- Conservative spending restraint was key to preparing North Carolina for last year’s economic slowdown

- Similar restraint could have better prepared NC for the great recession

- A Taxpayer Bill of Rights (TABOR) added to the state constitution could make wise conservative fiscal policy permanent

Legislators last week filed a bill to add a Taxpayer Bill of Rights (TABOR) to the state constitution. The move would place prudent restraints on the growth of state spending.

Sound, responsible fiscal policy was the key to North Carolina’s remarkable ability to weather an economic slowdown caused by the COVID lockdowns. It stood in stark contrast with how poorly North Carolina handled the onset of the Great Recession in 2008-09 after years of reckless, spend-and-tax policies.

Years of fiscal restraint – the state budget increased a total of only 16 percent in the eight years up to and including 2020 – enabled North Carolina state government to build up more than a billion dollars in its Rainy Day fund, courtesy of five consecutive budget surpluses. Moreover, state debt was reduced from $6.2 billion in 2013 to $4.1 billion last year, freeing up millions of dollars from debt obligation payments.

Compare that with the fiscal crisis the state confronted in 2009 when the Great Recession hit.

Despite significant increases in revenue and budget surpluses for the several years leading up to the Great Recession, the state’s Rainy Day fund stood at less than $800 million at the beginning of the fiscal year 2008-09. By the end of the year, it was quickly drained down to $150 million.

Moreover, the approved FY 2008-09 state budget marked a whopping 49 percent increase in state spending over eight years.

Also in 2009, the General Assembly was in the process of racking up an alarming $6.5 billion in state debt from 2001 to 2013 – an increase of 230 percent. The additional debt tied up hundreds of millions of additional dollars being diverted to debt payments rather than government operations.

Due in part to this reckless and unsustainable buildup in spending obligations, state budget writers faced a $2 billion shortfall for the 2008-09 fiscal year, followed by a gaping, $4.6 billion budget hole the following year largely due to declining revenue from the onset of the Great Recession.

Panicked by the massive deficits, legislators at the time passed arguably the biggest tax increase in state history, hiking personal and corporate income taxes along with the state sales tax rate. The combined effect of these tax hikes was estimated to cost taxpayers more than $1 billion per year.

To show how uniquely unprepared our state government was for the Great Recession, North Carolina raised all three major state taxes, while no other Southeastern state resorted to raising even one of them.

Even those sizeable tax hikes proved insufficient to cover the giant budget hole. Thousands of state employees were laid off, including teachers. Also, legislators made teachers go three straight years without a pay raise (fiscal years 2010–12) in order to help balance the state budget.

And while the major components of the Great Recession tax hikes expired after a couple years as scheduled (although not without a fight), tax increases on cigarettes and alcohol that disproportionately harm low-income households were permanent.

A Taxpayer Bill of Rights : Sensible Fiscal Restraint

Instead of allowing unrestrained spending growth during the flush years leading up to the Great Recession, if North Carolina had had a form of a constitutional Taxpayer Bill of Rights in place, there would have been less need to panic.

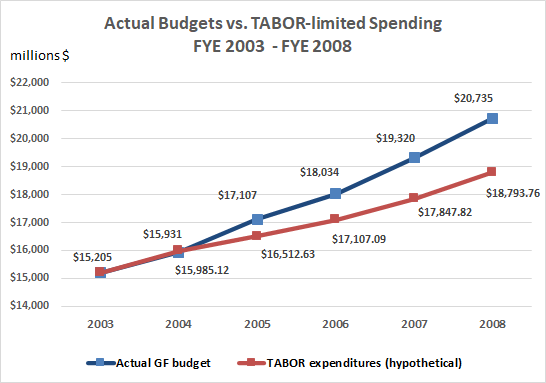

The graph below shows the trajectory of North Carolina’s actual General Fund budgets for fiscal years 2002-03 through 2007-08 compared with what it would have been if a TABOR had been in place.

In this case, I use 2002-03 as the baseline year, and to calculate annual expenditure limits, I use the average of the combined rate of population growth plus inflation for the previous three years (the formula included in SB 717).

The difference is striking. In just a five-year period, by FY 2007-08, General Fund spending would have been roughly $2 billion lower than the actual budget. That is nearly 10 percent less.

Indeed, the cumulative excess revenue during those five years would have totaled $4.9 billion. The excess revenue could have been used in a combination of tax refunds and savings in the Rainy Day fund, which would have been built up to nearly $3 billion.

State spending in 2007-08 would have been limited to $18.8 billion – compared with the actual, $20.7 billion budget. That budget proved way too large to be supported by the revenue collected that year, which was $19.8 billion. Now compare that amount with an $18.8 billion TABOR budget.

With a Taxpayer Bill of Rights in place for just five years prior to the greatest economic decline since the great recession, North Carolina still would have experienced a billion-dollar surplus in the first year it hit. Importantly, this would have bought budget writers time.

Due to the historical depth and extended duration of the recession, even a state budget restrained by a Taxpayer Bill of Rights – and buoyed by the significant savings reserves that would have generated – would still have needed spending cuts probably two years later to balance. But any adjustments would have been smaller, and could have been contemplated longer by legislators, with the benefit of a billion dollar surplus, rather than shortfall, the first year recession hit.

Moreover, the slow recovery of revenue would have required fiscal discipline and decisions even more restrictive than the TABOR restrictions for several years, and any tax increases would have required voter approval.

Time to make fiscal restraint permanent

Fiscally conservative legislative leaders have done an admirable job keeping state spending in check over the last decade.

The result has been a state far more prepared to handle economic downturns, and the enabling of aggressive tax reforms that have transformed North Carolina into one of the most attractive states for investment and job growth.

But state budget writers won’t always be so responsible.

The state is one election away from returning to the disastrous spend-and-tax policies of the past. The best tool to prevent that would be to add a Taxpayer Bill of Rights to the state constitution.