Despite no obvious geographical distinctions from the other U.S. states that would explain it, North Carolina is awash in solar energy facilities, more so than every other state except California. That is because the distinctions driving it are political, not geographical. A key reason is how North Carolina implements a four-decades-old law, the Public Utility Regulatory Policies Act of 1978 (PURPA).

Among other things, PURPA mandates that utilities buy any power generated from qualifying renewable energy facilities in their area, at predetermined prices, regardless of market need. States set the terms as to which facilities can qualify, what those prices are, and how long they are in effect.

As this paper will explain, North Carolina’s decisions on those factors differ significantly from other states to the special benefit of solar facilities — and ultimately to the detriment of electricity consumers.

PURPA: Obsolete but still in force

Partly in response to the Middle East oil embargo of the early 1970s and partly out of fear that traditional energy resources were “simply running out,” PURPA was part of a larger package of legislation known as the National Energy Act.1 It sought to reduce fossil fuel demands, decrease reliance on imported oil, boost electricity generation from abundant coal rather than oil and natural gas, and open competitive power markets by making utilities buy energy from eligible renewable energy and cogeneration facilities.2

There have been some important changes since PURPA became law. The resource fears of the 1970s (for example, the “Peak Oil” theory) have been obliterated by technological innovation3 in acquiring energy resources (domestic resources at that).4 Also, power markets are much different now. PURPA’s mandatory purchase obligation for electric utilities to buy power from qualifying renewable power facilities at set “avoided cost” rates (the cost utilities supposedly “avoided” by buying power from renewable facilities rather than generating it themselves) led to building booms and competitive power markets in much of the country.

Federal restructuring of the electricity industry and the Energy Policy Act of 2005 made PURPA even less relevant to many electric utility markets in the U.S. Those reforms removed PURPA’s must-buy provision from utilities if “certain market conditions” existed.5

As energy economist Travis Fisher explained,

[T]he Energy Policy Act of 2005 … changed [PURPA] section 210 to relieve utilities’ obligation to purchase QF [qualifying facilities’] output under “certain market conditions.” As FERC stated in 2006: “Section 210(m)(1) thus relieves an electric utility of its obligation to enter into a new contract or obligation to purchase QF power upon a Commission finding that certain market conditions exist.”

FERC laid out the criteria for those “certain market conditions,” which essentially refer to features of RTOs [Regional Transmission Organizations]. FERC also explicitly said that the Midwest ISO [Independent System Operator], PJM Interconnection, ISO New England, and the New York ISO satisfy the section 210(m)(1) criteria. But … much of the US electric grid is not organized under the RTO model (particularly the Northwest and Southeast), so PURPA-enabled QF purchases still proliferate in those non-RTO areas.6 (Emphasis added.)

Basically, PURPA’s must-buy provision no longer applies to much of New England, the Midwest, New York, Texas, and parts of California. It still applies to much of the Northwest and Southeast, including North Carolina. In fact, PURPA’s strictures affect North Carolina more than most other states.

PURPA anchors outsized expansion of North Carolina solar industry

The oft-repeated statistic of “second in solar” owes to favorable state energy policies for the solar energy industry.7 It is not market-driven8 — a fact renewable energy advocates readily acknowledge.9

