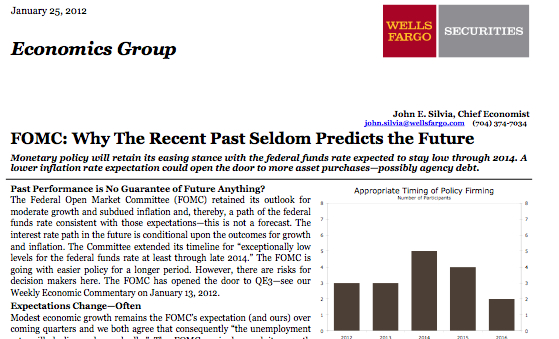

When the following email hit my inbox, courtesy of Wells Fargo Securities Economics Group …

… the line “Past Performance is No Guarantee of Future Anything?” caught my eye.

It calls to mind a basic tenet of Ludwig von Mises’ Human Action.

There are no rules according to which the duration of the boom or of the following depression can be computed. And even if such rules were available, they would be of no use to businessmen. What the individual businessman needs in order to avoid losses is knowledge about the date of the turning point at a time when other businessmen still believe that the crash is farther away than is really the case. Then his superior knowledge will give him the opportunity to arrange his own operations in such a way as to come out unharmed. But if the end of the boom could be calculated according to a formula, all businessmen would learn the date at the same time. Their endeavors to adjust their conduct of affairs to this information would immediately result in the appearance of all the phenomena of the depression. It would be too late for any of them to avoid being victimized.

If it were possible to calculate the future state of the market, the future would not be uncertain. There would be neither entrepreneurial loss nor profit. What people expect from the economists is beyond the power of any mortal man.

The very idea that the future is predictable, that some formulas could be substituted for the specific understanding which is the essence of entrepreneurial activity, and that familiarity with these formulas could make it possible for anybody to take over the conduct of business is, of course, an outgrowth of the whole complex of fallacies and misconceptions which are at the bottom of present-day anticapitalistic policies. There is in the whole body of what is called the Marxian philosophy not the slightest reference to the fact that the main task of action is to provide for the events of an uncertain future. The fact that the term speculator is today used only with an opprobrious connotation clearly shows that our contemporaries do not even suspect in what the fundamental problem of action consists.

Entrepreneurial judgment cannot be bought on the market. The entrepreneurial idea that carries on and brings profit is precisely that idea which did not occur to the majority. It is not correct foresight as such that yields profits, but foresight better than that of the rest. The prize goes only to the dissenters, who do not let themselves by misled by the errors accepted by the multitude. What makes profits emerge is the provision for future needs for which others have neglected to make adequate provision.