pay twice as much in taxes. For example, with a 10 percent flat tax, a person earning $100,000 will pay $10,000 in taxes while a person earning $50,000 will pay $5,000.

But the point of a progressive tax is to go beyond this proportionality; that is, under a progressive tax, if person A earns more than person B, he should pay proportionally more than his higher income would suggest. Hence progressivity is typically associated with the kind of tiered rate structure that was part of North Carolina’s tax code until the Republican-led General Assembly overhauled the system in 2013.

The question that arises is – can progressivity be achieved in the context of a flat-rate system? In other words, can the economic advantages of a flat-rate system be preserved while introducing the sought-after disproportionality associated with a multi-tiered rate structure? The answer to this question is yes, but the focus would need to shift from explicit marginal rates to implied average rates.

Under the guise of a flat tax, progressivity, in terms of average rates, can be achieved by creating a zero tax bracket, or what is also referred to as a personal exemption. In essence, this creates a zero tax liability on all income below a specified amount. By including a personal exemption, in what otherwise would be a pure flat tax system, the average tax rate increases along with incomes, ensuring that people who earn more pay proportionally higher rates.

In the previous example, person A earns $100,000 and person B earns $50,000. Instead of having a single rate of 10 percent that starts at the first dollar earned, assume that we have a personal exemption of $15,000. That is, the first $15,000 is not taxed. In this case, person A would pay the flat rate of 10 percent on $85,000 and person B would pay 10 percent on $35,000. The average tax rate for person A would be 8.5 percent ($8,500 tax on $100,000 in earnings) and the average rate for person B would be 7 percent ($3,500 tax on $50,000 in earnings). The tax code could be made even more progressive by increasing the personal exemption.

North Carolina’s (Progressive) Flat Tax

As a result of tax reforms passed by the General Assembly in 2013, North Carolina instituted a flat tax. The rates were reduced from the three-tiered system discussed earlier to a single rate of 5.80 percent in 2014 and 5.75 percent in 2015. This single rate was now below the bottom rate of 6 percent that prevailed under the previous tax regime, so everyone’s marginal rate was reduced. Despite claims to the contrary, the legislature was, in fact, mindful of building progressivity into the system.

