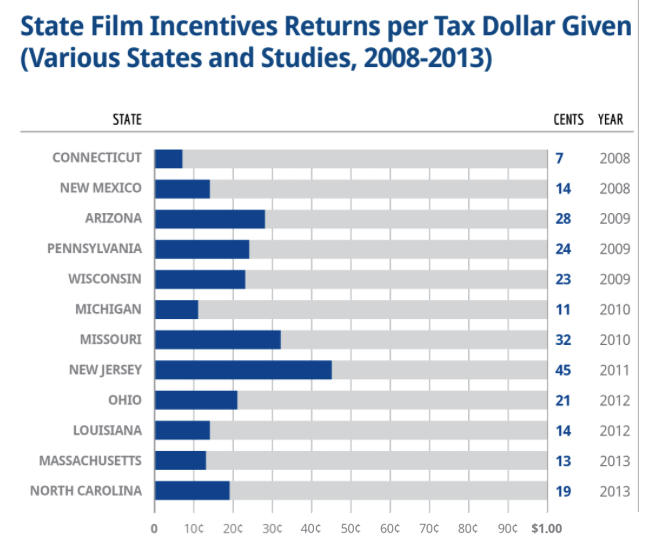

We have shown for years how state studies of their own incentives programs for film productions find them to be net money losers. Our most recent chart is below (sources are listed here); it builds on the one in my 2012 report.

That chart is due an update. In the course of checking the current disposition of state film incentives programs, I encountered a few new state reviews of their own film incentive programs.

- Virginia

A November 2017 evaluation by the state Joint Legislative Audit and Review Commission found that Virginia’s Motion Picture Production Tax Credit generated a return in revenue of only 20 cents per dollar. The evaluation found that the Governor’s Motion Picture Opportunity Fund (grant program) generated a return in revenue of only 30 cents per dollar. - West Virginia

A January 2018 agency review of the state Film Tax Credit Program from the West Virginia Legislative Auditor, Performance Evaluation & Research Division, found that the $15.11 million in tax credits issued had generated $6.15 million (only 41 cents per dollar) in economic impact, to which was applied a multiplier of 1.411 to estimate an economic impact of $8.68 million (only 57 cents per dollar). In February, Gov. Jim Justice signed a law ending West Virginia’s film tax credit program. - Florida

A January 2018 report from the state Office of Economic and Demographic Research found that the Florida Entertainment Industry Financial Incentive Program (tax credits to offset sales and use tax or corporate income tax) generated a return on investment of only 18 cents per dollar. That program was ended in 2016. The report found that the Florida Entertainment Industry Sales Tax Exemption Program generated a slightly higher return on investment that was still only 58 cents per dollar.