This week Gov. Roy Cooper signed an Executive Order and issued a press release announcing the creation of a “Governor’s Advisory Council on Film, Television and Digital Streaming.” This group will “advise Gov. Cooper on efforts to grow and develop North Carolina’s film industry and support the work of the State Film Office.”

What should such an advisory council do? Preferably, play the role of a servus publicus, standing behind the governor and reminding him, “Hominem te esse memento.” That is: Remember that you’re mortal man.

What should such an advisory council do? Preferably, play the role of a servus publicus, standing behind the governor and reminding him, “Hominem te esse memento.” That is: Remember that you’re mortal man.

A mortal man cannot make film incentives do what film incentives can’t do:

- They can’t be shown to boost a state’s economy

- They can’t be shown to work as an economic-development tool

- They can’t prevent a rent-seeking, extortive political economy

- They can’t be much more than a giveaway to outside film production companies

- They can’t do much even to boost just the state’s film industry

- They can’t prevent intended recipients from threatening to refuse the incentives as a way to extort social policy choices that align with their own political preferences

- They can’t make your favorite North Carolina movie that was made many years before film incentives the reason to have film incentives

Issuing such a helpful reminder is not, of course, what this council is set up to do. If a council member were to say “Hominem te esse memento!” to the governor, he’d probably look confused and maybe say “bless you” and hand him a tissue.

No, this council’s advice figures to be practically indistinguishable from aggressive begging. It’s a reasonable expectation that this elevated Special Interest Pleading Council will push first for returning the film grants program to the (likely unconstitutional) refundable tax credits for film productions. Cooper’s first budget sought the same.

If they can achieve that, the next step will be blowing the door wide open on how much taxpayer money can be spent “refunding” out-of-state film companies with no practical tax liability here. Return it to an open draw on the State treasury removed from budget appropriations (completely counter to Article V, Section 7 of the State Constitution), and the sky’s the limit.

Remember, you’re a mortal man

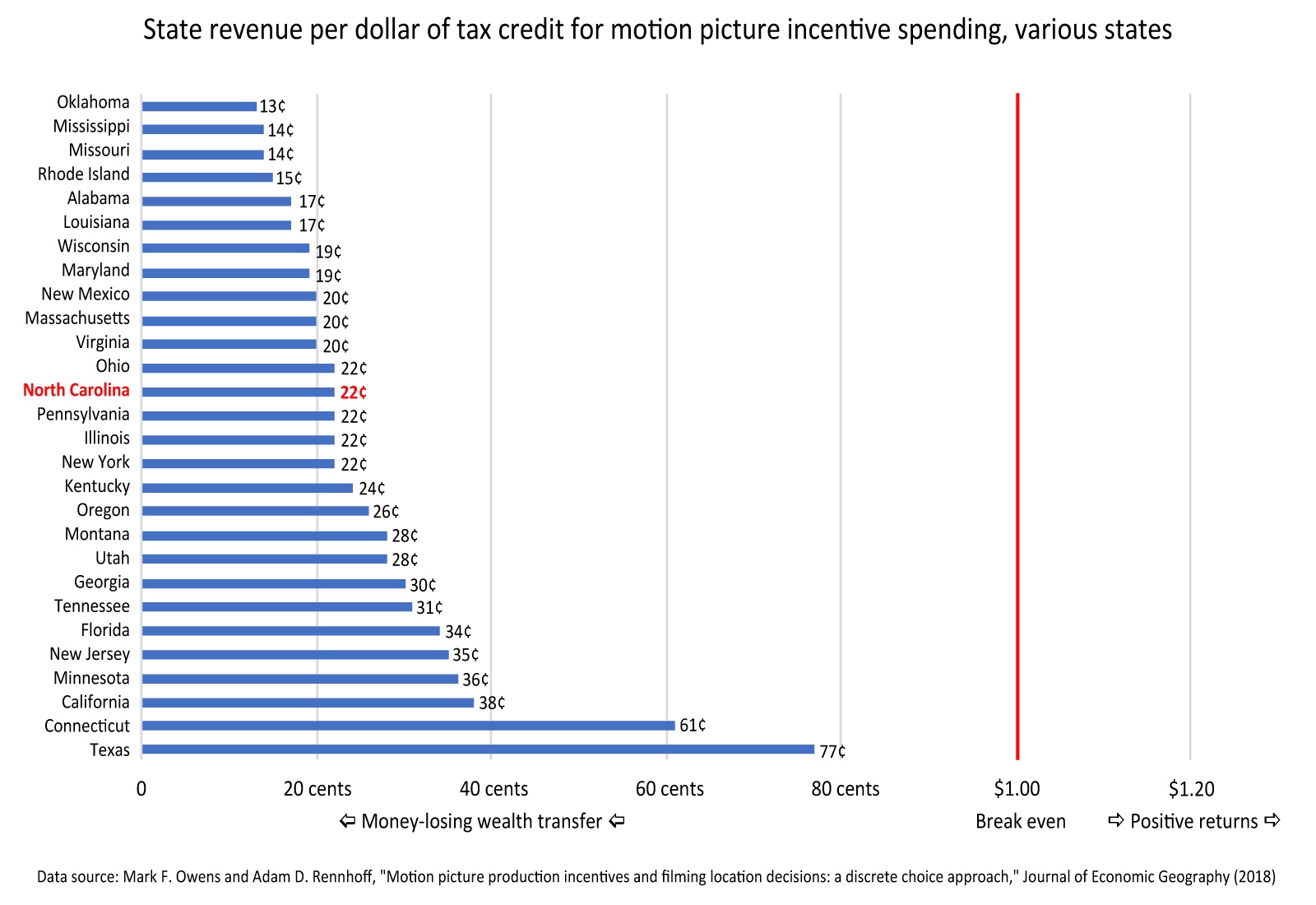

A 2017 study published by the Journal of Economic Geography by economists Mark F. Owens of Penn State University and Adam D. Rennhoff of Middle Tennessee State University looked at the impact of tax incentives on filming location decisions. They estimated the return on investment for North Carolina’s program at 22 cents per dollar.

Nor was North Carolina unique among the states in Owens and Rennhoff’s findings. No, they found that “movie incentive programs are revenue-negative for states.” I created this chart from their findings: