There are several prominent players in the health care delivery process. There are patients, physicians, insurers, hospitals, pharmaceutical companies, and pharmacy benefit managers, to name a few. Interestingly, when asked who is actually to blame for American’s high health care costs, each of these entities points the finger at someone else. In my view, hospitals are usually given a free pass, despite their significant contribution to the rising costs of health care.

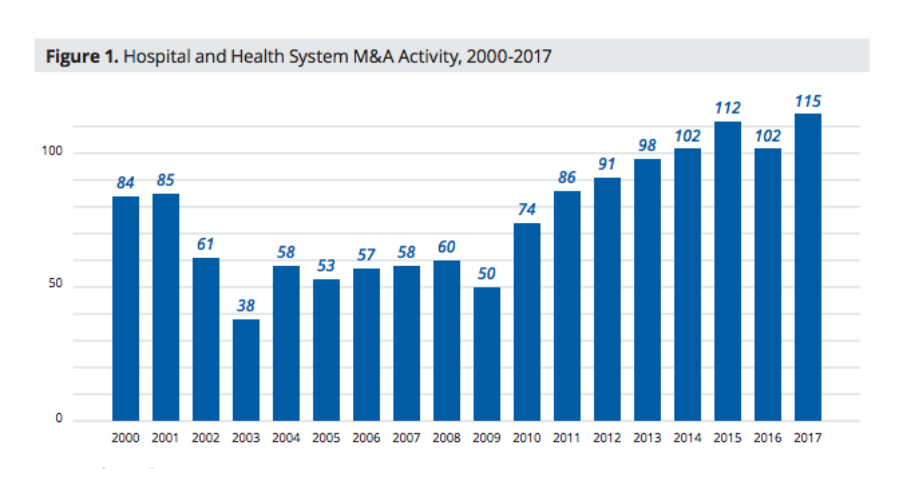

Hospital consolidations are a health care trend that has been well recognized as playing a role. Some view consolidations as positive because they create larger, more coordinated health systems. Others are skeptical. After the Affordable Care Act signed into law, hospital consolidations started to increase and have been growing in number per year since.

I don’t believe hospitals are inherently bad actors. However, I do think hospitals often engage in practices that inflate health care costs. The reason for this, in many instances, is that federal or state laws protect incumbent hospitals and incentivize monopolistic behavior. Hospital consolidations and monopolistic firm behavior usually go hand in hand. Whether you blame the hospitals or the lawmakers who sanction this behavior through legislation, is a separate issue.

So, what is the effect of hospital consolidations? Well, if you read a recently released study that was commissioned by the American Hospital Association, you would think that consolidations have beneficial results for everyone. However, if you look at a plethora of independent studies, the conclusions would be much different.

American Hospital Association Study

The new study builds on a report from 2017 that showed that hospital consolidation decreased costs and increased quality for patients. The researchers used hard data and interviews with leaders of health systems to draw these conclusions. In particular, the newly released study found that:

- Hospital acquisitions were associated with a 2.3 percent reduction in annual operating expenses at acquired hospitals

- Significant reductions in rates of readmission and mortality

- Revenues per admission at acquired hospitals reduced by 3.5 percent which the authors say is a result of merging hospitals passing on savings to patients and health plans

- An interview with one system leader indicated that if a health system doubled in size from $5 billion to $10 billion, per-patient IT costs would decline by 30 percent.

However, this hospital industry-funded research is squarely at odds with a substantial amount of other research on the topic of consolidation and prices.

Non-Hospital Funded Research

As I said before, if you only read the reports from the American Hospital Association, the trade group which represents the financial interests of hospitals and large health system, you may not know about other studies have found from hospital consolidation. Consider these other studies:

- As you can see from the graph above, yearly mergers and acquisitions have been up since the recovery following the Great Recession. A report by PricewaterhouseCoopers Health Research Institute found that costs were projected to rise by about 6 percent in 2020, attributable primarily to the industry’s “merger-mania” mindset.

- Before the ACA’s implementation, researchers conducted studies which showed that hospital concentration resulted in price increases.

- A study conducted by researchers at UC Berkeley for the New York Times examined 25 metropolitan areas with the highest rate of consolidation from 2010 and 2013 and found that prices in most areas increased between 11 and 54 percent.

- A 2018 study titled, “The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured” found hospital monopoly market power is positively associated with costs. In areas where a hospital has a monopoly hold on the market, prices are 12 percent higher compared to markets where there are four or more hospitals.

- A study posted in Health Affairs compared the price increases of hospitals and physicians from 2007 and 2014. The researchers found that hospital prices grew substantially faster than physicians’ prices in the time frame, 42 percent and 18 percent respectively.

- This study from researchers at the Kellogg School of Northwestern University found between 2007 and 2013, a hospital acquires physician practices, services increased by an average of 14 percent.

While the American Hospital Association continues to back its members’ recent activity of consolidation, a handful of research shows the opposite of what they claim is true. Hospital mergers and acquisitions have been increasing steadily in the past decade and are increasing the market share of large hospital systems. Further, when monopoly power is high, prices are free to rise without having to respond. Patients and taxpayers are the ones that pay the price. To combat this phenomenon, we should reevaluate our approach to hospital mega-mergers, remove state and federal laws that encourage consolidation and monopolistic behavior, and promote competition. Let’s not forget about the patients’ needs when considering an approach to provider consolidation.