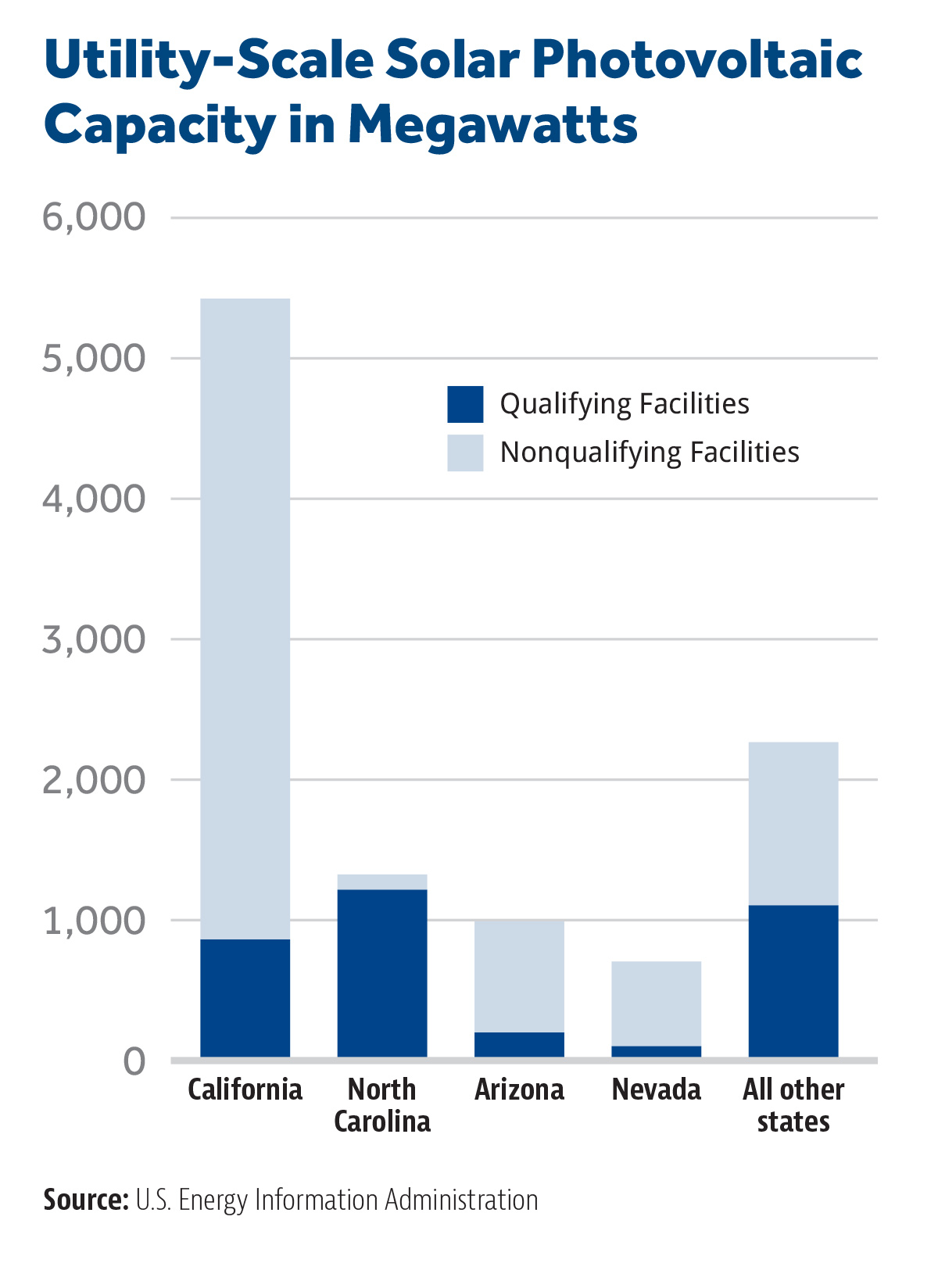

The way North Carolina has chosen to implement PURPA regulations is very favorable to solar energy facilities. In fact, North Carolina has several other public policies that are very favorable toward solar energy facilities. Their combined effect is that North Carolina alone is home to 60 percent of all PURPA projects in the entire United States.10 See chart.

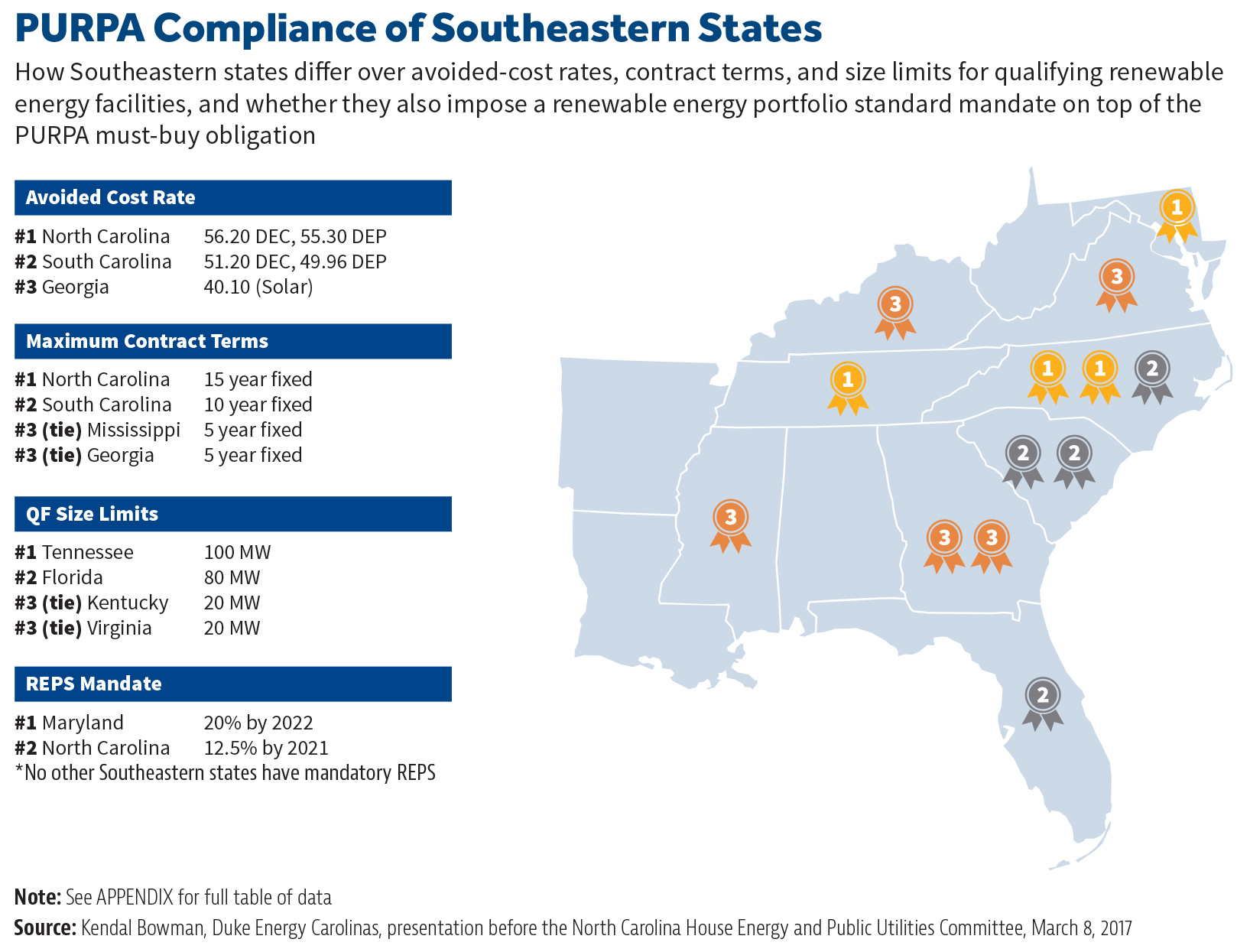

The Federal Energy Regulatory Commission lets each state implement PURPA regulations. This means states differ over them, sometimes widely. Over time, many states have changed how they implement PURPA rules, including reducing their avoided-cost rates and contract lengths.11

North Carolina relies on a combination of terms that are all very generous to solar energy facilities. For example, North Carolina has the highest avoided-cost rates and the longest fixed-rate contract terms of any state in the Southeast U.S. North Carolina also allows qualifying renewable power facilities up to 5 megawatts (MWs) in size (or 5,000 kilowatts, kWs). Many states are at the Federal Energy Regulatory Commission minimum of 100 kW, though some go to 20 MWs or more.

