A bill filed in the General Assembly would bring back unaccountable film tax incentives as an open draw on the State treasury. The incentives had sunset in 2014 and been replaced by a grant program (a budget line item). House Bill 751 would restore the refundable tax incentives, something Gov. Roy Cooper sought in 2017.

A bill filed in the General Assembly would bring back unaccountable film tax incentives as an open draw on the State treasury. The incentives had sunset in 2014 and been replaced by a grant program (a budget line item). House Bill 751 would restore the refundable tax incentives, something Gov. Roy Cooper sought in 2017.

Meantime, the General Assembly has already tripled the original grant program. In so doing, as the National Conference of State Legislators showed last year, North Carolina was bucking the trend of other states getting away from incentivizing film productions.

Restoring the old film tax incentives, however, would not just keep North Carolina heading in the wrong direction. It would loop the seatbelt through the steering wheel and put a cinder block on the gas pedal.

Terrible ‘investments’

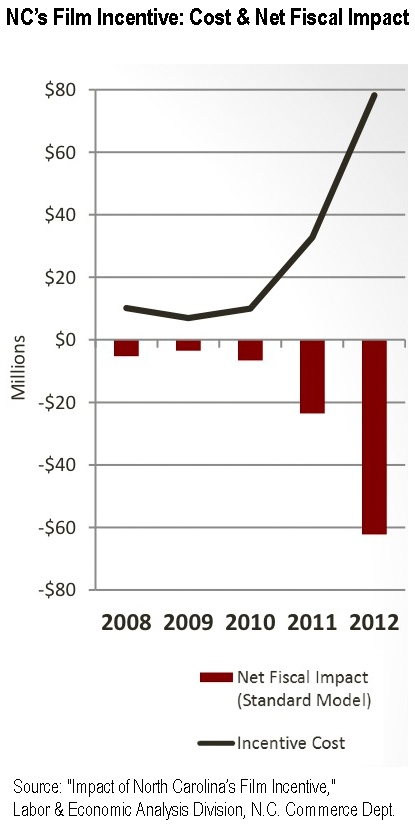

The reasons states are trending away from the programs is that they are consistently losing money on them. State after state after state have found that they get pennies on the dollar in these “investments.” North Carolina’s program, the one this bill would bring back? It had a “net negative budgetary impact” — returning only about 19 cents on the dollar (see chart, upper right).

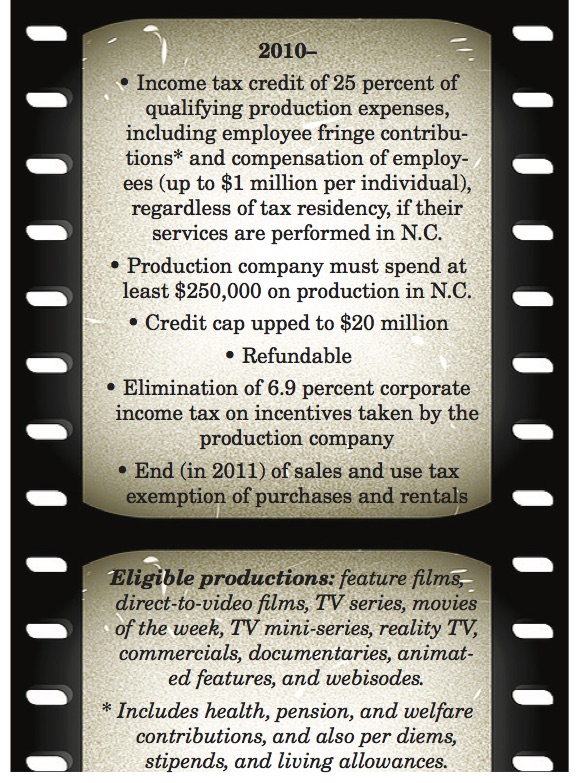

From my 2012 report on the film tax incentives program, here are highlights of what it would bring back:

That one bullet point, “Refundable”? That one is especially problematic. It’s not just that it’s irresponsible to extend refundable tax credits to outfits with basically no tax liability. As the North Carolina Institute for Constitutional Law has argued, it is likely unconstitutional:

The State Constitution prohibits the use of public money unless an appropriation has been made. Article V, Section 7, of the North Carolina State Constitution states in pertinent part:

Drawing Public money.

(1) State treasury. No money shall be drawn from the State treasury but in consequence of appropriations made by law, and an accurate account of the receipts and expenditures of State funds shall be published annually.

N.C.G.S. § 105-151.29(e) clearly and unambiguously authorizes the payment of public money to private film production companies as part of a so-called “refund.” The central constitutional question then is whether the General Assembly has appropriated money for payments to film production companies. The answer, as explained below, is no.

So just get rid of the refundability portion and then it’s no problem, right? Well, that’s the grant program, which film incentives backers gripe about. They had made it clear for years that having a path around constitutional appropriations for film cronies was the program’s linchpin.

Research shows that film incentives programs only benefit outside film production companies. They aren’t associated with actual growth to the state’s economy.

Even judged on its ostensible intent, a film tax incentive beyond 10 percent merely increases a wealth transfer from the state’s citizens to out-of-state film production companies without any corresponding benefits to the state.

Also, let’s not forget that the programs embolden out-of-state companies to bully state lawmakers to enact their preferred social agenda, not just their preferred incentives packages. (Just ask Georgia this year, if you don’t remember 2016.)

Research bears this out, too. Film tax incentives are shown to encourage rent-seeking behavior and lead to “an extortive political economy.” Are you sure that’s what we want?