Bob Dylan. Lindsay Buckingham. Stevie Nicks.

Bloomberg Businessweek reports these three are among the rock stars who’ve recently sold rights to their music. Dylan, who’s pushing 80, evidently has said no for years but recently decided to cash in with a $300 million deal. This kind of sale isn’t new, but BB’s Lucas Shaw and Thomas Seal write that COVID-19 has struck a blow to the income usually generated by touring. Plus, some of these stars are at the end of their working careers.

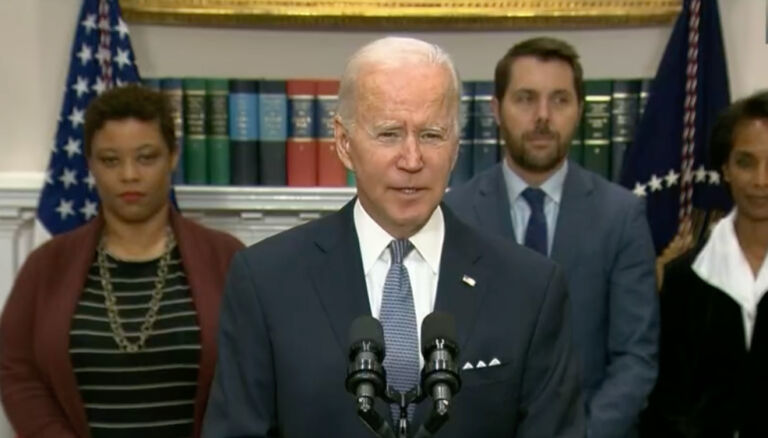

But the reality of Joe Biden’s election is a factor as well, according to Shaw and Seal’s story. Note this is a subscription site so you can’t read the entire piece unless you’re a subscriber.

Here’s the money quote.

Joe Biden has pledged to increase capital-gains taxes, so the stars wanted to reach agreements before that happens. “These artists are all in their early 70s, mid-70s, and at that age you should be thinking about estate planning,” says Josh Gruss, chief executive officer of Round Hill Music, a fund that owns rights to songs by artists including the Beatles.

Can you blame them? Here’s what candidate Biden promised in February 2020.

As John Kartch of Americans for Tax Reform wrote on that debate night:

Biden’s comments and his long Senate voting record mean voters should expect him to push for capital gains tax hikes if elected. During his time in the Senate, Biden consistently voted against tax cuts on capital gains.

In 2003, Biden voted against the reduction in the capital gains rate from 20 percent to 15 percent. In 2005 and 2006, Biden voted against extending the 15 percent rate.

In 2012, then-Vice President Biden and President Obama insisted the cap gains rate revert to 20 percent.

Biden and Obama then piled on another 3.8 percent capital gains tax hike — the Net Income Investment Tax — one of the many tax increases in Obamacare. The 3.8 percent tax hike took effect Jan. 1, 2013.

Currently, long-term capital gains are taxed at zero percent, 15 percent, or 20 percent, depending on income level.

Households subject to Obamacare’s 3.8 percent Net Income Investment Tax end up paying a 23.8% rate. And under Biden’s cap gains scheme, such households will face a 43.4 percent rate.

Dylan, Buckingham, and Stevie get it — or their financial advisors do. Good for them.

Here are my questions: Did they vote for him? Do they care who else will be hurt by his misguided policies? At the John Locke Foundation, we care about the impact of tax policy on every person, rich or not-so-rich. That’s why we advocate for a fair and neutral tax code that doesn’t penalize people for doing well. It’s only fair that we keep more of what we earn, turning over to federal, state, and local government only what’s necessary to fund core services.

Dylan, Buckingham, and Stevie deserve to enjoy the fruits of their labor. And so do you.