Christian Datoc writes for the Washington Examiner about the Biden administration’s approach to inflation.

The White House is sending mixed messages on the United States’s post-pandemic inflationary run, with quiet signals suggesting the period might last years longer than administration officials have publicly indicated.

The Consumer Price Index report for May published by the Bureau of Labor Statistics showed that year-over-year inflation jumped 5.4%, marking three straight months of increases and the single-largest increase since the Great Recession of 2008.

Still, the White House’s Council of Economic Advisers noted roughly 60% of that increase could be attributed to auto industry demand, exacerbated by severe semiconductor shortages.

The Biden administration previously identified semiconductors as one of four areas with major supply chain deficiencies. Yet, Sameera Fazili, deputy director of Biden’s National Economic Council, told reporters in June inflation caused by semiconductor supply chain issues would not last long.

“We fully expect these bottlenecks to be temporary in nature and to resolve themselves over the next few weeks,” she said. “These are good problems to be having. Demand came back much quicker than even companies expected.”

NEC Director Brian Deese similarly said in a speech the White House is “hearing from industry participants that you should expect some improvement sequentially over the second half of this year.”

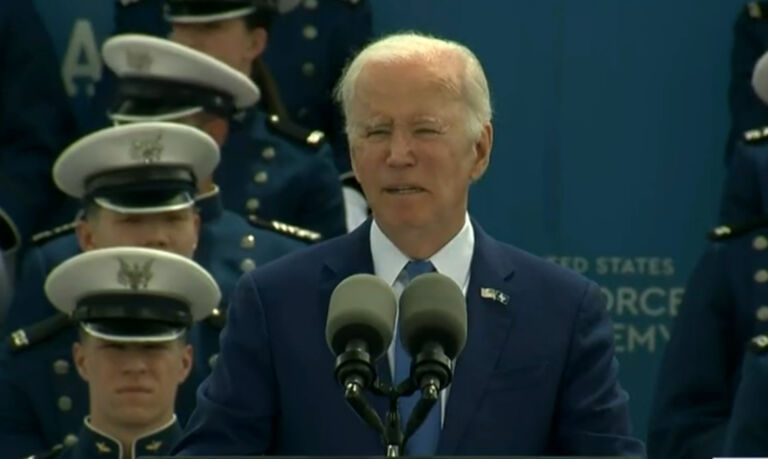

He added that “the long-term answer to this issue” is large-scale investments in domestic semiconductor production, such as the $50 billion investment President Joe Biden pledged in June.

Still, a semiconductor engineer at Intel — the world’s largest semiconductor producer in terms of total sales in Q1 of 2021 — told the Washington Examiner it would likely take at least a year for production to meet post-pandemic auto demands.

According to the engineer, who has “visibility” on the company’s overall semiconductor production and was granted anonymity by the Washington Examiner to speak freely on the issue, Intel missed its commitments for Q2 by “some percentage” and is currently anticipating a “short miss” for Q3.