These terms, established by the North Carolina Utilities Commission shortly after PURPA came to be, were originally geared to assist small hydroelectric power facilities.12 Solar energy facilities were an afterthought. (A similar dynamic played out during the consideration of the state’s Renewable Energy and Energy Efficiency Portfolio Standard mandate; wind power, not solar, was expected to be the primary beneficiary of policies then being put in place.13)

Qualifying renewable power facilities that are 2 MWs or larger are more expensive for the utility to interconnect as PURPA directs. They require more impact studies and engineering, and many of them require unanticipated delays, leading to more impact studies and problems with other qualifying facility interconnections. Those costs are ultimately borne by ratepayers. But nearly three-fourths of interconnection requests in North Carolina are to qualifying facilities over 2 MWs.14

PURPA + REPS = mandates, not market forces

At the same time, North Carolina employs an array of other policies that directly favor solar energy facilities:

- The state’s Renewable Energy and Energy Efficiency Portfolio Standard mandate contains a stepwise increase in the percentage of a public electric utility’s retail sales required to be generated from renewable energy sources

- The property tax that otherwise would be assessed on solar energy facilities is reduced by 80 percent15

- An extremely generous investment tax credit of 35 percent, meted out over five years, just sunset for new facilities in 201616

All told, the political environment in North Carolina is heavily tilted in favor of solar energy facilities. As a result:

- North Carolina has 60 percent of all PURPA projects in the entire country

- North Carolina has more PURPA-qualifying solar facilities than any other state

- Nearly every solar facility in North Carolina (92 percent) is a qualifying facility under PURPA — very different from the rest of the United States17

Bad to worse: mandate after mandate

Bad to worse: mandate after mandate

In 2007, ironically the same year that the North Carolina General Assembly enacted the state Renewable Energy and Energy Efficiency Portfolio Standard mandate, the North Carolina Utilities Commission signed on to a letter to Congress with eight other Southeastern U.S. states’ utilities commissions. The letter urged Congress to reject a federal renewable energy portfolio standard mandate in part because “our retail electricity consumers will end up paying higher electricity prices, with nothing to show for it.”18

Ten years later, those other states — Alabama, Arkansas, Georgia, Kentucky, Louisiana, Mississippi, South Carolina, and Tennessee — still haven’t imposed a renewable energy portfolio standard mandate on their retail electricity consumers. North Carolina has.

PURPA already has the must-take purchase obligation from renewable energy facilities. North Carolina’s Renewable Energy and Energy Efficiency Portfolio Standard layered it with another purchase mandate, and an expanding one at that. It requires a growing percentage of a public electric utility’s retail sales be generated from renewable energy sources, reaching 12.5 percent in 2021. (The law allows some of the requirement to be met through energy efficiency programs.) It also includes sources that aren’t qualifying renewable energy facilities under PURPA.19

Charles Bayless, associate general counsel at the North Carolina Electric Membership Corporation, testified before the Federal Energy Regulatory Commission in 2016 about the harm to ratepayers of this mandate overlap:

QFs [qualifying renewable power facilities] in states with RPS [renewable portfolio standard] requirements do not need to rely on PURPA to sell their output. The main function of QF status in these states is to rely on PURPA to negotiate better terms than the QF would be able to get otherwise. These “better terms” may ultimately end up costing customers in the long-run in the form of higher rates.20

The chart and map shown previously illustrate how North Carolina ranks with other Southeastern states in maximum contract terms, avoided-cost rates, whether they are fixed or variable, size limits of qualifying renewable power facilities, and whether they have also instituted a Renewable Energy and Energy Efficiency Portfolio Standard mandate.

No other Southeastern state has combined terms like North Carolina’s so highly favorable to solar energy facilities.

Costs to electricity consumers

Solar energy producers find these policies to be very important to the development of their industry in North Carolina. Maintaining them as features of North Carolina public policy in perpetuity is the primary interest of their lobby.21

Energy policy is of significant public interest not because of a particular kind of power producer, however. It is of significant public interest because electricity is a necessity for everyone, every household, and every business. Things that affect electricity rates resonate throughout the economy.

The Energy Policy Institute explained this relationship this way:

Given that electricity is a primary input for nearly every good and service produced in the country, a rise in price should be expected to have a negative impact throughout the national economy.22 (Emphasis added.)

Furthermore, rate increases are like highly regressive taxes: They affect the poor disproportionately more than they affect others.23

North Carolina’s current configuration of policies to comply with PURPA regulations is producing large unnecessary costs. Duke Energy estimates that having to pay qualifying solar facilities avoided-cost rates higher than market prices will cost its ratepayers over $1 billion extra in the next 12 years.24

North Carolina’s current configuration of policies to comply with PURPA regulations is producing large unnecessary costs. Duke Energy estimates that having to pay qualifying solar facilities avoided-cost rates higher than market prices will cost its ratepayers over $1 billion extra in the next 12 years.24

State law directs the Utilities Commission to revisit avoided-cost rates and contract terms every two years.25 Utilities have requested that the maximum length of contracts be reduced from 15 years to 10 or even five, expressing concern of harm to consumers from locking in rates over that long a period despite considerable uncertainty over actual rather than projected costs. Renewable energy interests have argued against that — and sought even longer contract lengths of 20 years — on the basis that longer contract terms make it easier for them to secure investors.26

