- Pension plans for state government retirees are strained

- ESG funding in pension plans prioritizes “woke” values over return on investments, while exposure to China stocks has some fund managers worried

- While our pension fund in North Carolina is better than most other states’, it was not built for today’s economy, and unfunded liabilities need to be addressed

North Carolina’s pension plan for state government retirees often ranks as one of the best in the nation. Our state has more than one million members in the North Carolina Retirement System (NCRS), meaning nearly one in ten North Carolinians participate in the program.

Major headwinds — foreign investments, ESG funding, inflation, the coming recession, and looming unfunded liabilities — threaten today’s pension funds. Reforms are needed, especially as taxpayers are on the hook for growing unfunded liabilities.

This brief will highlight the major challenges and discuss potential solutions.

ESG

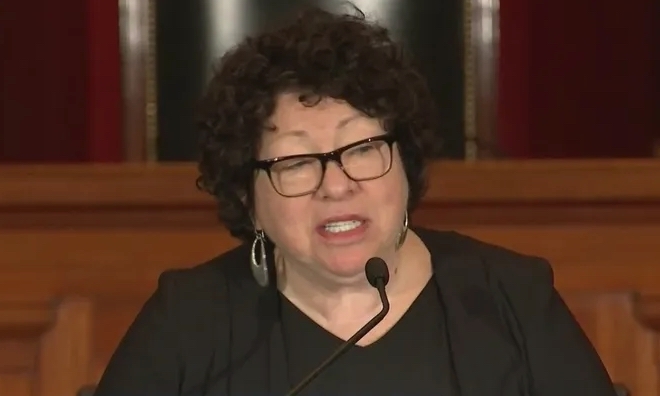

Large asset managers exert increasing pressure on their clients. Such companies are focused on Environmental, Social, and Corporate Governance (ESG) investing at the expense of return on investments.

One such asset manager, BlackRock, manages approximately $14 billion for NCRS. In December, State Treasurer Dale Folwell called on the BlackRock CEO to resign, saying, “As keeper of the public purse my duty is to manage our investments to ensure that the best interests of those that teach, protect and serve, as well as of our retirees, are always paramount.” Folwell added, “Unfortunately, Mr. Fink’s political agenda has gotten in the way of his same fiduciary duty.”

ESG policies detrimentally affect investments, which should be focused on profit value. Folwell said that, “A focus on ESG is not a focus on returns, and potentially could force us to violate our own fiduciary duty of loyalty.”

In response to the backlash, in 2021 BlackRock created the proxy voting program Voting Choice to allow investors to more directly engage in proxy voting. Treasurer Folwell signed an agreement enabling NCRS to vote its own shares managed by BlackRock.

Some states are taking legislative action to enforce state fund managers’ fiduciary duties. Some, like Texas, are refusing to contract with companies that use “woke” reasoning to discriminate against conventional industries. For example, a state might refuse to contract with a business that boycotts or denies capital to companies whose businesses involves such things as fossil fuels, agriculture, or firearms. This year Indiana, Texas, and Kansas have introduced bills to prohibit ESG investing in public pension funds.

