A "sunset" provision infers an end to something — that its day is over. In North Carolina, however, a bill to extend more than a dozen tax exemptions past their previously agreed sunset provisions has just received unanimous approval in the state senate.

Yes, a lower tax burden would leave more money available for private investment and consumption and attract migration and investment. But a complicated tax code and discriminatory burden, as this bill perpetuates, will do just the opposite. It will raise the cost of compliance, reward lobbying, divert investment, and create uncertainty about the stability of the tax climate.

Perhaps the most unfortunate part of these exemptions is the mislabeling. This latest round, for example, includes a credit for "Creating Jobs" and a credit for "qualified business ventures" — not to mention misguided environmentalist schemes. These branding ploys play on the seen-versus-unseen fallacy — as though these credits are a free lunch and that, without spending cuts, other people will not have to cover the difference.

In this case, the lost revenue of $136 million in fiscal year 2014 would otherwise allow for an outright elimination of the estate tax. Alternatively, it would allow for an across-the-board reduction to the state income tax, which is the highest in the South and the seventh highest in the nation.

If you want to lower the tax burden, find cost savings and pass the reduced spending on by either eliminating taxes or lowering their rates. This game of rewarding some people at the expense of everyone else is a counterproductive exercise.

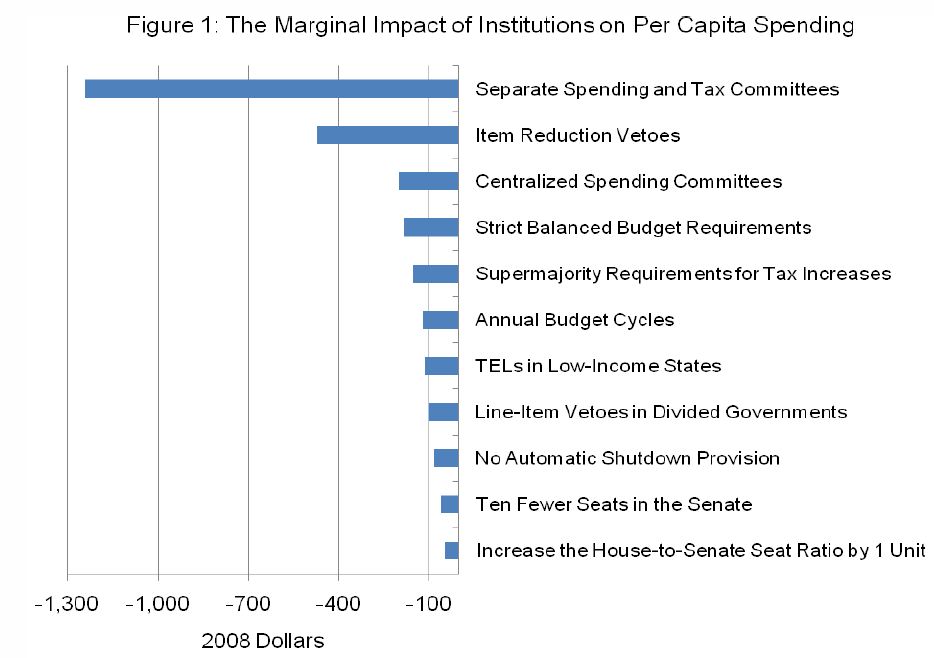

Good news! Institutional changes can bring savings

The Independent Institute of California has released a concise overview of the impact of different institutional constraints on government. While many of these attempts have been failures, the good news is that many do have teeth and bring positive outcomes. Over the next few weeks, I plan to digest this research more, breaking down its most important findings, but let this image whet your appetite.

Image courtesy of the Bacon’s Rebellion blog.

Image courtesy of the Bacon’s Rebellion blog.

Notes

- Through these newsletters, I’ve emphasized the importance of an attractive policy environment for both migrants and entrepreneurs. One exciting prospect in this realm has been the Honduran special development regions. Through my radio show, I’ve continued to examine Honduras, with both hopeful and frightening findings. If you are interested in learning more about this prospect, please consider this article and the interviews it includes.

- As some of you may already know, I am highly active on Twitter and glad to engage with more people through that medium. If you would like to follow me, my username is@FergHodgson (si prefiere espanol @Fergusito).

Click here for the Fiscal Insights archive.