North Carolina’s decade of economic success deserves celebration. Even more so, however, it is worth applauding the important steps toward reform that state lawmakers have undertaken over the past decade.

Limiting government and reining in spending was critical for the growth we’ve seen over the past several years and to shore up our reserves for the current recession. Decades of fiscal restraint and responsible budgeting have allowed North Carolinians to keep more of their money.

Without such effort, North Carolina would still have the high unemployment, incomes that trail the national averages, and an inhospitable business climate of the early 2010s. Studying this history reminds us that we must continue to promote sound fiscal policy.

Smart budgeting should not be dependent upon who is in charge in Raleigh. Unfortunately, however, some lawmakers have an appetite to take and spend more from taxpayers.

We need a budget that works for North Carolinians in times of plenty and scarcity. North Carolina cannot settle for a budget that gives in to special interests or succumbs to tax and spend cycles that ultimately harm the taxpayer and those on the margins.

It is always a good time to implement common-sense reform that respects taxpayer dollars. Moreover, with expanding federal aid to states, this matter is urgent. Washington continues to tempt states with national solutions to state problems. Federalism’s value is precious.

The state budget is far from the most tantalizing policy topic. But almost no other policy priority can be addressed before the budget. For example, healthcare, education, public safety, and transportation infrastructure require funding from the state budget. Debates about any of these often comes down to funding amounts, methods, and timing.

A simplified budget that exemplifies limited government principles would save the state and the taxpayers who fund it significant time and money.

During the upcoming long session, the General Assembly should implement the following.

Click on each arrow to learn more about these priorities.

1. Enact a Taxpayer Bill of Rights (TABOR)

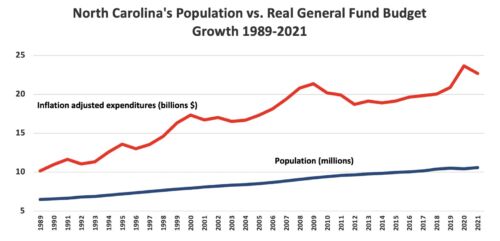

The problem: Budget volatility encourages irresponsible budget growth during economic growth periods that prove unsustainable when recession hits.

The key takeaway: A Taxpayer Bill of Rights (TABOR) would smooth out budgeting volatility, limiting state spending growth to a formula of population growth plus inflation, and return excess revenue to taxpayers.

The details: A TABOR would amend the North Carolina Constitution and add an article to put an upper bound on state spending.

The state House and Senate each have existing drafts of a TABOR bill.

Senate Bill 717 would likely be the more effective TABOR application for North Carolina. The bill establishes a maximum annual percentage increase for state fiscal year spending that “shall not exceed the average inflation growth for the prior three calendar years plus the average growth in State population for the prior three calendar years before the fiscal year start.”

By using three trailing years instead of one, as the House bill does, the formula provides a smoother number that is less subject to stints of high inflation or rapid increases or decreases in population.

Moreover, S.B. 717 uses the GDP deflator to calculate inflation. This economic indicator is less volatile than the Consumer Price Index used in other bill versions.

According to the bill, excess revenues will be sent to the Savings Reserve until the balance of the Reserve reaches fifteen percent of the prior fiscal year’s General Fund expenditures. Any such excess reserves would be sent to the Unfunded Liability Solvency Reserve. Any amount that exceeds the spending limit and the reserve targets “shall be returned equally to every individual who filed a return for the tax year prior to the start of the fiscal year.”

Without commonsense guardrails, North Carolina will likely revert to a state of constant “budget crisis” under more progressive leadership. North Carolina’s recent fiscal restraint has benefitted the state, but this should become permanent for the sake of anyone who calls North Carolina home. A TABOR would thwart any spending sprees popular during times of economic plenty. Moreover, voters support amending the state Constitution to limit spending growth. A March 2021 Civitas poll found 58% of likely North Carolina voters supported TABOR, compared to just 17% voicing opposition.

If surpluses like our current one occurred under a progressive legislature, there’s little doubt it would be spent on pet projects, bloating the budget, and overextending future taxpayer obligations. A TABOR would prevent such shortsighted spending sprees, regardless of who is in charge.

Additional resources:

https://www.johnlocke.org/six-items-to-consider-in-north-carolinas-latest-budget-proposal/

https://www.johnlocke.org/last-fiscal-year-produces-major-surplus/

https://www.johnlocke.org/the-real-lesson-from-colorados-taxpayer-bill-of-rights/

https://www.johnlocke.org/taxpayer-bill-of-rights-also-known-as-a-tabor/

2. Index The Standard Deduction to Inflation

The problem: Without indexing, wage increases merely keeping pace with inflation push taxpayers into a new bracket, bringing in more revenue to the government while the taxpayer is no better off. The taxpayer’s burden changes with no political accountability.

The key takeaway: Low-income families are already disproportionately harmed by inflation. Indexing the state’s standard deduction to inflation would prevent low-income taxpayers from being unnecessarily pushed above the standard deduction ceiling, causing them to have to pay state taxes.

The details: The Internal Revenue Service adjusts the federal standard deduction each year for inflation. In 2022, the standard deduction increased $800 for married couples filing jointly and $400 for single taxpayers and married filing separately.

North Carolina should index the personal income standard deduction as the IRS does, using the Chained Consumer Price Index (C-CPI) and indexing for the rate from the prior calendar year. According to the Bureau of Labor Statistics, this indicator is “designed to be a closer approximation to a cost-of-living index in that it, in its final form, accounts for any substitution that consumers make across item categories in response to changes in relative prices.”

Indexing the standard deduction to inflation prevents “bracket creep,” where tax brackets do not adjust to consumers’ real income changes. Without indexing, tax burdens increase due to inflation, not higher real income. This is especially harmful to low-income households.

North Carolina has a flat personal income tax, meaning everyone who pays the personal income tax pays the same percentage on income above the standard deduction. Therefore, the only bracket to index is the “zero tax bracket” or the standard deduction.

Indexing the state’s personal income standard deduction to inflation should garner bipartisan support.

Eleven of the states that have a standard deduction index it to inflation. North Carolina should join the states that target low-income families for tax relief.

Additional resources:

3. Apply the Insko Rule for Budget Transparency

The problem: Lawmakers are increasingly spending your tax dollars on local projects with no accountability.

The key takeaway: The Insko Rule, our nickname for House Bill 83, would increase transparency and encourage responsibility by requiring each requesting member’s name to be indicated with a special provision in the state budget (also called pork spending).

The details: The Insko Rule is essential to North Carolina’s budget. Representative Verla Insko (D-Orange), the bill’s namesake, understood the need for transparency. The bill requires that every special provision “shall indicate the name of the member or members who requested the provision.”

Her bill could be bolstered with additional taxpayer protections. For example, the pork spending data should be publicly available and easily searchable. Other safeguards could include capping the total dollar amounts each legislator can request, limiting types of eligible recipients, disclosing any conflicts of interest, and ensuring projects are noted with specific detail to make taxpayers aware of precisely what their dollars are funding.

Steering state funding to localities or special projects via pork in the state budget is inappropriate. It undermines local authorities, agency grant processes, and private competition. Furthermore, it often compels statewide taxpayers to pay for a project that should be funded locally – if at all.

Additional resources:

https://www.johnlocke.org/who-asked-for-that-north-carolina-needs-insko-rule/

https://www.carolinajournal.com/house-bill-would-enact-locke-presidents-insko-rule/

4. Eliminate the Privilege License Tax

The problem: The privilege license tax burdens workers through costs and an archaic compliance process. Moreover, it disproportionately affects certain sectors.

The key takeaway: Earning a living in North Carolina is a right, not a privilege. The privilege license tax should be eliminated to reflect this and to alleviate the unnecessary burden on workers.

The details: First, the privilege license tax revenue is negligible to the state. Revenue from the privilege license tax is relatively minuscule, less than one-quarter of one percent of total tax revenue in Fiscal Year (FY) 2020-21.

Moreover, as I wrote previously, most of that revenue comes from installment paper dealer fees. Installment paper dealers must pay 0.277% of the total face value of the obligations “dealt in, bought, or discounted in the business of handling installment papers, notes, bonds, contracts, or evidences of debt” – a small amount relative to the money being handled, but a significant amount when looking at the composition of the privilege license tax revenue.

Excluding installment paper fees, the privilege license fees brought in a mere $6.6 million in FY 2021.

Second, the privilege license tax is applied unevenly to occupations in North Carolina. And even among the professions, the rates are not neutral. Most pay $50 yearly, but pawnbrokers and loan agencies must pay $250 yearly, for example.

The largest share, 39% of the tax burden, falls on real estate. The North Carolina Department of Revenue (DOR) processed more than 53,000 licensees or renewals for real estate agents in North Carolina in FY 2021.

Other occupations that must pay this redundant tax include architects, physicians, attorneys, veterinarians, massage therapists, dentists, embalmers, opticians, and photographers.

Third, the compliance process for the privilege license tax is archaic and unnecessarily complex. Fees are only collected through snail mail. No online process exists.