The Utilities Commission has so far chosen not to alter avoided-cost rates and contract terms, nor lower the size limits on qualifying renewable energy facilities. A Utilities Commission decision not to make changes to those policies is regarded as a “victory” for the solar energy industry.27

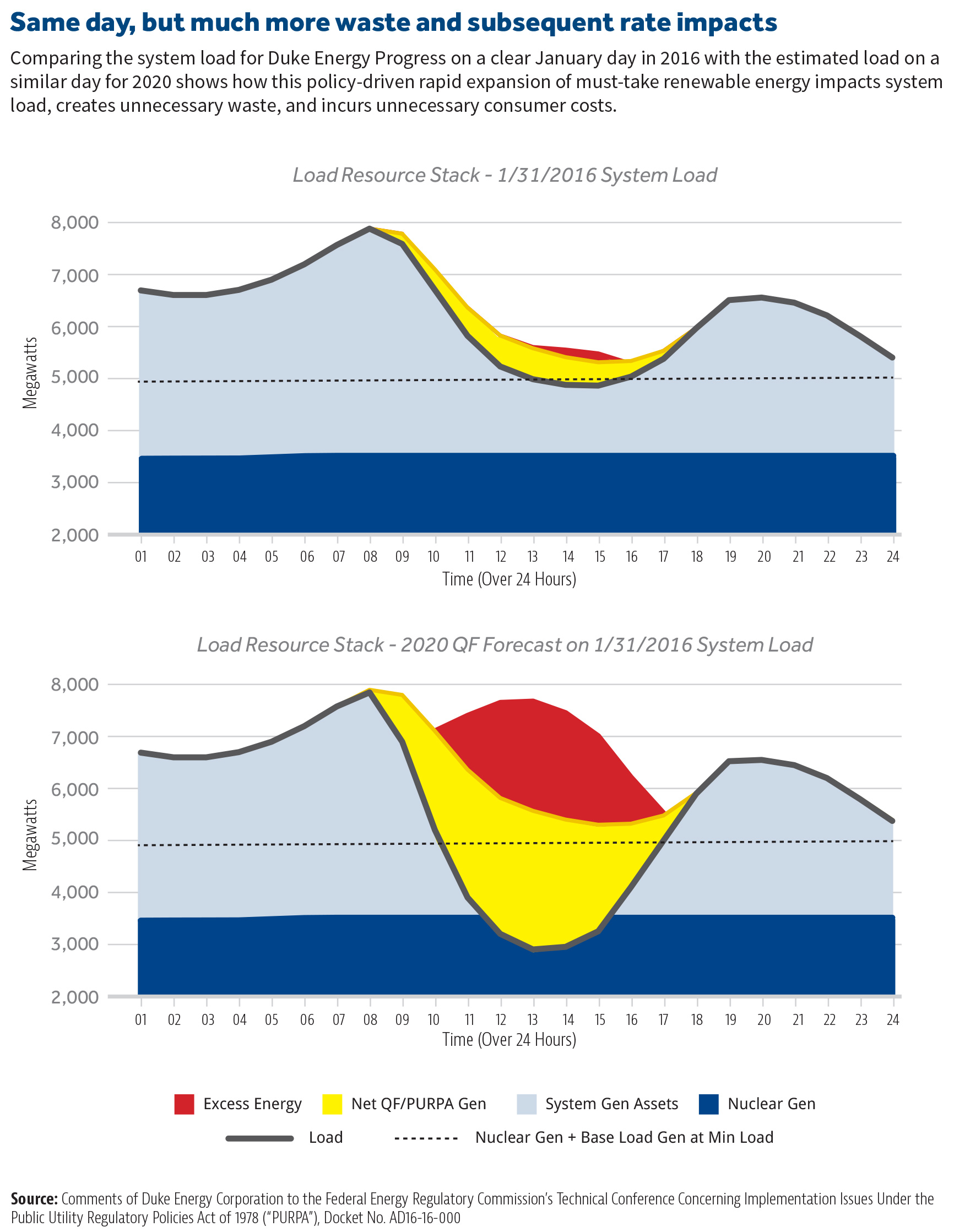

Those policies interact with North Carolina’s expanding Renewable Energy and Energy Efficiency Portfolio Standard mandate and other state and federal policies that spur growth in solar energy facilities. On some days, it forces this domino effect of problems:

- The utility must buy energy from qualifying renewable power facilities well beyond system needs

- Those qualifying renewable power facilities energy purchases cut the utility’s needed base load units (gas-fired, coal-fired, and nuclear) below their minimum load capabilities

- So after buying relatively expensive qualifying renewable power facilities’ energy, the utility either has to cycle down base load units, but that outcome is undesirable and inefficient because:

- Base load units aren’t suited for cycling

- In a few short hours, the utility will need them back in operation, as evening approaches and solar facilities go dark

- This usage renders their operation more costly

- Or the utility has to dump its excess energy units if it has a buyer and way to transmit it

And that domino effect will only get worse as the Renewable Energy and Energy Efficiency Portfolio Standard mandate grows larger and more solar facilities get built and generate output North Carolina’s utilities have no option but to take. Compare the effect on Duke Energy Progress of must-take renewable energy on a clear January day in 2016 (mandate at 6 percent) with the estimated effect on a similar day for 2020 (mandate at 10 percent). See chart.

