According to a report released yesterday by the State Treasurer’s office, most nonprofit hospitals are not meeting their requirements of charity care.

Yet with inconsistent definitions of what is required, the divergence of charity care among nonprofit hospitals is less surprising. And with Covid changing how hospitals are operating, including the composition of services offered and patients seen, this is less surprising still. There is an accountability vacuum.

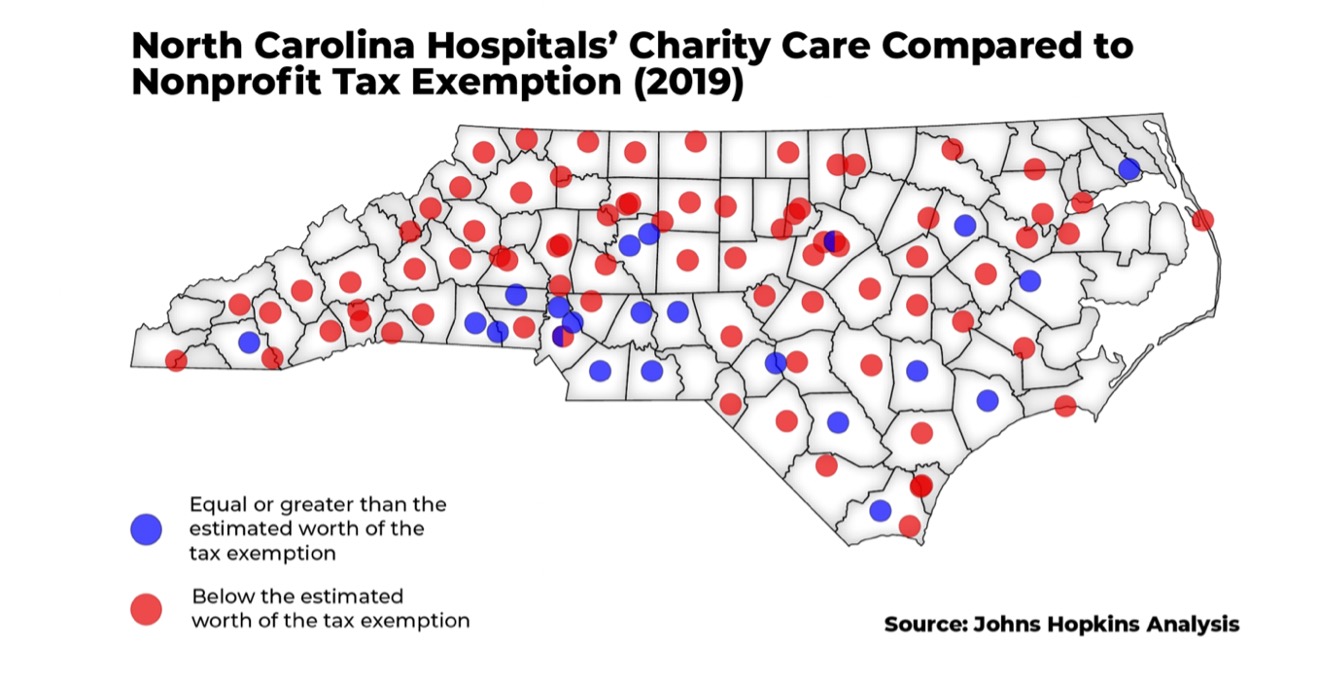

The Treasurer’s report states that very few nonprofit hospitals provide charity care that exceeds the dollar amount of their tax exemption.

The report focuses on bad debt, the uncollectible bills written off by a hospital. The gap between bad debt and charity care exposes these hospitals to scrutiny.

According to the Johns Hopkins Bloomberg School of Public Health report on North Carolina’s Health plan, many nonprofit hospitals are reaping massive profits, paying no taxes, and still not delivering “sufficient” charity care. But what is required of hospitals?

There is no accountability and there are no real requirements. The patterns are upsetting, but there is nothing incentivizing the hospitals to change.

The IRS, however, does establish some guidelines for nonprofit hospitals. Specifically regarding charity care, “Section 501(r)(6) requires a hospital organization to make reasonable efforts to determine whether an individual is eligible for assistance under the hospital organization’s financial assistance policy (FAP) before engaging in extraordinary collection actions (ECAs) against that individual.”

This imposes heavy administrative burdens for both patients and hospitals.

But no public agency currently monitors how nonprofit hospitals meet their charitable requirements. According to the report, and as suggested by their guidelines, the IRS even allows hospitals to set their own restrictions on charity care eligibility.

Of course, these decisions are better suited to be answered at the local level. Local hospitals should not be made to answer to the IRS. Yet some oversight is necessary to ensure poor families are not inadvertently or perniciously overcharged.

Nonprofit hospitals should not bill poor patients eligible for charity care. As the report says, “Existing law offers little protection to patients and taxpayers.” But without easy-to-follow benchmarks, it is unclear how hospitals should proceed. If nonprofit hospitals were required to report consistent measurements of charity care to retain their tax exempt status, more efficient charity care could be the result.