Moreover, the privilege tax fee is annual – meaning the compliant business or individual must perform the entire renewal process each year by July 1 through a mailed form. Should a business relocate, they are required to notify DOR via snail mail using a separate form.

Compliance costs are already high for these businesses and workers that serve fellow North Carolinians, there’s no need to add more in the form of the privilege license tax. It is not significant to state revenue and should be easily eliminated.

Additional resources:

https://www.johnlocke.org/three-reasons-to-remove-the-privilege-license-tax/

5. End the Corporate Welfare Cycle

The problem: Lawmakers on both sides of the aisle have applauded the unfair and wasteful spending of taxpayer dollars on corporations that would have come here anyway.

The key takeaway: Corporate welfare redirects taxpayer resources away from productive uses and toward politically favored projects. North Carolina should repeal all economic development policies and close its major grant programs. One way to accomplish this could be through a multi-state compact.

The details: In 2021 alone, Governor Cooper pledged $1.3 billion to just 58 corporations. The General Assembly supports such giveaways, enabling the state’s two primary grant vehicles: the Jobs Development Investment Grant (JDIG) and One North Carolina (OneNC).

Corporate giveaways are increasingly popular in Raleigh because politicians like taking credit for “creating jobs.” But that presumption is flawed. Politicians do not have special knowledge of the economy. That type of central planning is antithetical to the free market. There are many more factors at play than a handout from the state when a business decides to open, expand, or relocate. Corporate giveaways, funded with taxpayer dollars, come at the expense of jobs and economic activity elsewhere.

Politicians too often claim to drive investment to their own localities, to their benefit.

Take the egregious deal with Apple, for example. The Center for Economic Accountability (CEA) awarded North Carolina’s deal with Apple as the “Worst Economic Development Deal of the Year.” CEA says Apple has more money than the entire state of North Carolina – why would we give them taxpayer money to come here?

Moreover, most corporate welfare in North Carolina goes to the wealthiest counties with the least need. If politicians were interested in investing in jobs where they’re most needed, they would focus efforts on the areas of the state with high unemployment.

Economic development policy is ultimately a barrier to entrepreneurship. The policies and grant programs should be removed entirely. Combined with a zero corporate tax, as is scheduled for 2030, North Carolina would have a fair, competitive playing field for businesses. And to avoid objections about “unilaterally disarming” in the incentives game, North Carolina legislators could consider partnering with neighboring states in a multi-state agreement to end incentives.

Additional resources:

https://www.johnlocke.org/most-corporate-welfare-in-nc-goes-to-the-wealthiest-counties/

https://www.johnlocke.org/our-corporate-welfare-insanity-is-fast-heading-to-a-bad-place/

https://www.youtube.com/watch?v=Pa4BJw2kuHU

6. Refuse Medicaid Expansion

The problem: Medicaid expansion grows government and ignores the underlying issues that plague the health care system. Even so, there is increasing pressure to expand Medicaid in North Carolina.

The key takeaway: Lawmakers must continue to refuse Medicaid expansion for North Carolina, which would inevitably saddle taxpayers with a massive, ongoing government obligation.

The details: Governor Pat McCrory promised not to expand North Carolina’s Medicaid eligibility to match the expansion within the newly passed Affordable Care Act (ACA). Since then, conservative lawmakers in North Carolina have long resisted calls to expand Medicaid to include those with incomes up to 138% of the federal poverty level as the ACA allows.

Medicaid expansion was a bad idea then, just as it is now.

However, the share of federal government reimbursement to the program has changed. President Joe Biden’s American Rescue Plan Act (ARPA) sweetened the deal to states, albeit temporarily, by expanding reimbursement to states from the federal government. According to the Kaiser Family Foundation, “In addition to the 90% federal matching funds available under the ACA for the expansion population, states also can receive a 5 percentage point increase in their regular federal matching rate for 2 years after expansion takes effect.” Even if hospitals and health insurance providers agree to fund the state’s remaining 10% through taxes on hospitals, for example, there will likely still be a massive funding gap.

ARPA and increasing pressure from the left have resulted in debate within the Republican-led North Carolina House and Senate to pursue expansion. Ultimately, however, Medicaid expansion would create a long-term fiscal liability for North Carolina. Medicaid expansion would increase the amount of North Carolinians dependent on government health care. With expansion, healthier populations are likely to crowd out the neediest populations the program is supposedly intended for.

The sweetened deal from the feds does not make Medicaid Expansion a better deal for North Carolina. Any additional reliance on our broke and dysfunctional federal government must be avoided.

Additional resources:

https://www.johnlocke.org/reminder-that-medicaid-expansion-is-still-bad-for-north-carolina/

https://www.johnlocke.org/research/big-government-big-price-tag-part-01/