As Kendal Bowman, Duke Energy’s vice president of regulatory affairs and policy, explained to the Federal Energy Regulatory Commission in June 2016:

Mandating purchases from QFs [qualifying renewable power facilities] regardless of the utility’s needs, and setting those purchase rates in excess of the utility’s incremental costs, forces consumers to pay the high rate for the life of the utility commitment to the QF, in addition to the costs from integration and spinning reserves the customers also incur.28

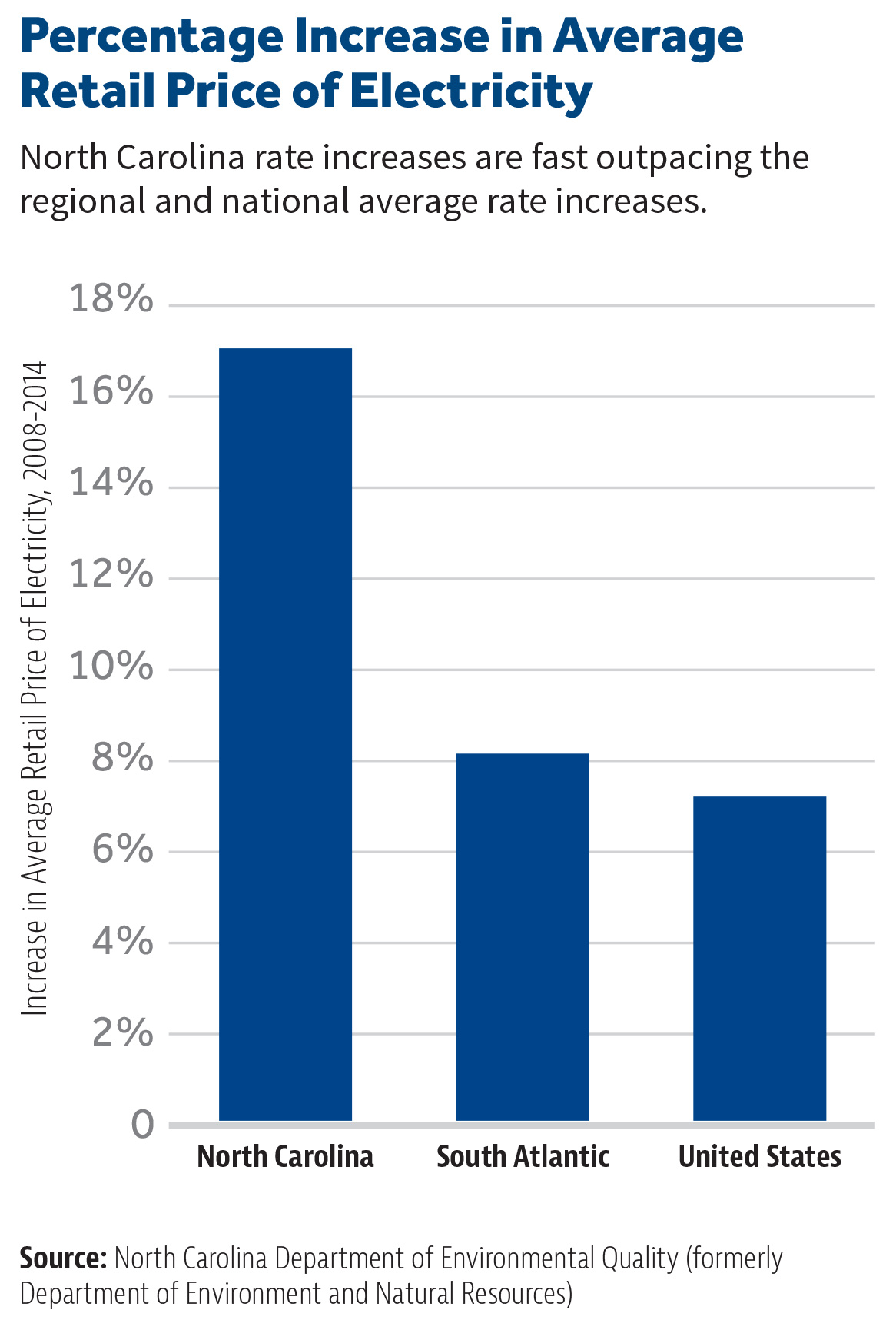

As discussed earlier, the state’s Renewable Energy and Energy Efficiency Portfolio Standard mandate only makes the problem worse. Since its mandate took effect in 2008, North Carolina has seen its electricity rates increase by over twice the regional average increase and nearly two-and-a-half times the national average increase.29

Reform recommendations for lower energy costs

PURPA and North Carolina’s overbroad interpretation of its mandates are heaping unnecessary costs on North Carolina ratepayers. This problem is made worse by other state policies favoring renewable energy facilities, especially the Renewable Energy and Energy Efficiency Portfolio Standard mandate.

But as those costs are driven by policy, they can be addressed by policy changes.

Policy Change #1

The Federal Energy Regulatory Commission gives states wide latitude to set contract term lengths, decide on how to calculate avoided-cost rates and let them be fixed or variable, and decide upon the size of qualifying facilities. Many other states have already lowered their avoided-cost rates and contract lengths. Where North Carolina’s policies differ significantly from other states’ — significantly longer contract terms, significantly higher avoided-cost rates, fixed rather than variable rates, etc. — North Carolina policymakers can and should rein in PURPA requirements.

Policy Change #2

The state’s Renewable Energy and Energy Efficiency Portfolio Standard mandate is slated to increase from 6 percent this year to 10 percent next year and 12.5 percent in 2021. That’s more than double in four years, and more than a quadrupling since 2014.

Policymakers should repeal the Renewable Energy and Energy Efficiency Portfolio Standard altogether. They should weigh its effects on rates and system reliability, its contribution to the energy load domino effect, and other issues affecting ratepayers before deciding what is the best approach for energy policy for North Carolinians going forward.

Policy Change #3

Further, policymakers should stop excluding 80 percent of the appraised value of solar energy facilities from property taxes. They should also resist pressure to reinstate the 35 percent investment tax credit for renewable energy facilities.

APPENDIX

PURPA compliance of Southeastern states

How Southeastern states differ over avoided-cost rates, contract terms, and size limits for qualifying renewable energy facilities, and whether they also impose a renewable energy portfolio standard mandate on top of the PURPA must-buy obligation.

