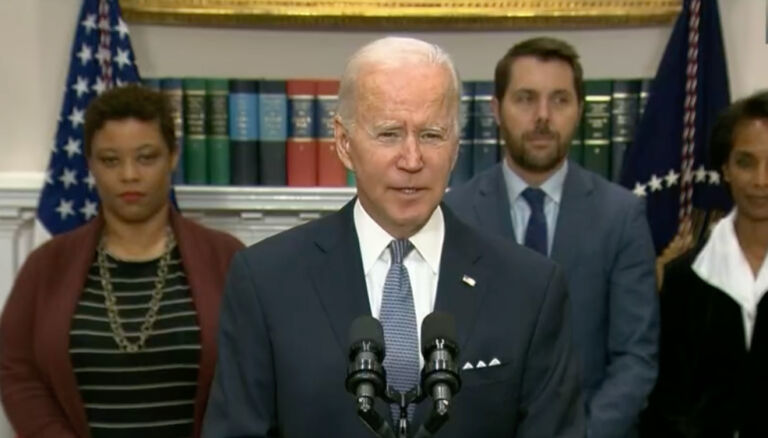

Senate Republicans have passed a bill, in assistance with the House, that would block Pres. Biden from forcing companies to adopt an ESG investment agenda for employee retirement plans. This blocks the government from intervening unnecessarily in the decisions of individuals and companies.

Having a strong retirement plan is critical for ensuring that the rest of your life remains comfortable. But what if the government is requiring you to invest only in certain companies, regardless of their potential profitability? What if the White House demands that your company can only use your money to invest in businesses that align with progressive ideas?

That’s what the Biden administration was proposing in a voluntary Labor Department rule, which went into effect on January 30.

ESG stands for “environmental, social, and corporate governance,” and it’s a philosophy that demands financial advisors consider those factors, and really only those factors, when investing in a company. That means that they may suggest investing in a solar panel company, even when it’s failing because it adheres to the ESG principles. It’s a perspective that has been aggressively pursued and weaponized by one of the most powerful financial companies in the world, BlackRock.

As Unherd explains, “As February turns to March, the finance world is waiting with bated breath for one of its most dubious annual traditions: The Larry Fink Annual Letter to CEOs. Since 2012, when the BlackRock chief executive wrote his first letter, the occasion has come to symbolise the growing threat both to shareholder capitalism and American democracy posed by investment houses’ crusade to force the principles of ESG, or ‘environmental, social, and governance’ investing, down the throats of companies, investors, and the public.”

The enormous capital that BlackRock has acquired has been used to force companies to adopt more progressive and woke policies and practices. Companies then have to choose between losing access to BlackRock’s enormous resources or following a route that could be much less profitable.

For example, the state of Louisiana severed ties with BlackRock over its anti-fossil fuel policies, which treasurer John Schroder believed would “destroy Louisiana’s economy.”

While it’s understandable that some people want to invest in companies that are dedicated to a cause like climate change, that isn’t what everyone wants. Most want the best return on investment to maximize profitability, especially as everyone knowns Social Security will probably become insolvent, not to prop up a failing wind turbine company because it’s helping the environment and might be profitable, some day.

Sen. Mike Braun of Indiana said, “The last thing we should do is encourage fiduciaries to make decisions with a lower rate of return for purely ideological reasons.”

Pres. Biden is expected to veto the legislation, the first of his term. There’s also a case moving through the court system, supported by Republicans and the oil industry.

When it comes to North Carolina, BlackRock currently manages $14 billion of The North Carolina Retirement System. State Treasurer Dale Folwell called out BlackRock for its investment practices, that are antithetical to the beliefs of many North Carolinians.

But the pushback is growing against BlackRock and now the Biden administration as well when it comes to ESG motivated.