Ken Fisher of Forbes investigates the history of the stock market and presidential election outcomes.

I’ve turned up a 155-year indicator that suggests Hillary Clinton will not be elected next year–and offers some interesting perspective as to the market direction in 2016 and 2017.

An old, little-known truth: Overwhelmingly, when Republicans are elected President, stocks soar during the year they are elected (this has held true every single election since World War II, except 2000, an election in which Al Gore won the popular vote). Average S&P 500 gain: 12%, presumably in anticipation of market-friendly policies. Then stocks flipped negative during most GOP inaugural years–presumably when investors realized the new guy was, yes, still just a politician.

By contrast, when Democrats won, election years typically lagged as investors feared an antibusiness, antimarket President. But their inaugural years all surged double-digit positive (except Jimmy Carter’s 1977, off 7.4%), a whopping 21% overall. Presumably when investors realized the new guy was, yes, still just a politician.

Regardless of “why,” them’s the numbers! Playing purely historical odds, for a strong 2016, hope for a Republican; if you prefer a heady 2017, hope for Hillary.

And who will win? There’s some unnoticed historical truth here, too:

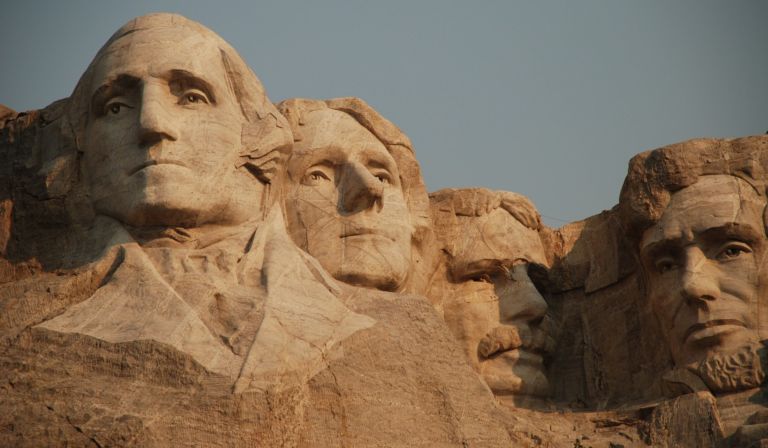

Since the Civil War we’ve elected Democrats who were either (1) already President or (2) a fresh new face (Obama, Clinton, Carter, Kennedy, FDR, Woodrow Wilson, etc.). Democrats have never elected anyone who would have been considered a likely nominee during the previous election cycle (Walter Mondale, Hubert Humphrey, Al Smith, etc.). Debate about FDR if you will, but I’ll win. He was an unlikely 1932 nominee as of 1928.

Speaking of FDR and debate, it’s also a good idea to investigate the debate surrounding Roosevelt’s legacy as president.