DEFINITIONS

PURPA

The Public Utility Regulatory Policies Act of 1978, a Carter-era law passed during the oil and energy crises of the 1970s.

Federal Energy Regulatory Commission

The regulatory agency that enforces PURPA.

Qualifying facilities

There are two kinds of qualifying facilities under PURPA:

Small power production facilities

- Solar, wind, waste, or geothermal source of electricity

- can’t exceed 80 MWs in power production capacity

Cogeneration facilities

- produce electricity and also “steam or forms of useful energy (such as heat) which are used for industrial, commercial, heating, or cooling purposes”30

- The discussion in this paper surrounds the use of qualifying small power production facilities.

Must-take, or the mandatory purchase obligation

PURPA requires that electric utilities must buy any power generated from qualifying facilities in their territory, regardless of need, as long as the qualifying facility can deliver its power to the utility.

Interconnect

PURPA requires that electric utilities must interconnect qualifying facilities to their electric system — to sell them the energy to power their operations and for them to be able to deliver their energy that the utility must take.

Avoided cost

The price the utility must pay to a qualifying facility for the electricity it is obligated to buy. As the name suggests, it is intended to represent the cost to the utility if it would have produced the electricity itself:

- How much it would have cost to build the generating capacity

- How much it would have cost to generate the electricity

PURPA requires avoided cost to be:

- just and reasonable to electricity consumers and also in the public interest (a different standard from least-cost mix of generation)31

- not discriminatory against qualifying facilities

Setting avoided-cost rates is a controversial topic. There are several methods to determine avoided cost. The Federal Energy Regulatory Commission lets states decide which one to use.

Peaker methodology

The method chosen by the North Carolina Utilities Commission to determine avoided cost for Duke Energy Carolinas and Duke Energy Progress. It is based on a natural gas–fired peaking unit, which is basically a combustion turbine that would be used for marginal power generation during peak times.32

Peaker methodology

- assumes that the power purchased from the qualifying facility takes the place of marginal (most expensive) power generation by the utility at any given time

- uses the lowest-cost source of marginal generation to build

- used to be the highest cost to operate, owing to the price of natural gas

Power purchase agreement

The contract between an electric utility and a qualifying facility for the utility to buy the facility’s power at the avoided cost.

The Federal Energy Regulatory Commission gives state utilities commissions wide latitude in these contracts regarding:

- the maximum length of contract term

- whether the avoided-cost rate is fixed or variable

- the size of qualifying facilities (the Federal Energy Regulatory Commission minimum is 100 kW)

15-year fixed-rate contracts

In North Carolina:

- the maximum contract term is 15 years

- the avoided-cost rate is fixed

- the size limit of qualifying facilities is 5 MWs

Renewable Energy and Energy Efficiency Portfolio Standard mandate

A 2007 state law that requires utilities to generate a growing percentage of their retail sales from new renewable energy resources, in combination with energy efficiency programs.

Acceptable sources include solar, wind, geothermal, biomass, only small hydroelectric facilities (under 10 MWs), but no “peat, a fossil fuel, or nuclear.”33

The Renewable and Energy Efficiency Portfolio Standards mandate requires the following schedule for public utilities:

- 2012: 3 percent of 2011 retail sales (minimum 2.25 percent renewable and 0.75 percent energy efficiency)

- 2015: 6 percent of 2014 retail sales (4.5 percent renewable, 1.5 percent energy efficiency)

- 2018: 10 percent of 2017 retail sales (7.5 percent renewable, 2.5 percent energy efficiency)

- 2021: 12.5 percent of 2020 retail sales (7.5 percent renewable, 5 percent energy efficiency)

The schedule for electric membership corporations and municipal electric utilities is similar but tops out at the 10 percent requirement of 2018 and beyond.

Endnotes

1. Jimmy Carter, “Address to the Nation on Energy,” April 18, 1977, viewable at http://www.presidency.ucsb.edu/ws/index.php?pid=7369.

2. The original text of the Public Utility Regulatory Policies Act of 1978 is viewable at https://www.usbr.gov/power/legislation/purpa.pdf. For discussion, see Travis Fisher, “PURPA: Another Subsidy for Intermittent Energies,” MasterResource, January 22, 2013, https://www.masterresource.org/energy-efficiency/purpa-renewable-energy-subsidies, and “Public Utility Regulatory Policies Act,” Union of Concerned Scientists, http://www.ucsusa.org/clean_energy/smart-energy-solutions/strengthen-policy/public-utility-regulatory.html.

3. Jon Sanders, “So CO2 emissions are down nearly 15% in NC since 2000—mostly thanks to fracking,” The Locker Room, John Locke Foundation, January 17, 2017, http://lockerroom.johnlocke.org/2017/01/19/so-co2-emissions-are-down-nearly-15-in-nc-since-2000-mostly-thanks-to-fracking.

4. See, e.g., Rob Wile, “Peak Oil Is Dead,” Business Insider, March 29, 2013, http://www.businessinsider.com/death-of-peak-oil-2013-3, James Pethokoukis, “Creative destruction wins again: How innovation killed ‘peak oil,’” AEIdeas, American Enterprise Institute, July 16, 2013, http://www.aei.org/publication/creative-destruction-wins-again-how-innovation-killed-peak-oil, and Jon Sanders, “Peak Oil blog waves the white flag,” The Locker Room, John Locke Foundation, July 16, 2013, http://lockerroom.johnlocke.org/2013/07/16/peak-oil-blog-waves-the-white-flag. Cf. Julian Simon, “When Will We Run Out of Oil? Never!”, Chapter 11, The Ultimate Resource II, Princeton: Princeton University Press, 1981; 2nd edition 1996; viewable at http://www.juliansimon.com/writings/Ultimate_Resource/TCHAR11.txt.

