The real story about the budget should be about how much each chamber is spending. It depends on what you use for your baseline, but compared to last year, the House’s budget increased spending by 5%. But that is if you only measure the spending side.

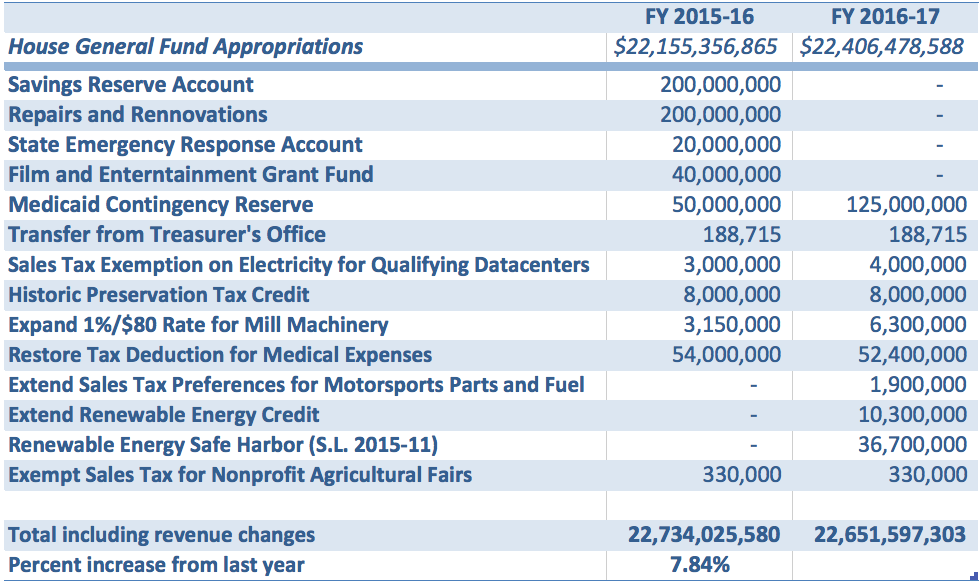

In state budget accounting there is the spending side of the ledger and the revenue side. When we look at spending increases…we tend to focus on the spending side of the ledger, even though there is spending on the revenue side. On the availability statement for the House budget, everything in parenthesis is a reduction to the available cash the state can spend…essentially a spending item in the availability statement. This is a prime example of how accounting tricks can hide things. There is no reason the film grant should be in the availability statement. It is strictly a spending item. Here is a complete picture of what the House spent in their availability statement:

So what does that mean? The House spent nearly 8% more in its first year of the budget when compared to last year. I didn’t compare what was taken out in last year’s availability statement, so it might be a little less, but the general idea is that the House is spending more than is being claimed.

So what does that mean? The House spent nearly 8% more in its first year of the budget when compared to last year. I didn’t compare what was taken out in last year’s availability statement, so it might be a little less, but the general idea is that the House is spending more than is being claimed.

Some will argue that tax credits are not a form of spending, others say it is. The point to all this is not to focus on the amount that it increased, because everyone has different opinions for what should be included and what shouldn’t. The point is…there is a considerable amount of money that is allocated and spent in the availability statement in every budget. If we want to get a clear picture of what we are spending….we don’t need to focus too much on the spending side – we also need to focus on the revenue side of the budget.