I have been an unrepentant mocker of that subset of academic research, usually funded with public monies, that purports to “find” the obvious.

Some of those include such game-changers as men want hot women, women appreciate jokes more when they’re funny, distractions impede learning, and a person who hates Israel is more likely to be anti-Semitic. Research has even proven that hugs are good and not disproven, even after three years of study, that drinking water helps prevent dehydration.

Nevertheless, I am very glad Johnson & Wales associate economics professor Adam C. Smith has proven the obvious. Because obviously, his proof was made necessary.

People aren’t always rational. (But policymakers are people, too.)

Last year, President Barack Obama issued an executive order requiring federal regulatory agencies to use behavioral economics and psychology in designing their policies. The idea is to address the fact that people often make the “wrong choices” — a “behavioral market failure.” It is to rectify flaws in the “private choice architecture.”

As Smith explains it, “policymakers are increasingly operating under the assumption that people consistently fail to make rational choices.”

What should be glaringly obvious at this point is that, to accept that premise, one must realize that policymakers are people, too.

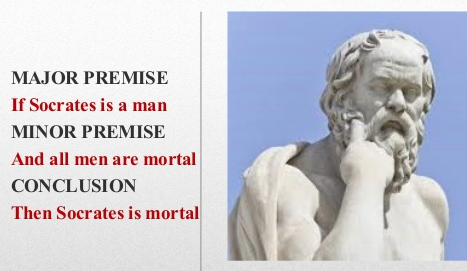

A syllogism (which otherwise needs not to be stated) would then emerge:

Major premise: People consistently fail to make rational choices

Minor premise: Policymakers are people

Conclusion: Policymakers consistently fail to make rational choices

Smith’s paper argues the need for accounting for public-choice economics alongside behavioral economics or else the endeavor is not likely to succeed. Massaging policies to produce the proper private choice architecture also require the proper public choice architecture. He concludes,

The more general lesson is that without the proper public choice architecture in place, there is little hope for improving private choices in practice. … Without proper understanding of context and the institutional constraints regulators will inevitably face, it is unlikely that behavioral ideas will lead to better private choice architecture. While these efforts are encouraging for attempting to improve the choices people face, this paper exposes the importance getting the institutions right. Those who truly wish to improve private choice architecture should take greater care in understanding the public choice architecture in which their theories are applied.

Addendum: I acknowledge there are those who see certain policymakers as higher beings — i.e., not people — but I consider such a belief the ne plus ultra of folly.