5. Fisher, “PURPA: Another Subsidy for Intermittent Energies.”

6. Fisher, “PURPA: Another Subsidy for Intermittent Energies.”

7. See, e.g., John Downey, “N.C. ranks second nationwide for solar on the power grid,” Charlotte Business Journal, September 12, 2016, www.bizjournals.com/charlotte/news/2016/09/12/n-c-is-second-nationwide-for-solar-on-the-power.html.

8. For a contrast, see Jon Sanders, “The Market Forces Behind North Carolina’s Falling Emissions,” Spotlight No. 486, John Locke Foundation, January 31, 2017, https://www.johnlocke.org/research/the-market-forces-behind-north-carolinas-falling-emissionsnew-research-shows-that-improvements-are-market-oriented-not-government-driven.

9. A March 2017 fundraising call from the NC Sustainable Energy Association explained: “North Carolina is now second in the nation for installed solar capacity. … Much of the utility-scale solar industry’s success can be attributed to our state’s strong clean energy policies, such as favorable contracts and rates paid to these facilities for the energy and generation capacity they provide.” Clean Energy Storyteller, NC Sustainable Energy Association, March 2017, https://energync.org/wp-content/uploads/2017/04/March-Clean-Energy-Storyteller.pdf. Also see, e.g., Luis Martinez, “NC Now Second In Solar; Smart Policies Can Keep It That Way,” Natural Resources Defense Council, September 20, 2016, https://www.nrdc.org/experts/luis-martinez/nc-now-second-solar-smart-policies-can-keep-it-way, and Donna Robichaud, “Why is Utility Scale Solar So Popular in North Carolina?”, slide 6, “Why is utility scale solar booming in NC?”, QF Solutions LLC, presentation to Epic Energy Seminar, Energy Production & Infrastructure Center, The William States Lee College of Engineering, University of North Carolina at Charlotte, April 7, 2015, viewable at http://epic.uncc.edu/sites/epic.uncc.edu/files/media/Apr%207_Donna%20Robichaud%20presentation.pdf. And more broadly, see Peter Dizikes, “Will we ever stop using fossil fuels? Not without a carbon tax, suggests a study by an MIT economist,” MIT News Office, Massachusetts Institute of Technology, February 24, 2016, http://news.mit.edu/2016/carbon-tax-stop-using-fossil-fuels-0224, and Kathleen Hartnett White, “Renewables are incapable of replacing hydrocarbons at scale,” The Hill, March 30, 2016, http://thehill.com/blogs/pundits-blog/energy-environment/274645-renewables-are-incapable-of-replacing-hydrocarbons-at.

10. Manussawee Sukunta, “North Carolina has more PURPA-qualifying solar facilities than any other state,” Today in Energy, U.S. Energy Information Administration, August 23, 2016, https://www.eia.gov/todayinenergy/detail.php?id=27632.

11. Sukunta, “North Carolina has more PURPA-qualifying solar facilities than any other state.”

12. See, e.g., comments by Kendal Bowman at the Federal Energy Regulatory Commission’s Technical Conference Concerning Implementation Issues Under the Public Utility Regulatory Policies Act of 1978, Docket No. AD16-16-000, June 29, 2016, transcript viewable at https://www.ferc.gov/CalendarFiles/20160826133239-Transcript%20-%20062916technical.pdf, p. 86, and discussion in Owen Smith and Christa Owens, “5 Reasons for North Carolina’s Rapid Emergence As a Solar Energy Leader,” CleanTechnica, April 29, 2015, https://cleantechnica.com/2015/04/29/5-reasons-for-north-carolinas-rapid-emergence-as-a-solar-energy-leader.

13. Daren Bakst and Geoffrey Lawrence, “Renewable Energy At All Costs: Legislation ignores the will of the public and would have unintended consequences,” Spotlight No. 395, John Locke Foundation, July 9, 2007, https://www.johnlocke.org/research/renewable-energy-at-all-costs-legislation-ignores-the-will-of-the-public-and-would-have-unintended-consequences, p. 7.

14. “PURPA and Qualifying Facilities in North Carolina,” Duke Energy Corporation.

15. G.S. § 105-275 (45), “Property classified and excluded from the tax base,” viewable at http://www.ncga.state.nc.us/EnactedLegislation/Statutes/HTML/BySection/Chapter_105/GS_105-275.html.

16. See discussion at Don Carrington, “Renewable Projects to Cost Taxpayers Nearly $1 Billion,” Carolina Journal, December 17, 2015, https://www.carolinajournal.com/news-article/renewable-projects-to-cost-taxpayers-nearly-1-billion/.

17. Sukunta, “North Carolina has more PURPA-qualifying solar facilities than any other state.”

18. Matthew Letourneau, “Southeastern Utility Commissioners to Congress: RPS Means Higher Prices for Consumers,” press release, U.S. Senate Committee on Energy & Natural Resources, June 6, 2007, www.energy.senate.gov/public/index.cfm/republican-news?ID=183a660e-c6ea-49e5-b4ce-8a0fe060365e.

19. S.L. 2007-397, http://www.ncga.state.nc.us/gascripts/BillLookUp/BillLookUp.pl?Session=2007&BillID=s3&submitButton=Go. Note: for municipally owned and electric membership utilities the Renewable Energy and Energy Efficiency Portfolio Standard mandate limit is 10 percent. Also, energy efficiency programs may account for 25 percent of the Renewable Energy and Energy Efficiency Portfolio Standard mandate requirement at first, then 40 percent by 2021.

20. Charles Bayless, Implementation Issues Under the Public Utility Regulatory Policies Act of 1978, Docket No. AD16-16-000, presented to the U.S. Federal Energy Regulatory Commission, June 16, 2016, viewable at https://www.ferc.gov/CalendarFiles/20160616092252-Bayless,%20NRECA.pdf.

