- The North Carolina Senate released its biennium budget proposal this week as scheduled, with the expectation of meeting with the state House to establish a conference budget before the current fiscal year ends on June 30

- The Senate proposal contains personal income tax rate cuts, capital spending, state employee raises, and investments in workforce training

- It would also allocate significant funding to various reserves, which are not counted in the General Fund bottom line

In a press conference today, North Carolina Senate budget leaders revealed their budget proposal for the upcoming biennium. The state House unveiled their version in late March, and the chambers are expected to come together to agree on a conference budget before the new fiscal year begins on July 1.

This brief highlights important items proposed in the Senate budget, but it is not comprehensive. The 387-page budget bill can be found here.

The Senate proposes spending $29.8 billion in the first year of the biennium (fiscal year 2023–24), a roughly 6.5% increase from the current fiscal year’s spending. They proposed spending $30.9 billion for the second year, though that number would likely be adjusted during next year’s short session. These bottom-line numbers are consistent with the House version.

The latest forecast from the Office of State Budget and Management and the General Assembly’s Fiscal Research Division estimates that General Fund revenue will exceed projections by $3.11 billion this year. It gives the General Assembly a surplus to work with. Even so, the Senate proposal would send $250 million to the Rainy Day Fund, which would bring the total Rainy Day Fund to $5 billion. The proposal also would add $1.5 billion to the Clean Water and Drinking Water Reserve and send an additional $900 million to the Stabilization and Inflation Reserve. Among other reserve funding, this budget would spend more than $1.4 billion to create the NCInnovation Reserve to “apply research to actual market needs” according to the press conference.

Indeed, money set aside into various reserves adds up to about $5 billion and also includes $250 million each year to the Regional Economic Development Reserve and $500 million to the Medicaid Contingency Reserve. The funds set aside in these reserves are not counted in the General Fund expenditures.

The proposed year-over-year General Fund spending increase is quite large. As our nation is on the brink of recession, the new recurring spending that the state would then be on the hook for indefinitely is worrisome. The latest revenue forecast shows economists still “anticipate a significant slowdown in economic growth.” This budget would add a net $1.64 billion in new recurring spending in the first year and $2.98 billion in new recurring spending in the second year. Moreover, with the signing of this budget, Medicaid expansion would be authorized, creating long-term vulnerabilities for state and national taxpayers and threatening to overwhelm an already bloated program.

Even so, the top line spending number for the Senate proposal is much more conservative than Gov. Roy Cooper’s recommended budget, which would have grown spending by 18%.

This budget proposal, if enacted, would:

