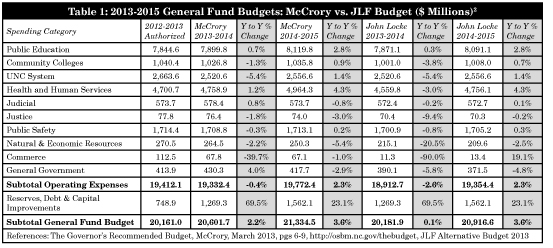

This week, The John Locke Foundation published its own budget, an alternative to Gov. McCrory’s budget. Here are some excerpts from that document:

The John Locke Foundation is carrying on its tradition, started in 1995, of offering an alternative to the governor’s budget recommendation. Our approach to this year’s alternative budget is particularly mindful of the dismal economic climate in North Carolina. The state’s unemployment rate is one of the highest in the nation, as the state’s slow recovery from the Great Recession continues. This budget proposal represents our best efforts to apply simple, yet firm, principles of limited government, free enterprise, and fiscal conservatism in assessing and offering an alternative to the budget that Gov. McCrory has proposed.

Our proposal calls for a reduction in spending and an increased contribution to the savings reserve account of more than $400 million in 2013-14 and more than $700 million in 2014-15. The most significant of the differences between our budget and the McCrory proposal relates to the decision-making process. Like those of his predecessors, McCrory’s plan often funds or increases funding for programs that cater to specific interests. Our plan took some of these programs and operations, such as the Museum of History and the NC Maritime Museum, and reduced overall funding allowing those facilities to find savings in efficiency or increase user fees to cover lost state aid. Other programs were removed from the state budget completely, such as the Partnership for the Sounds, Biofuels of NC, the Rural Economic Development Center, and the High Point Furniture Market in the hope that state money can be spent on statewide operations instead of special interests in certain locations.

Changes to the state’s tax code and funds available from transfers and non-tax revenue were also addressed in this year’s alternative budget. For example, we propose ending the transfer of funds from the Highway and Highway Trust Funds to the General Fund. Our budget takes the governor’s proposed $218 million and $215 million transfers for each fiscal year and redirects them to the Highway Trust Fund while shifting responsibility for the Highway Patrol back to the General Fund.

In addition to the highway changes, we also call for a comprehensive overhaul of the state tax system, introducing a consumption-based tax known as an Unlimited Savings Allowance, or USA, Tax. This tax proposal would replace the revenue from the personal, corporate income, and estate taxes with a USA tax of 6% while lowering the existing sales tax to 4.5 percent on a revenue-neutral basis. The change in the tax code along with spending changes allowed for an additional half-percent cut in the sales tax, down to 4 percent, and a 60 percent reduction in the franchise tax for fiscal year 2014-15.

If you find this interesting or want to learn more, check out the entire John Locke budget proposal online. You can also take this quick five-question quiz from the Civitas Institute about the budget, and see how well you know North Carolina’s budget.

Click here for the Fiscal Updates archive.