21. See Jon Sanders, “Renewable Energy: Lobby’s report is more fog than light,” Spotlight No. 469, John Locke Foundation, June 3, 2015, https://www.johnlocke.org/research/renewable-energy-lobbys-report-more-fog-than-light.

22. Chris Juchau and David Solan, “Employment Estimates in the Energy Sector: Concepts, Methods, and Results,” Energy Policy Institute, Center for Advanced Energy Studies, Boise State University, March 2013, http://epi.boisestate.edu, viewable at http://www.ourenergypolicy.org/wp-content/uploads/2015/06/employment-estimates-in-the-energy-sector-concepts-methods-and-results.pdf.

23. See, e.g., Eugene M. Trisko, “Energy Cost Impacts on NC Families, 2015,” American Coalition for Clean Coal Electricity, January 2016, http://www.americaspower.org/wp-content/uploads/2016/02/NC-Energy-Cost-Analysis-116R.pdf; Gene R. Nichol, “Re: Docket E-100, Sub 133; Order Requesting Comments,” The Center on Poverty, Work, and Opportunity, University of North Carolina School of Law, statement to the North Carolina Utilities Commission concerning allocation methods in rate hike proceedings, July 6, 2012, viewable at http://www.ncwarn.org/wp-content/uploads/2012/08/NCW-motion-letter-from-UNC-Center-on-Poverty-statement-William-Marcus.pdf; Michael Jensen and William Shughart, “How green energy hurts the poor,” The Detroit News, August 4, 2016, http://www.detroitnews.com/story/opinion/2016/08/04/green-energy-hurts-poor/88282074; and Jon Sanders, “Graphing energy’s budget bite on NC’s poor,” The Locker Room, John Locke Foundation, June 21, 2016, http://lockerroom.johnlocke.org/2016/06/21/graphing-energys-budget-bite-on-ncs-poor.

24. David Fountain, “Solar policies need to change to benefit customers,” Charlotte Business Journal, April 25, 2017, http://www.bizjournals.com/charlotte/news/2017/04/25/viewpoint-solar-policies-need-to-change-to-benefit.html.

25. G.S. § 62-156, http://www.ncga.state.nc.us/gascripts/statutes/statutelookup.pl?statute=62-156.

26. See arguments in Docket No. E-100 Sub 140, In the Matter of Biennial Determination of Avoided Cost Rates for Electric Utility Purchases from Qualifying Facilities – 2014, North Carolina Utilities Commission, hearing June 7, 8, and 10, 2014, viewable at http://starw1.ncuc.net/ncuc/ViewFile.aspx?Id=bfd0ce81-d613-4eca-8a6a-dcf0abe3e901.

27. See, e.g., Michael Puttre, “Utility Commission Order Bolsters N.C.’s Status As A Rising Solar Power,” Solar Industry, January 8, 2015, http://solarindustrymag.com/utility-commission-order-bolsters-ncs-status-as-a-rising-solar-power; John Downey, “Solar industry welcomes order that leaves N.C. solar regs intact,” Triad Business Journal, January 2, 2015, http://www.bizjournals.com/triad/news/2015/01/02/solar-industry-welcomes-order-that-leaves-n-c.html; and Herman K. Trabish, “North Carolina regulators reject proposals to change utility-scale solar regulations,” Utility Dive, January 2, 2015, http://www.utilitydive.com/news/north-carolina-regulators-reject-proposals-to-change-utility-scale-solar-re/348314.

28. Kendal Bowman, Comments of Duke Energy Corporation to the Federal Energy Regulatory Commission’s Technical Conference Concerning Implementation Issues Under the Public Utility Regulatory Policies Act of 1978 (“PURPA”), Docket No. AD16-16-000, presented to the U.S. Federal Energy Regulatory Commission, June 17, 2016, viewable at https://www.ferc.gov/CalendarFiles/20160617152411-Bowman,%20Duke%20Energy%20-%20Long%20paper.pdf.

29. See “The Energy Report: A Snapshot of North Carolina’s Energy Portfolio Seven Years After Session Law 2007- 397,” North Carolina Department of Environment and Natural Resources, March 2015, viewable at http://portal.ncdenr.org/c/document_library/get_file?uuid=369122bb-0ed1-4974-b62c-3efec5930ff9&groupId=14, p. 26, and Jon Sanders, “Why it’s not enough to say ‘but our electricity rates are some of the lowest around,’” The Locker Room, John Locke Foundation, November 3, 2016, http://lockerroom.johnlocke.org/2015/11/03/why-its-not-enough-to-say-but-our-electricity-rates-are-some-of-the-lowest-around, chart viewable at http://lockerroom.johnlocke.org/wp-content/uploads/2015/11/elec-rate-increases.jpg.

30. 16 U.S. Code § 796 — Definitions, viewable at https://www.law.cornell.edu/uscode/text/16/796.

31. G.S. § 62-2 (3a) includes the “least cost mix of generation and demand-reduction measures” as a standard, and (4) includes “To provide just and reasonable rates and charges for public utility services,” but without the public-interest addendum; viewable at http://www.ncga.state.nc.us/gascripts/statutes/statutelookup.pl?statute=62.

32. “PURPA and Qualifying Facilities in North Carolina,” Duke Energy Corporation, and discussion at Frank Graves, Philip Hanser, and Greg Basheda, “PURPA: Making the Sequel Better than the Original,” Edison Electric Institute, December 2006, http://www.eei.org/issuesandpolicy/stateregulation/Documents/purpa.pdf.

33. S.L. 2007-397, http://www.ncga.state.nc.us/gascripts/BillLookUp/BillLookUp.pl?Session=2007&BillID=s3&submitButton=Go.