The Consumer Price Index (CPI) fell 0.1% in December after increasing 0.1% in November, according to the latest release from the Bureau of Labor Statistics. On an annual basis, prices have increased 6.5%. Core inflation, which excludes volatile energy and food prices, rose 5.7% on an annual basis.

Decreasing energy prices caused overall CPI to fall last month. Led by declining gas prices, energy prices dropped 4.5% over the month but are still up 7.3% annually. Gasoline fell 9.4% over the month, leaving prices 1.5% lower than they were in December 2021. Even in December 2021, however, the national average for gas prices was $1.19 per gallon more than in December 2020.

Relief at the pump has been in part due to the Biden administration draining an historic amount of oil from the nation’s strategic reserves, leaving the reserves at a 40-year low. With the last such drawdown occurring in December, relief may prove to be temporary. Since Christmas, gas prices are up about 15 cents per gallon.

Despite the lower gas prices, energy services are up 15.6% over the year. Electricity alone has risen 1.0% over the month and 14.3% over the year.

Food prices continue to rise. This is especially devastating for low-income families who spend a greater share of their income on food. Groceries are up 10.4% on an annual basis, while food away from home is up 11.8%.

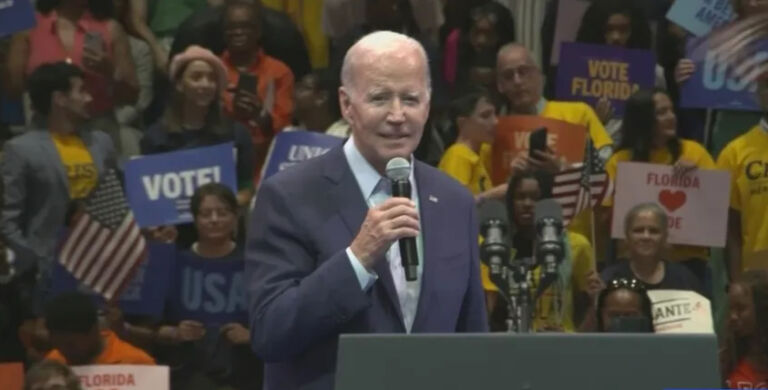

President Biden sees today’s inflation data as “a break for families and proof that [his] plan is working.” This unfortunate political spin fails to acknowledge the reality that families are hurting from his reckless spending. CPI’s annual rate has been 5.0% or more since May 2021. Even after cooling to a 6.5% annual rate, current inflation is still at heights not seen in more than 40 years. Family budgets are strained and household debt is on the rise, and the personal savings rate since September has only been lower in one month since the Fed started tracking the rate in 1959.

Moreover, average earnings are down. Real average hourly earnings are down 1.7% on an annual basis, demolishing hopes of saving for the future for some families. Average weekly hours continue to fall, signaling stress in the job market.

The Federal Reserve increased rates seven times in 2022. Jobs and wage growth, as well as home and retail sales, slowed nationwide as a recession looms.

Government deficit spending fueled by money printing is the cause of today’s inflation. Unfortunately, Washington shows no sign of fiscal restraint, even as working families struggle to make ends meet.