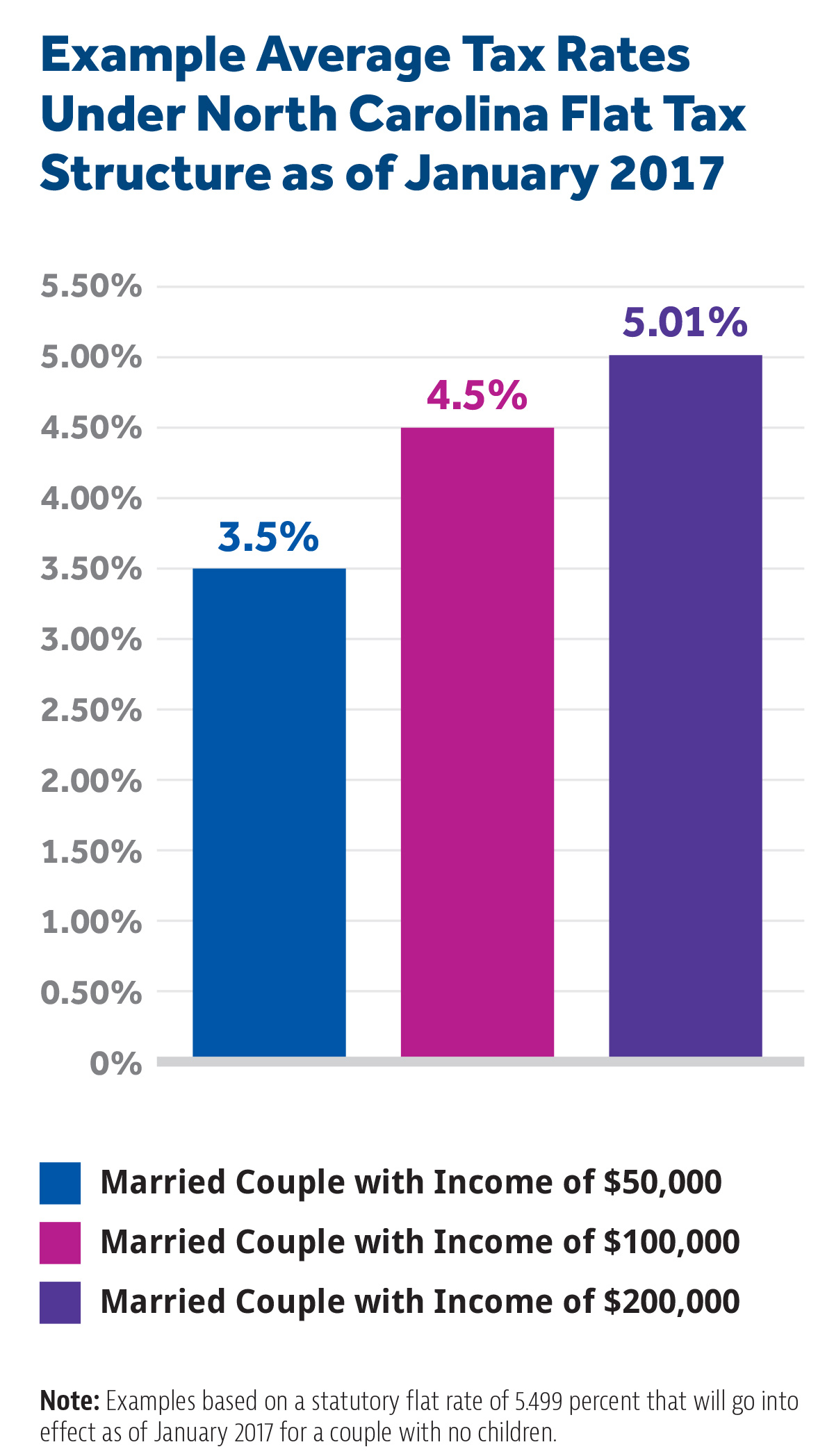

As part of the reform, lawmakers dramatically increased the personal exemptions from $6,000 prior to the 2013 reforms to $15,000 for a couple filing jointly. Continuing along this path, in 2016 the zero tax bracket was increased even further to $17,500, almost triple what it was in 2012. This made the system even more progressive as measured by the average or effective rate. With the statutory flat rate of 5.499 percent that will go into effect as of January 2017, the effective rate for a couple with no children earning $100,000 will be about 4.5 percent, while the effective rate for a similarly situated couple earning $50,000 would be 3.5 percent. I emphasize that these are childless couples because North Carolina also instituted a generous per-child tax credit of $125 that would have to be figured into the calculation depending on the family’s individual circumstance.

Conclusion

Economists generally agree that, all else being equal, a broad-based flat-rate income tax is less harmful to economic growth than a system that relies on a tiered progressive rate structure. But for some observers, including many pundits and those in the media not familiar with the economics of taxation, it is believed that in order to gain these economic benefits, tax fairness, defined as progressivity, has to be sacrificed. But clearly this is not true. If tax reformers who view progressivity as being important focus on the average or effective rate rather than the marginal rate, the economic benefits of a flat tax can be maintained while seeing to it that income earners pay an increasing proportion of their income in taxes as their incomes grow.

It should be reiterated that for purpose of this analysis, we accept the egalitarian notion of fairness that undergirds the desirability of progressive taxation, particularly by those on the political Left. Of course there are alternative visions of tax fairness or justice that are not based on this egalitarian concept of wealth redistribution, which have purposely been, except for a brief mention at the outset, left out of this discussion.

But the reader should be reminded that in North Carolina it is not this concept of fairness that is enshrined in the state’s constitution. Instead the notion of justice captured in this, the foundational document for all North Carolina laws, including tax law, suggests that the focus of tax policy should be on allowing people to keep as much of their income as possible.

The first principle of the Declaration of Independence is that all people are created equal and endowed with inalienable rights to life, liberty, and the pursuit of happiness. Article 1, Section 1 of the North Carolina Constitution includes a fourth right, the “right to the fruits of one’s labor,” that is, the right to keep the income they earn.1

Endnotes

- See the North Carolina Constitution at http://www.ncga.state.nc.us/legislation/constitution/ncconstitution.html. Article 1, Section 1 titled “The Equality and Rights of Persons” state “We hold it to be self-evident that all persons are created equal; that they are endowed by their Creator with certain inalienable rights; that among these are life, liberty, the enjoyment of the fruits of their own labor, and the pursuit of happiness.”