Given the inability of federal and state officials in the United States to cut spending in the past decade, one might assume growth of government to be as sure as death and taxes. However, one need only look to Canada of the 1990s for evidence that one can cut spending without ill effects.

In 1993, Canada’s federal debt was equal to 67 percent of the nation’s annual economic output, and in 1995 theWall Street Journal called it an honorary member of the third world.

How times have changed. By 2009, that level of debt had fallen to 29 percent of economic output. While still at an irresponsible level and rising of late, Canada’s debt appears to be far more manageable than that of the United States.

So how did they do it?

A concise report from the Frontier Centre, Canada, and the Mercatus Center says that following their 1995 budget, "Canada did not resort to major tax increases to eliminate its budget deficit and reduce public debt… [They] did not merely reduce the growth rate of government spending — the government cut absolute spending on many programs…" [Emphasis mine]

Regarding taxes, they "increased by about one dollar for every six or seven dollars worth of spending cuts."

Even better, "Throughout the austerity era, Canada experienced strong economic growth," undermining Keynesian fears. Writers from the McDonald-Laurier Institute have noted that this growth, of 3.3 percent on average between 1997 and 2007, brought consistent surpluses. Yes, they do exist, and they allowed for real tax cuts, not the kind that simply defer the burden into the future.

The take home message, as fiscal incompetence and negligence fosters uncertainty in financial markets both here and abroad:

"Even very large budget deficits can be turned around through real cuts to government spending, with no major increases in taxes."

Click here for an insightful interview with the author, David Henderson, conducted by Peter Holle, president of the Frontier Centre (18 minutes). Henderson is a native of Manitoba, Canada, but he is an associate professor of economics at the Naval Postgraduate School in Monterey, California. He was also a member of Ronald Reagan’s Council of Economic Advisers

Why Question the Purported Economic Recovery?

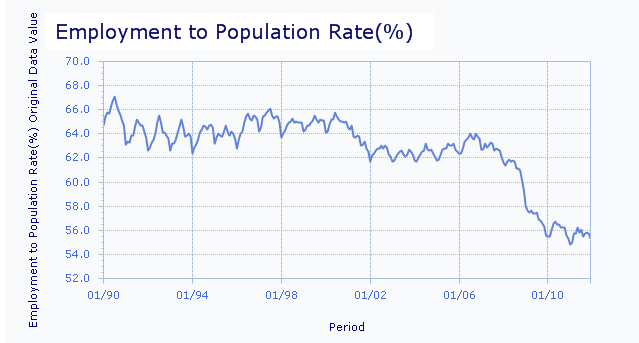

Last week I mentioned the jobless recovery, but in hindsight a graphical presentation would have made the point clearer. As you can see, North Carolina’s employment level, through to the end of 2011, remains comfortably lower than it has been for the past two decades.

If there has been a recovery, it has yet to show in employment. Additionally, since state-level GDP measures, both in aggregate and per capita terms, have yet to come out for 2011, evidence remains to be seen in the income realm as well. Even for the 2010, the Bureau of Economic Analysis only promoted each state’s gross domestic product, rather than the more-relevant per capita measure. If people were to dig for that they would see that the North Carolina 2010

level remained below 2005 levels.

Notes

- There will be a Constitutional Candidate Forum, hosted by Founders’ Truth and Constitutionalist Gathering Place, taking place this Saturday, March 31, from 8.30 a.m. to 12:30 p.m. at the Lighthouse Convention Center, Raleigh. Go here for more details.

Click here for the Fiscal Insights archive.