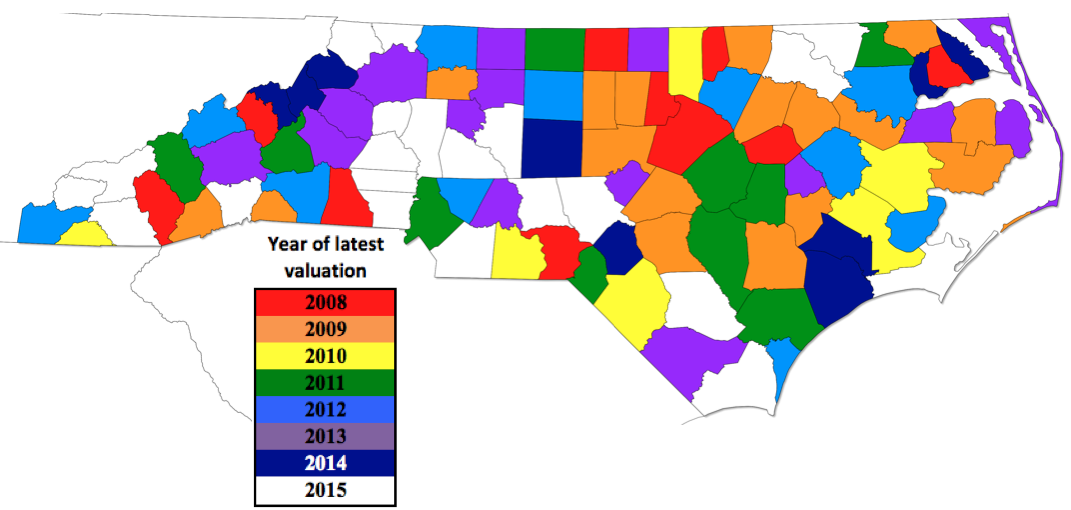

Property taxes, while they are the largest revenue source for local governments, have not had much interference at the state level and remain a locally controlled revenue source. Real property is required by the state to be revalued every 8 years, but many counties elect to revalue more frequently. Unfortunately, after a decade of property value increases in the 2000s, the housing market saw declines due to the recession. Many governments need to prepare for a reset. Twenty-seven of the state’s counties last revaluation were in 2009 or earlier, causing taxpayers to pay property taxes on inflated property values. County governments need to be fair to residents and stop taking overinflated property tax collections from citizens. All counties should have revaluations on their properties after 2009 to assess taxpayers at a fairer rate.

See the map below of NC counties and the counties that need to revalue property values sooner rather than later.