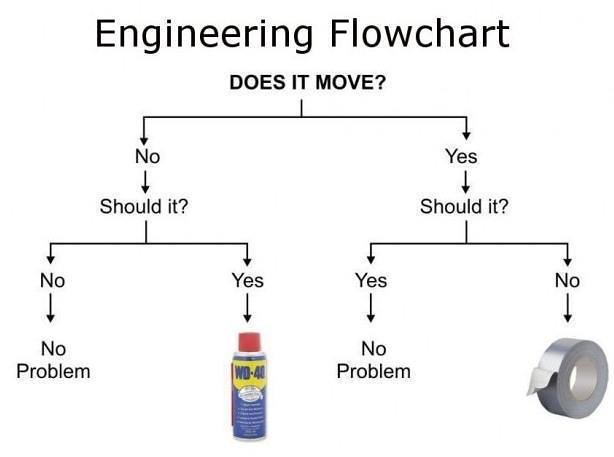

Tax policy is as much about regulation as it is the efficiency and simplicity of raising revenues to pay for government activity. The regulatory aspect is clear in Ronald Reagan’s famous adage: “If you want more of something, subsidize it; if you want less of something, tax it.” Sin taxes are designed to reduce consumption of sugar drinks, alcohol, and tobacco. Tax experts recognize the penalty capital gains taxes impose on productive investment. Governments use tax credits and deductions to accomplish a number of goals, only sometimes having to do with reasonable tax policy. They are the equivalent of WD-40 in the internet’s famous engineering flowchart, applied to anything that politicians think should move but doesn’t.

Charitable contribution deduction: subsidizes contributions to churches and other civil society organizations

Charitable contribution deduction: subsidizes contributions to churches and other civil society organizations- Mortgage interest deduction: subsidizes larger homes financed with debt

- Medical expense deduction: subsidizes costly treatment of disease and injury

- Student loan interest deduction: subsidizes borrowing for higher education and human capital development

- Standard deduction: subsidizes initial steps to work and earn income

Charitable contributions, mortgage interest, and medical expenses are only deductible within limits. They are itemized deductions, which means the combined value of deductions must be more than the standard deduction before it makes sense to take any of them. As a result, few taxpayers take them. Medical expenses must also exceed ten percent of a taxpayer’s adjusted gross income, further limiting their use.

There are a number of theoretical arguments over efficiency, simplicity, and fairness for and against each deduction, but student loan interest is the only one that is available even to taxpayers who do not itemize deductions.

Federal tax reform would eliminate or limit the state and local tax (SALT) deduction, which subsidizes high local government spending financed with either an income tax or a sales tax. The Center for Budget and Policy Priorities confirms this, though it frames it that state and local governments would either run deficits or spend even less on roads or schools without the SALT deduction. Jared Walczak of the Tax Foundation, is more honest at Bloomberg BNA, “The chief argument advanced in favor of the status quo, [is] predicated on the postulate that local government spending, in particular, is suboptimal.”

Ronald Reagan, former governor of California, tried to eliminate the state and local tax deduction as president in the 1980s. He clearly understood the nature of this subsidy. It is time to end it.