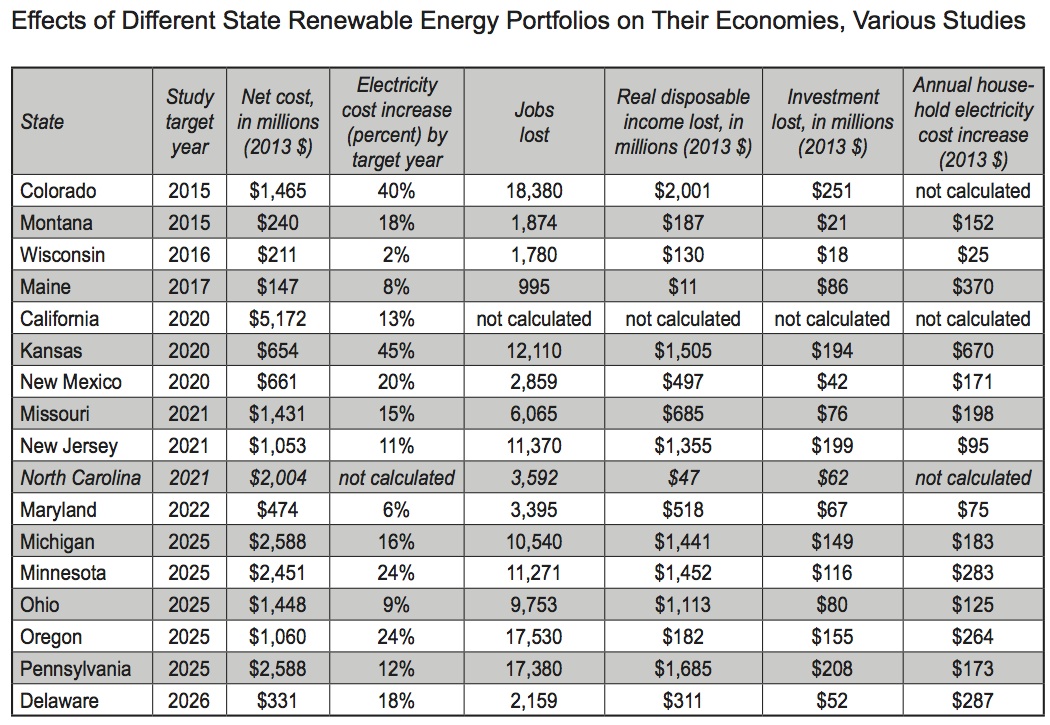

A growing list of states are learning the Bastiat 2014 lesson that imposing renewable portfolio standards (RPS) on electrical utilities raises prices on ratepayers and harms the state’s economy, costing thousands of jobs and millions of dollars in investment while robbing citizens hundresd of millions of dollars in disposable income.

This chart updates a previous compilation in my report on North Carolina’s RPS mandate and includes three additional studies on RPS mandates in Maryland, Michigan, and New Jersey (click the image for the full size):

As explained by Beacon Hill economists in the New Jersey study, here is what is at stake in N.J. and any other RPS state, including of course North Carolina (emphasis added):

Lost among the claims of increased investment and jobs in the “green” energy sector is a discussion of the opportunity costs of RPS polices. By mandating that electricity be produced by more expensive sources, ratepayers in the state will experience higher electricity prices. This means that every business and manufacturer in the state will have higher costs, leading to less investment in both capital and labor. Moreover, every household will have less money to spend on other purchases, such as groceries and entertainment.

Proponents of the RPS law are correct: there will be more investment and jobs in the “green” energy sector, but rarely do they mention the loss of jobs and investment in every other sector in the state.