Zachary Halaschak of the Washington Examiner ponders the end game for the federal government’s ongoing debt ceiling debate.

The United States is inching closer to the deadline for action on raising the debt ceiling. Here is what will happen as that date approaches — or even lapses.

It has been months since the government hit its $31.4 trillion debt ceiling, and both Democrats and Republicans want to raise the cap, although Republicans are using it as an opportunity to score concessions like spending cuts.

President Joe Biden and Republican leadership now must negotiate a deal and are set to meet Tuesday afternoon. Any agreement, though, is likely to come down to the wire, and there is a small possibility that the worst-case scenario occurs and the two sides fail to make an agreement on time.

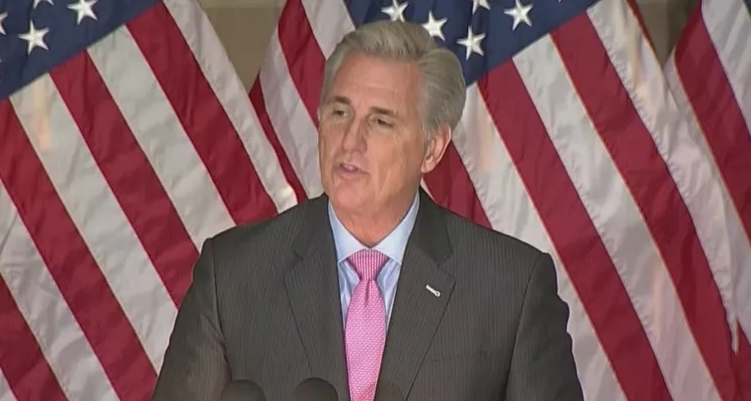

House Speaker Kevin McCarthy (R-CA) offered up a plan that would raise the debt ceiling over the next year either by $1.5 trillion or until March 31, 2024, whichever comes first. But the plan would cut back on spending and includes other provisions that are unacceptable to Democrats in the Democratic-controlled Senate, such as beefed-up work requirements for welfare. …

… The longer the two sides fail to come to an agreement, the more markets will react as investors fear default. It is worth noting that the U.S. has never defaulted on its obligations in all the times Republicans and Democrats have sparred over the ceiling, with an agreement always being inked in time.

Still, the mere perception that the Treasury might run out of “extraordinary measures” to pay incoming bills would roil the markets. Such measures have been used at least 16 times since first being deployed in 1985, according to the Committee for a Responsible Federal Budget, and as recently as two years ago.