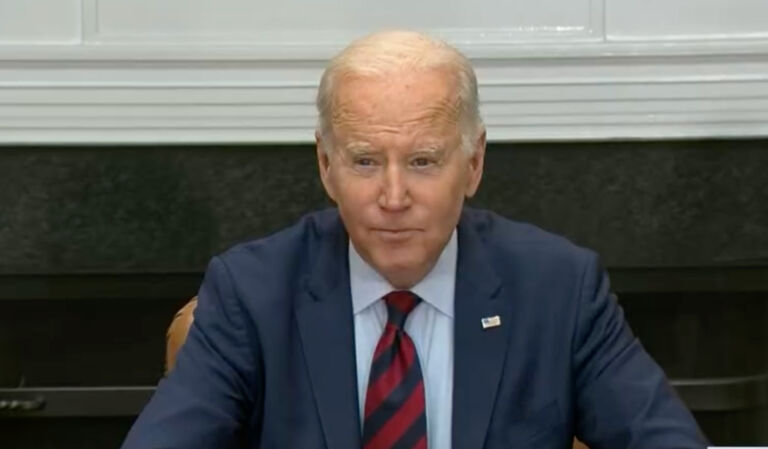

David Harsanyi of the Federalist probes President Biden’s latest promise about American taxes.

Harsanyi quotes a Biden tweet:

“Donald Trump was very proud of his $2 trillion tax cut that overwhelmingly benefited the wealthy and biggest corporations and exploded the federal debt. That tax cut is going to expire. If I’m reelected, it’s going to stay expired.”

Well, obviously Trump should be “proud” of the Tax Cuts and Jobs Act, which is set to expire at the end of 2025. If the GOP presidential candidate had any sense, he would be running Biden’s promise to enact a $2 trillion tax hike, one of the biggest in American history, in a perpetual ad loop.

Of course the rich benefited. As did everyone else. Even the New York Times and Washington Post were compelled to admit as much.

In raw terms, as with any across-the-board tax cut, Trump’s reform helped higher earners most, because high earners pay most of our federal taxes. In 2023, the top 1 percent paid eight times the rate paid by the bottom half of taxpayers. The idea that the rich aren’t paying their share is a preposterous zero-sum economic myth spread by resentment-racket class warriors on left and right. If everyone actually paid his “fair share” in this country, we’d be years deep into a violent revolution.

If anything, the problem with Trump’s tax cuts was that the code became more progressive, although other downsides include the lack of any corresponding cuts or reforms of debt-driving entitlements. Quite the opposite.

As a percentage of income, though, the Trump tax cuts benefited the middle class most. …

… Let’s not forget, as well, when “that tax cut is going to expire”—and there are no assurances anything would pass to take its place—that would slash child tax credits from $2,000 per child to $1,000 and cut additional credits for older children and dependents in half. It should also be remembered that corporate taxes—which Trump cut from 35 percent to 21 percent and Democrats raised again—are also just a tax on consumers.