Earlier this week, JLF’s Jordan Roberts published a research brief examining the merits of reinsurance in state health exchanges and whether or not it could be a viable option for North Carolina.

What is Reinsurance?

It works a lot like personal health insurance. In individual health insurance, you pay a premium every month to have insurance. If your health expenses pass your deductible (the point where insurance starts covering your expenses), your health insurance starts to pay a portion of your claims. If you are healthy, you pay your premiums and don’t surpass your deductible. Because you haven’t met the deductible, the insurer doesn’t pay out. But if you get sick one year, you surpass your deductible, and the insurance company starts paying.

Reinsurance is insurance on your insurance (I know, as if it wasn’t complicated enough already).

Just like in personal insurance, companies pay a premium every month to have reinsurance. If their payouts pass their “attachment point” (exactly like your deductible – a cost threshold at which reinsurance start covering expenses) – reinsurance starts to pay a portion of the company’s payout to hospitals. Just like your health insurance protects you from paying large medical bills in full, reinsurance protects insurance companies from having to cover large payouts in full. If a company never reaches its attachment point, the reinsurer keeps all the premium money. But if the company’s expenses surpass its attachment point, the reinsurance company starts paying.

How Do States Implement Reinsurance?

To implement reinsurance in a state, the state must first obtain a Section 1332 “Innovation” waiver. Roberts explains:

For a section 1332 waiver to be approved, state officials would have to show HHS [U.S. Department of Health and Human Services] that their new alternative will function in accordance with the following guardrails: “provide coverage at least as comprehensive as that provided under the ACA; provide coverage and protection against excessive out-of-pocket expenditures at least as affordable as that provided under the ACA; cover a number of residents at least comparable to the number who would be covered under the ACA; and not increase the federal deficit.”

Why Do States Implement Reinsurance?

Roberts quotes Louise Norris from verywellhealth to explain why states implement reinsurance:

“In a nutshell, the idea is that the reinsurance program lowers the cost of health insurance, which means that premium subsidies don’t have to be as large in order to keep coverage affordable, and that saves the federal government money (since premium subsidies are funded by the federal government). By using a 1332 waiver, the state gets to keep the savings and use it to fund the reinsurance program. That money is referred to as “pass-through” savings since it’s passed through to the state.”

So, when reinsured, health insurance companies are not fully on the hook for huge payouts; they have lower risk. That lowered risk allows health insurance companies to drop premium prices. When the state saves money every month on premiums, it can use some of those savings to pay for the reinsurance program.

If the goal is lowering premiums, reinsurance seems to work. Roberts writes:

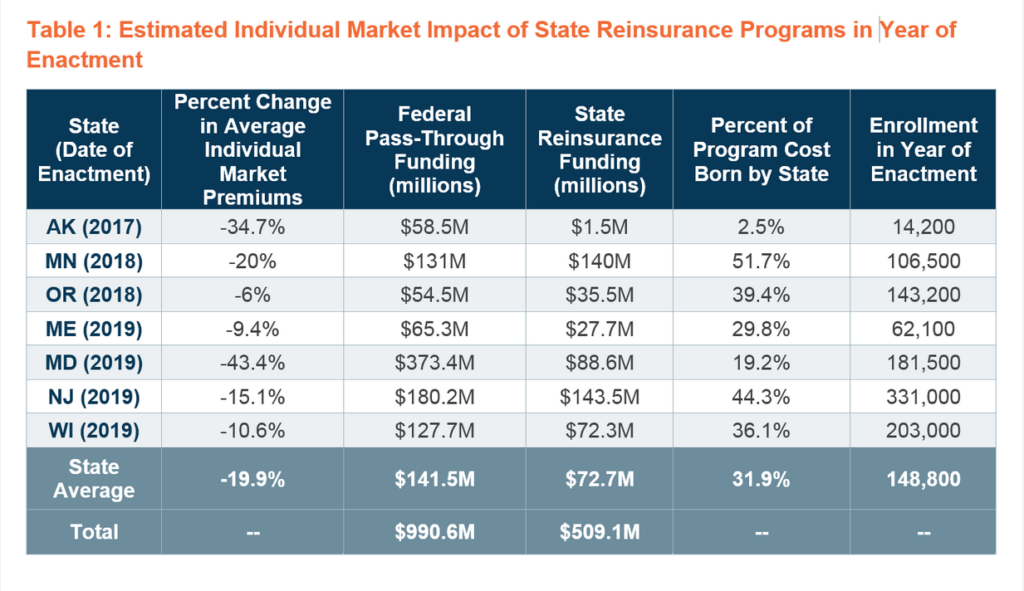

On average, the states with an implemented reinsurance program were able to reduce premiums by 19.9 percent compared to what the premiums would have been in the absence [of reinsurance].

Should North Carolina Implement Reinsurance?

Maybe. Roberts writes:

Would a reinsurance program work for North Carolina? It could. Is it the right idea? Maybe. A 1332 waiver would help North Carolina by allowing the state to set up an insurance market without all of the excessive burdens of Obamacare. If this included a reinsurance program as other states have implemented, the devil would be in the details…

Using a reinsurance program (or another risk-adjustment program) is one method to try to reallocate existing funding to meet the needs of patients better and lower costs for everyone in the insurance market. The key here is that this type of program would reallocate funding that is already slated to come to the state. If properly set up, this type of program could spread risk without requiring any new federal funding.

As the Affordable Care Act remains the law of the land, states are looking for additional ways to provide relief for those who cannot afford or struggle to afford insurance. A 1332 waiver may be the way to do so.

Read the full brief here. Learn more about health care reforms in North Carolina here.