The Center for American Entrepreneurship recently released an interactive online report called, “The Rise of the Startup City.” Aaron Renn provides a summary at Urbanophile.com:

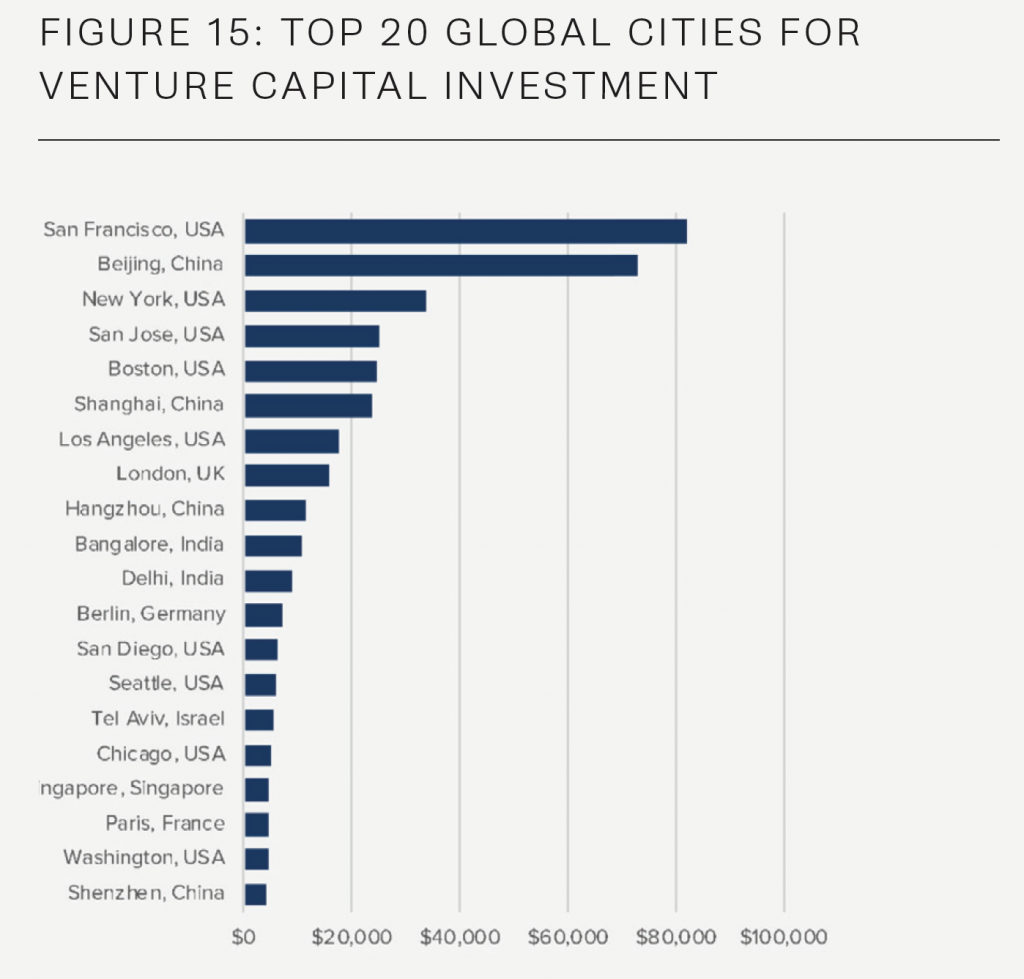

The main message of the report is that the US is losing its global dominance in venture capital investing as the real “rise of the rest” happens overseas, particularly in China.

While the U.S. continues to generate the largest amount of startup and venture capital activity, its share of the global total has fallen significantly, from more than 95 percent in the mid-1990s to more than two-thirds in 2012 to a little more than half today. Among other nations, China has gained the most ground, attracting nearly a quarter of global venture capital investment in recent years. India and the United Kingdom together account for another nine percent of global venture capital investment, while Germany, France, Israel, Singapore, Sweden, and Japan collectively contribute another nine percent to the global total.

Renn notes that “VC funding is very concentrated in a limited number of cities,” which isn’t surprising. Nor is the list of cities that make the top 20:

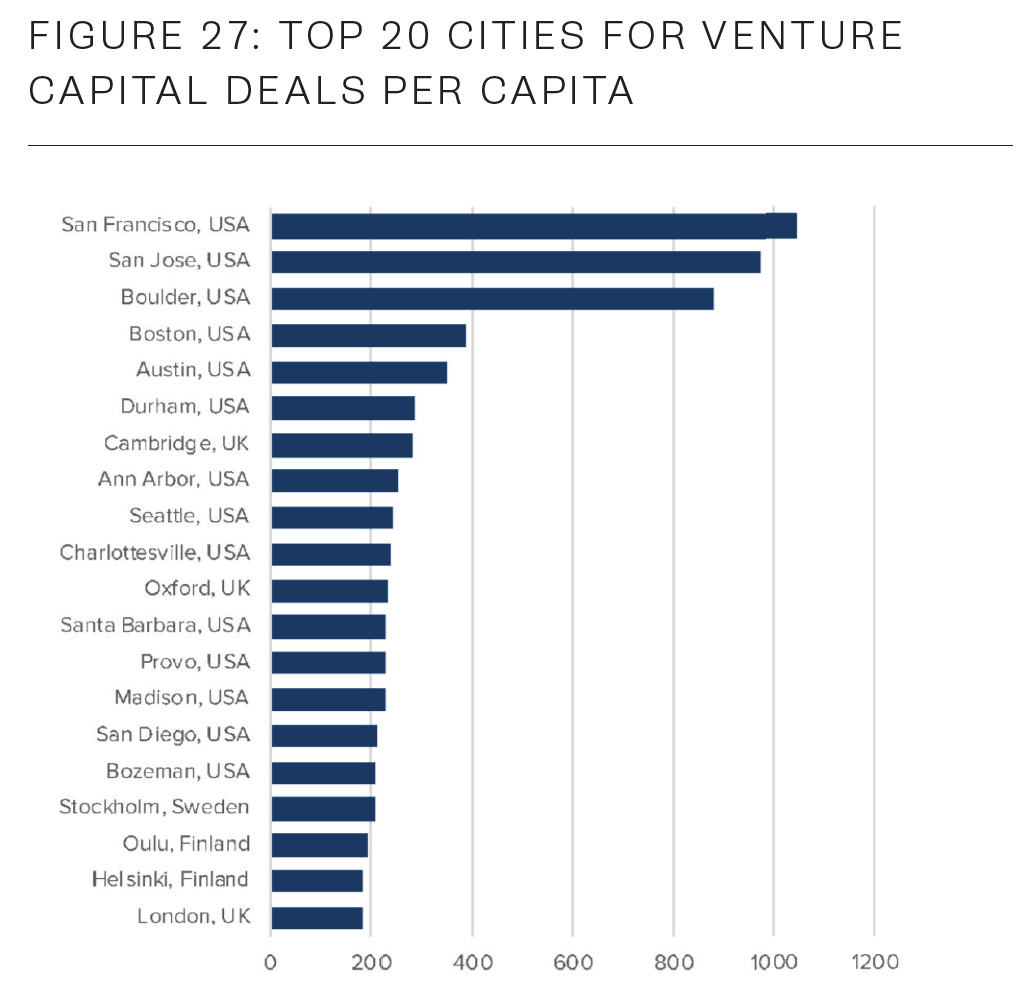

What did surprise me, however, was a table Renn provides showing VC deals per capita. Many cities in the first list, including New York, Shanghai, Beijing, and Los Angeles, fail to make the top twenty (and look at number 6!):