China

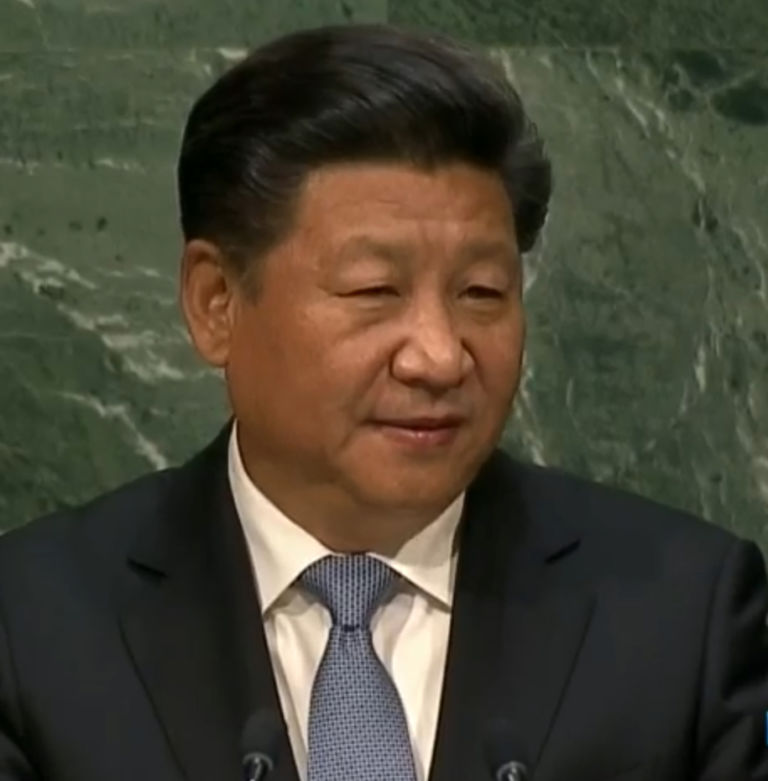

Exposure to Chinese stocks in state pension funds has some states concerned. Because China has high growth potential, investors have often sought out Chinese companies for high returns. But following the Chinese Communist Party’s squashing of Ant Group Co.’s initial public offering (IPO), pension fund leaders in the U.S. are “increasingly fretting over the sensitivities of Chinese government officials,” according to Wall Street Journal reporting.

Ant Group is an Alibaba affiliate. The company’s IPO would have been one of the most lucrative in the country to date. As tensions increase between the two largest economies, this sensitivity to invest in China will only increase. U.S. leaders recognize the grip that the Chinese government has on its companies. Risking state employees’ pensions in a Chinese company would be unwise.

As Folwell told The Wall Street Journal, “Any time you see the types of drawdowns that we’ve been seeing in China, you have to be concerned.”

Despite the many risks associated with China investments, Folwell said he would not be making changes to the state fund’s China allocation. “It’s the second-largest economy in the world,” he said. Other states, however, are making changes. In Florida, for example, the State Board of Administration (SBA) stopped funding new investment strategies in China. The SBA’s Chief Investment Officer said the composition of Chinese investments in the retirement system is low, just 2.8% of the total.

Economic Trends

Inflation has stretched family budgets, restrained household choices, drained savings, and caused more families to rely on their credit cards, increasing household debt. Inflation is also bad news for pension funds. While Folwell calls inflation “a thief,” he said that rising interest rates have also helped the state pension fund’s bottom line. As reported by Carolina Journal, Folwell said in a prior monthly Ask Me Anything session that “being able to earn 4 and 5% where we were previously earning less than 1% on hundreds, and hundreds of millions, if not billions of dollars, means that the plan is earning more interest than it has in a long period of time.”

The state’s pension fund lost 7% of its value in 2022. But when compared with other states’ pension funds, or even the S&P 500, which lost 12% of its value, North Carolina is in a relatively good spot.

The economic downturn from Covid and ensuing government-mandated lockdowns also encouraged some to retire early. In fact, people were already leaving the labor force before Covid, resulting in more state retirees collecting pensions.

Reforms — especially action on unfunded liabilities

States can certainly take action to divest from China and halt ESG activities in pension funds. Return on investment to state employees must be prioritized over ideology-based investment goals and untrustworthy foreign investments.

Ultimately, however, the current pension plan was not built for today’s economy. Any long-term solution must address the unfunded liabilities, which total $4.7 billion.

The state has made promises it cannot keep. “Buy now, pay later” has not worked. It now costs taxpayers more than $2.7 billion a year to finance pension benefits, which is nearly ten percent of the entire General Fund.

Pensions often fall on the back burner, giving way to more immediate budget issues. But pensions are a fundamental problem for the budget, bleeding revenue and creating additional risk during economic downturns.

Economic slowdowns, in particular, drain revenue and threaten already underfunded pension programs. Meaningful reform must shift away from the defined-benefit model. Transitioning to a 401(k) model with a defined contribution would allow workers to contribute to a retirement plan like those in private sector employment. The state employees would be empowered to manage their retirement accounts during and after their state employment. The state (funded by the taxpayers) could contribute to the account at some rate, say 5%, as in most 401(k) plans under private employers.

Critics might argue that workers would undersave for retirement on their own or that a defined contribution plan would be less attractive for potential state workers. But the overwhelming majority of private sector workers are now enrolled in defined contribution plans. Such plans would be more predictable and simpler for budgeting purposes, while providing ownership and greater portability for workers.

Other states are taking action to remove the pension burden from taxpayers. State workers in Texas will now be enrolled in a retirement system that resembles a 401(k). The bill’s sponsor declared that “it is imperative that we take legislative action or this plan will literally run out of money to pay benefits that are already earned.”

Any discussion about increasing state spending will necessarily increase taxpayers’ long-term liability to support more state employees indefinitely. Pension reform may not be a hot topic, but it must eventually be addressed.