Gov. Roy Cooper’s policies on corporate taxes and corporate welfare can seem confusing at first. How can he be so pleased to announce giving millions of dollars to individual corporations, yet so angered by the prospect of tax breaks for companies statewide?

Gov. Roy Cooper’s policies on corporate taxes and corporate welfare can seem confusing at first. How can he be so pleased to announce giving millions of dollars to individual corporations, yet so angered by the prospect of tax breaks for companies statewide?

You have to realize that, at its base, it’s all about government control. Here are the four policy combinations of corporate taxes and corporate welfare:

- The Freedom & Growth combo joins low corporate taxation with low corporate welfare. It’s about letting producers and households expand their horizons as best they see fit.

- The Redistribution, Anti-Business combo joins high corporate taxes and low corporate welfare. It’s about policymakers redirecting resources from businesses to others.

- The Redistribution, Pro-Business combo joins low corporate taxes with high corporate welfare. It’s a lower level of redirecting resources to some businesses from others.

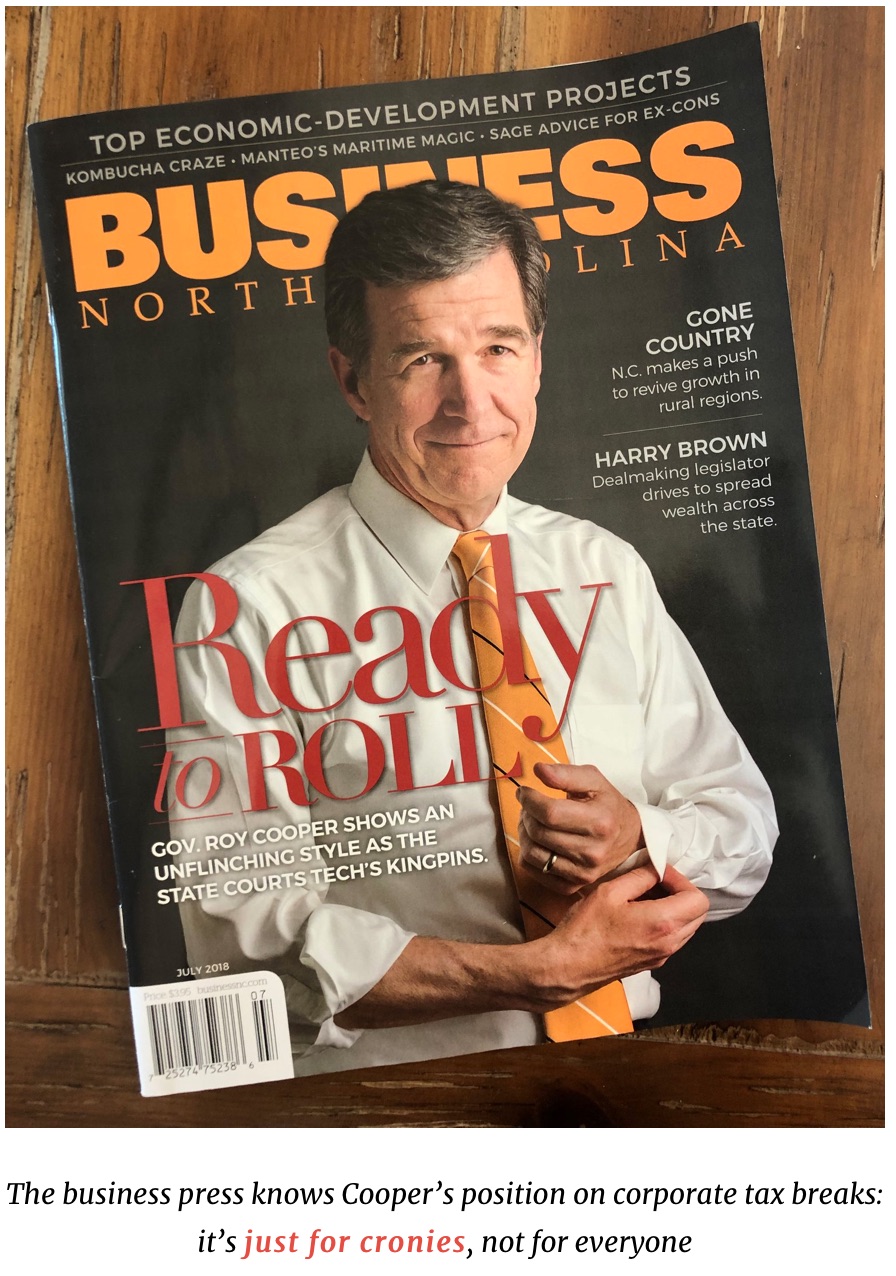

- The Central Planning & Cronyism combo is Cooper’s preference. It joins high corporate taxes and high corporate welfare. It’s about government control, with politicians directing others’ resources at their whim.

Of the four, Freedom & Growth is a proven way to promote faster economic growth and expansion. Central Planning & Cronyism is a proven way to slow economic growth while empowering politicians. It’s a public choice problem, as Cooper reaps the benefits of empowering his office, while the costs of slower economic growth get spread out among North Carolinians.

Last year, despite citing “corporate tax breaks” (the franchise tax) as his top reason for vetoing the state budget, Cooper approved $146 million in grants to a select handful of favored corporations.

The month of January saw much of the same:

- January 7: announced $90,000 to LLFlex

- January 21: announced $8.7 million to Eli Lilly and Company

- January 24: announced $50,000 to Pactiv Corporation

And of course, in the midst of approving those corporate welfare giveaways, there was this:

- January 14: complained about corporate tax cuts