Complacency is a lose-lose for retirees and future generations alike

The term "third rail," in the context of politics, refers to a policy one cannot touch for fear that he will suffer career electrocution. The analogy stems from the hazardous third rail that powers some train systems.

In the American context, many issues could fall under this banner, but Social Security is the perennial example. In 2011, for example, when Gov. Rick Perry identified Social Security as a lie and Ponzi scheme, which it is, the other candidates fled. Former Gov. Mitt Romney even attacked Perry over the matter, because speaking frankly would have made the candidate "unelectable."

The consequences of decades without reform, though — aside from increased generosity to buy votes — are painfully obvious. A recent article in Forbes, by Laurence Kotlikoff, notes 38 Social Security secrets that recipients and Baby Boomers ought to know. Before even getting to these secrets, Kotlikoff notes 2,728 rules that govern benefits and "thousands upon thousands" of explanations for those rules. To make matters worse, "a large share of the rules in Social Security’s Handbook rules are indecipherable to mortal men and the POMS (Program Operating Manual System) is often worse."

If you have the energy to wade into these 38 secrets — I could not bring myself to finish — you will see what happens when a bureaucracy has a monopoly on retirement pensions. A lack of accountability means the formulas have grown so complex that even specialists do not understand them, and "folks at the local Social Security offices routinely tell people things that aren’t correct…"

This convoluted system benefits the bloated bureaucracy and professionals required to offer guidance on the matter, not those receiving the payments. And that is true without even looking at the fiscal impact of the program.

If one does consider the Social Security program alone, it has unfunded liabilities in excess of $21 trillion, and even that is based on optimistic actuarial techniques. Just as informed government employees ought to see the writing on the wall with their defined-benefit pension plans, many new entrants now know they are not going to get their mandatory "contributions" back when they retire.

An audience member once questioned Rep. Ron Paul on whether anyone still wanted to participate in Social Security and pay the associated taxes on income. "[Do you have] any idea how many people you think, what percentage, would opt-out? Do you think it would be mostly young people?"

Well, I listed as 25 [and] under to get started, but I’ve announced that in audiences where there were a lot of people over 25, and all they do is [nod] ‘how about including me.’ But on the campuses, I can’t remember anybody coming up and saying, ‘Hey, I don’t want you to do that. Save me. I want to pay Social Security because I know it’s a good deal. I want to retire on Social Security. Never.

Awareness has grown to such a degree that the illusion of the third rail, the untouchable nature of Social Security, is over. An opt-out option for new entrants, which respects an individual’s right to choose and is economically prudent, is going to become more politically popular. It would reveal the Ponzi nature of the program and generate fiscal challenges in the near term, but it would halt the growth of unfunded liabilities and allow people to achieve better and safer returns without the bureaucracy.

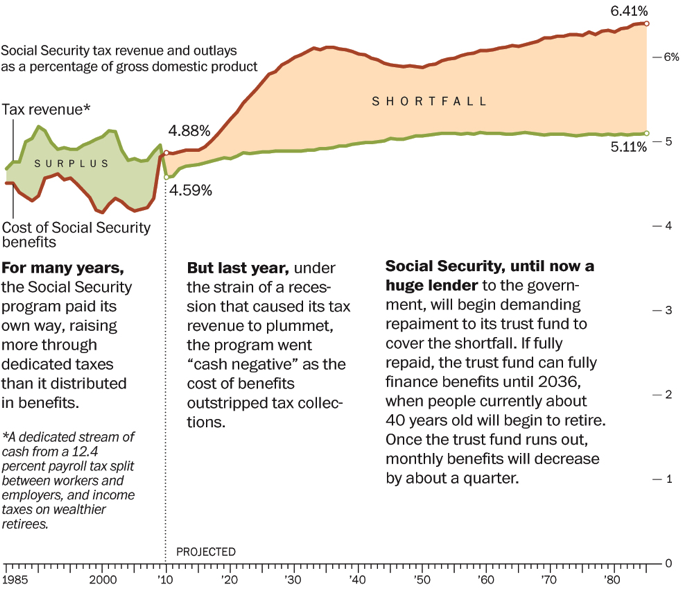

Image of the week

This one appeared in the Washington Post late last year, and I’m not aware of any change to this outlook. As you can see, the Social Security system has deficits as far as the eye can see, and these will have to come from tax revenue or further borrowing. There is no "trust fund," only debts with the federal government, since federal officials spend the Social Security tax revenue as it comes in.

Notes

- The Agenda 2012 book is now out and provides a breakdown of many policy areas for legislators to consider. It includes four chapters from me: State Spending Restraint, State Tax Burden, Federal Aid Dependency, and State Unfunded Liabilities. You’re welcome to let me know any feedback you may have.

- Do you know any individuals interested in exploring the philosophy of and political movement towards liberty? If so, please let them know that Students for Liberty will be hosting a regional conference in Chapel Hill on November 3, 2012. These conferences highlight the wave of articulate and passionate young liberty advocates and are for both students and non-students alike.

- Recently, the staff of the John Locke Foundation hosted candidates for a policy briefing, and my focus was a Taxpayer Bill of Rights for North Carolina. While I’ve touched on this in an earlier newsletter, here is a video of my presentation with new insights from my latest research. If you are a candidate but did not attend, don’t hesitate to request the hard copy materials that we handed out at the event.

- If you have not tried the website, Reddit.com, you are missing out. Here is a blog post from me that explains its benefits, and I have just added a page for pro-liberty content in North Carolina. Don’t hesitate to subscribe and submit content of your own!

Click here for the Fiscal Insights archive.