Taxes

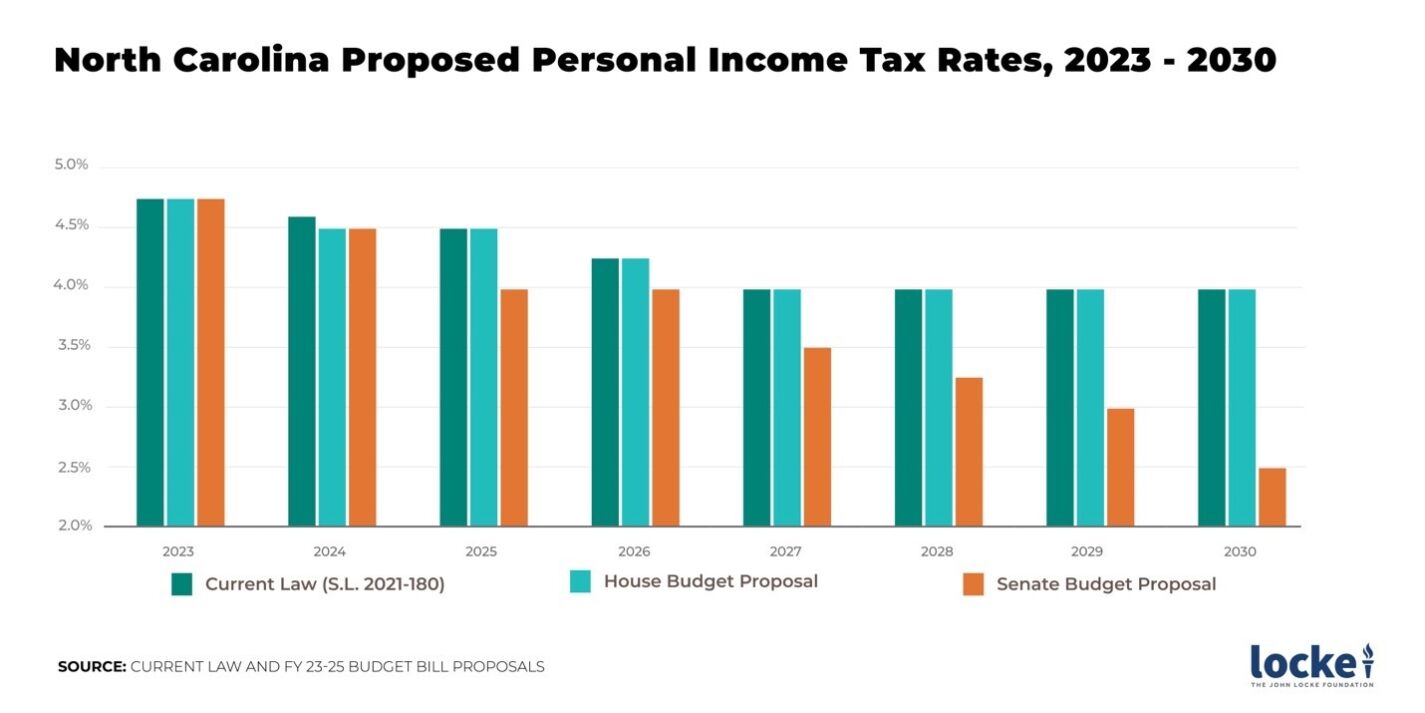

- Accelerate and increase the cuts to the personal income tax rate. Under the Senate proposal, the personal income tax rate would decrease to 2.49% by 2030. Under current law, the rate is scheduled to decrease to 3.99% after 2026. The Senate proposal’s tax cuts would start in 2024, when the rate would decrease to 4.5%. These cuts would be more aggressive than those proposed by the House. According to Senate President Pro Tempore Phil Berger in today’s press conference, these cuts would result in $6.6 billion in tax savings over the next five years. For a comparison of the scheduled rate decreases with the House and Senate proposals, see the below graph:

- Propose no increases to the standard deduction, unlike the House budget proposal. The John Locke Foundation has recommended indexing the standard deduction to inflation to prevent low-income taxpayers from becoming unnecessarily pushed above the standard deduction ceiling even if their inflation-adjusted wages had fallen. The Senate proposal also would not increase the child deduction as the House proposal would.

- Expand the sales tax exemption to include more aircraft. Currently, aircraft with take-off weight between 9,000 and 15,000 pounds are exempt from paying a sales tax on parts and accessories. Under this proposal, any aircraft with a take-off weight of 2,000 pounds and above would be exempt from a sales tax for parts and accessories.

- Exempt breast pumps and breast pump supplies from the sales tax.

- Expand the short-term car rental tax of 8% to include peer-to-peer rentals, like Turo and Getaround.

- Change the method of taxing smokeless tobacco, basing it on weight instead of cost.

- Not repeal the harmful privilege license tax nor reduce the franchise tax, two changes the House budget proposal would make.

State Employee Salaries and Benefits

- Provide most state employees with a 5% raise over the biennium (a 2.5% raise each fiscal year). They would be lower than the increases proposed in the House’s version, under which state employees would receive a 7.5% raise over the biennium.

- Give teachers an average pay raise of 4.5% over the biennium. The budget proposal focuses on new teachers, increasing starting pay by almost 11% this fall, according to the press conference.

- Give school superintendents, supervisors, finance officers, and other central office school staff 5% raises over the biennium.

- Set aside $94 million into the Labor Market Adjustment reserve for additional, targeted raises to state employees.

- Provide $10.9 million in recurring funding for salary supplements to teachers serving in advanced roles in the Advanced Teaching Roles program.

Capital Spending

- Set aside $700 million to the State Capital and Infrastructure Fund (SCIF) for the biennium on top of the statutorily required reservation ($2.9 billion for the biennium, in this case) to fund capital and construction across the state and avoid needing to finance such projects through debt. These funds are not counted in the General Fund total. This amount is less than the $1.3 billion of additional funds proposed by the House.

- Provide $400 million over the biennium in nonrecurring dollars on repairs and renovations for state-owned facilities (not including the UNC System) and more than $500 million in nonrecurring dollars on repairs for the UNC System.

- Spend $155 million of additional funding for the General Assembly’s downtown education campus, for the UNC System Office, the Community College System Office, Department of Public Instruction (DPI), and the Department of Commerce.

- Fund $200 million in nonrecurring funding over the biennium for construction, repairs, and renovations at community colleges.

