Bonuses for and penalties against marriage, undermining it either way

I have a strange memory from my travels in San Francisco during my college years. An uncle took me to the courthouse downtown, and all I could see throughout the building were people getting married.

Call me old-fashioned, but seeing so many couples in plain clothes with only a witness or two next to them — all in such close proximity to each another — made the ceremonies seem underdone. "Why," I asked my uncle, "was everyone getting married in such a rush?"

A long-time divorce lawyer and a man who’d seen this scene many times before, he shrugged, "Oh, they just want to claim it on their tax returns." "Do people really do that?" I pondered, but he was right. It was just a few days before the New Year, and the evidence was right before my eyes.

From that moment on, I was conscious of how politicians could effectively use the tax code to manipulate people — and my first academic work was an economic investigation of marriage. Taxpayers may even feel smug when they manage to get ahead by jumping through the hoops placed in front of them by the government. That’s one reason why G. Edward Griffin has called the income tax an instrument of tyranny, since people are often so responsive to it yet apathetic to its manipulation.

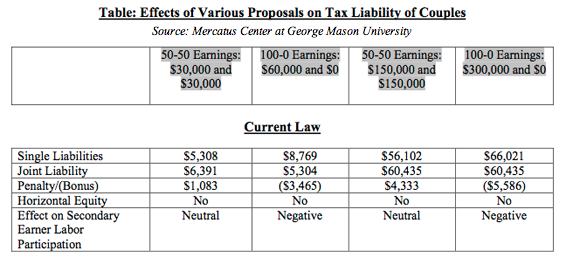

The bizarre part of marriage relative to taxation in the United States, though, is that the federal code simultaneously rewards and penalizes marriage, and in an arbitrary manner. In other words, it’s not central planning of marriage; it’s central confusion of marriage, based on whether the two incomes match closely and whether the people involved are receiving the Earned Income Tax Credit. While estimates vary, a recent Mercatus Center working paper (p.8) noted that 52 percent of couples paid a marriage tax, while 38 percent received a marriage bonus. Tell me how that makes sense.

Correspondingly, this "horizontal inequality" — where families of the same size and income levels face different tax burdens — also interacts with divorce and cohabitation incentives. As the diagram indicates, a couple earning $150,000 each would save $4,333 by filing separately so, everything else being equal, they are more likely to divorce or less likely to get married if they are cohabitating. Similarly, a couple earning $30,000 each would save $1,083 by filing separately, or 17 percent of their income tax burden, and these penalties are set to increase at the end of the year. Some people have even taken to getting divorced before the New Year and then remarrying soon after.

This is the silliness we face with alternative taxation schemes for married people. On the one hand, we’re paying some people to get married, as though a government hand-out should be the motivation for marriage. On the other hand, some couples are paying higher taxes and suffer because they happen to have chosen marriage rather than cohabitation. Additionally, given the disproportionate burden on split income households, as opposed to single-earners, the marriage penalty increases the marginal tax rate of and dissuades labor force participation from second income earners.

That this has continued for decades defies justification and testifies to the fact that Congress has priorities other than tax equality. Representatives could resolve this without any complexity, towards neutrality with respect to marriage. That would mean individual filing across the board, as is the case in 27 out of 34 OECD nations.

Libertarianism and Christianity: Archenemies, right?

A friend of mine recently asked me whether libertarianism and a classical liberal, limited view of government were consistent with Christianity. Whether you are a believer or not, it is a question worth pondering, and I’m aware of authors who persuasively make the claim that Christianity is not only consistent with limited government, but necessitates it. As Randy England puts it, "real virtue makes a better world than compelled virtue…. Liberty frees us to live — if we choose — a virtuous life in this world, and a life capable of sharing in the divine life in the next."

For more on this, here is a review that just came out from The New American magazine on England’s book, Free is Beautiful: Why Catholics Should be Libertarian, and here is one of my own reviews on The Locker Room, this one on Nullifying Tyranny: Creating Moral Communities in an Immoral Society. For a broader understanding of libertarianism, I highly recommend Libertarianism Today by Jacob Huebert. Huebert agrees that libertarianism is consistent with Christianity, and he is confident that a freer society would allow a morally conservative culture to thrive.

Notes

- This week, October 5, the $10 Million-a-Minute Tour is coming to Chapel Hill to quantify the nation’s debt problem. Sponsored by the North Carolina Association of Certified Public Accountants, it will explain how accounting tricks conceal the depth of the problem. You can get more details here.

- Do you know any individuals interested in exploring the philosophy of and political movement towards liberty? If so, please let them know that Students for Liberty will be hosting a regional conference in Chapel Hill on November 3, 2012. These conferences highlight the wave of articulate and passionate young liberty advocates and are for both students and non-students alike.

Click here for the Fiscal Insights archive.