A study was released on Monday stating that 76% of Americans are living paycheck-to-paycheck. This reminded me of when I worked as a teller at a bank. To my surprise, many people would have to ask for their balance every time they came into the bank to make sure they did not withdraw too much. One person even kept as low as $15 in his checking account and would come in once a week to withdraw $2 until he got paid again. So when I saw some statistics from this study, unfortunately they weren’t that surprising.

- 22% of people have less than $100 in savings for an emergency expense

- 46% have less than $800 in savings

- 27% have no savings at all

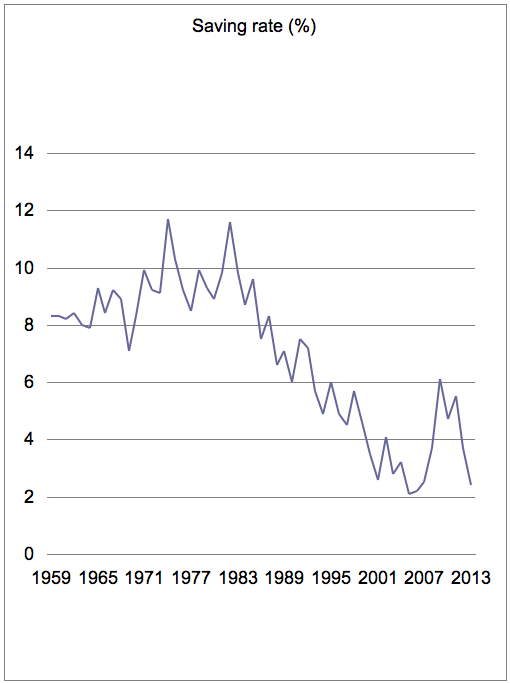

Reading about these numbers, it made me curious to know how many people DO save. That statistic is recorded by the US Department of Commerce and is known as the savings rate; household savings divided by household disposable income. The chart below shows the savings rate over the last 44 years in the United States.

The Economist published an article about the falling savings rate in April which outlined many ideas of why this has happened over the last decades:

“The falling saving rate is a worrying trend. A low stock of savings increases vulnerability to economic shocks. Expansionary economic policy has helped invigorate the economy by boosting consumption, through low interest rates. People save more during recessions—and more then businesses care to invest, leading to underutilized resources—so boosting consumption increases aggregate demand and jumps starts recovery. With saving rates already so close to zero, the government might have had better luck boosting the economy through its own dissaving, via deficit-funded stimulus, than through trying to encourage such behavior in strapped households. And over the longer run, policies that discourage saving look foolish at current saving rates.”