Health Care

- Expand Medicaid as authorized in House Bill 76. The nonfederal share of the costs, totaling nearly $500 million in the first year, would mostly be covered by a new fee assessed on hospitals. For more on Medicaid expansion and what it would mean for the state’s fiscal future, see here.

- Authorize the state treasurer to reimburse lower-priced premiums in lieu of the State Health Plan, giving the treasurer additional cost leverage to reimburse premiums outside the State Health Plan.

- Create a new savings requirement between urban hospitals (any hospital located in a county with a population greater than 210,000) and the State Health Plan. As the bill reads, “It is the intent of the General Assembly to realize savings to the State Health Plan for Teachers and State Employees by requiring urban hospitals to reduce healthcare costs to the citizens of this State as a requirement for hospital licensure.”

- Eliminate certain health care regulations by extending temporary certificate of need (CON) exemptions, including eliminating CON review for kidney disease treatment centers, linear accelerators, and magnetic resonance imaging scanners.

- Spend $15 million in each year of the biennium to provide a grant to the North Carolina Association of Free & Charitable Clinics.

- Expand health care workforce programs by spending $30 million over the biennium to develop and expand courses that lead to credentials in health care–related fields at community colleges.

- Spend $100 million over the biennium to permanently retain “at least half of the COVID-19 add-on amount in the Medicaid reimbursement rates for skilled nursing facilities.”

- Provide $120 million over the biennium to increase wages of those providing services to individuals on the NC Innovations Waiver, a federally approved Medicaid Home and Community-Based Services Waiver designed to support those with disabilities.

- Increase the Medicaid reimbursement rates for behavioral health providers.

Education and Schools

- Expand the Opportunity Scholarship program to all families, with scholarships awarded on a sliding scale based on income found in Senate Bill 406.

- Spend $11 million in the next fiscal year to support additional Opportunity Scholarships in the 2023–24 academic year.

- Provide additional funding ($105 million recurring in the first year, $163 million recurring in the second year) to the Opportunity Scholarship Grant Reserve to help avoid a waitlist for the program.

- Spend $1.425 billion on the NCInnovation Reserve “to develop a network of regional innovation hubs, to incentivize applied research opportunities, and to support the commercial growth and scale of emerging technologies to promote the welfare of the people of the State and to maximize the economic growth in the State through expansion of both (i) the State’s high technology research and development capabilities and (ii) the State’s product and process innovation and commercialization.”

- Establish the Early Graduate Scholarship Program to provide scholarships to UNC constituent institutions to qualified students who graduate early.

- Increase funding to support tuition grants for graduates from the North Carolina School of Science and Mathematics (NCSSM) and the University of North Carolina School of the Arts (UNCSA) who attend a UNC constituent institution.

- Spend $70 million over the biennium on school safety grants for school safety training and students in crisis.

- Promote health careers to high school students by spending $2 million to create a competitive grant program at DPI.

- Provide $850,000 in recurring funding each year to continue the anonymous tip line for school safety threats.

- Spend $10.5 million for completion assistance to provide aid to students at risk of dropping out of certain UNC institutions due to financial shortfalls.

Policy Changes

- Raise the mandatory retirement age for appellate judges.

- Prohibit discrimination or retaliation against a state employee or potential state employee for refusing to provide proof of a Covid-19 vaccination.

- Limit state funding for abortions. State funds are already prohibited from being used to support abortion except if the life of the mother is at risk or in cases of rape or incest. With the Senate proposal, no state funds could be used to renew or extend contracts with any provider that performs abortions.

- Prohibit cap-and-trade requirements for carbon dioxide emissions.

- Put into effect a prohibition on state or regional emissions standards for new motor vehicles.

Corporate Welfare and Pork Spending

- Add $10 million to the Economic Development Project Reserve, along with $500 million to the Regional Economic Development Reserve, over two years. Putting funds into these separate reserves allows for future politically favored local projects to be funded without transparency. These are smaller funding additions than the House proposed to send to the reserves.

- Send $8 million over the biennium to the World University Games Reserve for the 2029 World University Games.

- Spend $10 million on the Megasite Readiness Program. Among other things, this budget would expand the program to include sites smaller than 1,000 acres that are suited for industrial development. A grant program would be established to assist local governments in the acquisition of a newly identified or existing megasite.

- Add dozens of pork spending projects, including sending $692,500 to the Museum of Natural Sciences to staff the dueling dinosaurs exhibit, $300,000 to the NC Sports Hall of Fame, and over $1 million to the USS North Carolina Battleship Commission’s Living with Water Project.