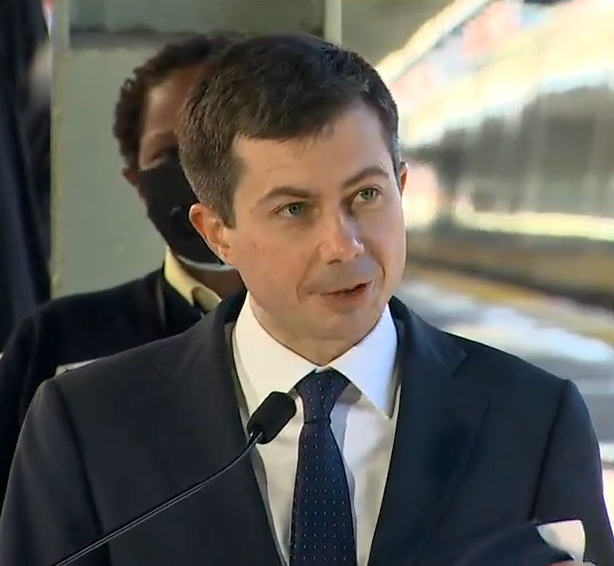

Incoming Transportation Secretary Pete Buttigieg says he is open to a federal gas tax hike. One of the arguments for hiking the federal gas tax is that it hasn’t been done since 1993. Many on the left want to tie the gas tax to inflation. At any rate, a hike is no guarantee in 2021 given that it still has to pass Congress. The federal tax is currently 18.3 cents per gallon on gasoline and 24.3 cents per gallon on diesel fuel.

A gas tax, like the sales tax, is a regressive tax, meaning the pain is felt most by those with lower incomes. It’s particularly painful in North Carolina since we have one of the highest gas taxes in the Southeast. North Carolina currently has a 36.35 cents per gallon tax, which is the 13th highest in the nation. Almost 55 cents of every gallon of regular gasoline that is purchased in North Carolina goes to taxes.

Many older North Carolinians will remember Jesse Helms’s virtually lone battle against a hike of the federal gas tax early in the Ronald Reagan administration (1981-1982). He ultimately lost but endeared himself to many working-class voters and long haul-truckers, particularly those who owned their own rigs. Helms was even cheered during an unplanned stop at a rural Hardee’s restaurant on his way back home while battling the tax on Capitol Hill.

Need another solid and common-sense argument against a higher federal gas tax? Washington lawmakers have put this country $28 trillion in debt and sending even more money to a Congress that has been horrible stewards of our dollars seems nonsensical at this point. If they can’t manage and prioritize all the money we send them now for budgeting and infrastructure improvements, why punish the poor and middle class even more?