Kevin Hassett of the American Enterprise Institute predicts major supply-side tax reforms next year.

With apologies to Ronald Reagan, next year is teed up to be the biggest supply-side-policy year in American history. The expected changes are too numerous to list, but the most economically consequential will be tax reform. President-elect Trump promised a sweeping tax reform that strikingly resembled a proposal sketched last summer by House Republicans. These plans also closely followed ideas long sketched by Senate Republicans, so it seems certain that something like the Trump/House plan will become law. Thank goodness.

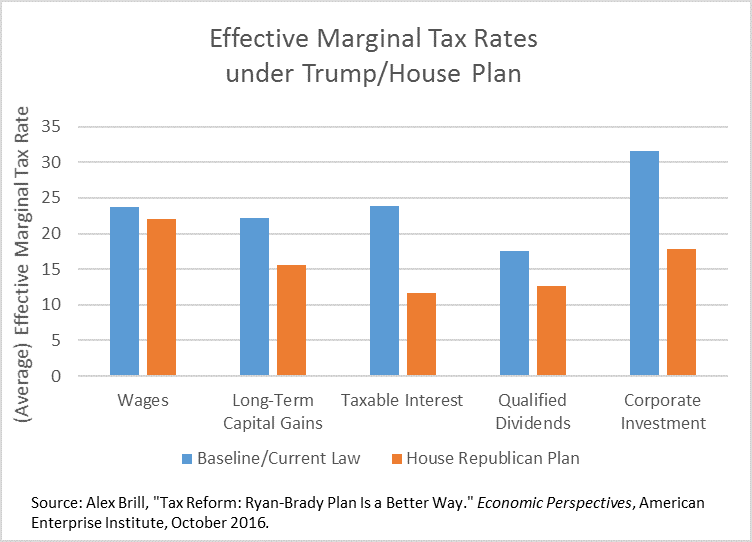

The chart below, which is drawn from a recently released study of the House plan by my American Enterprise Institute colleague Alex Brill, provides a summary view of the tax reform. There are many ways that taxes can influence the decisions of firms and individuals, but a nice summary statistic is the impact they have on the effective marginal tax rate (EMTR). The EMTR is the extra amount of tax that is owed should the firm or individual earn an extra dollar of income.

On the corporate side, the big news is that rates are reduced dramatically, with the likely endpoint being around 20 percent, as compared with our current rate of 35 percent. But the proposal would also allow firms to fully deduct capital expenditures in the year that they are made rather than spread them out over a number of years. Factoring that in with the lower rates, and adjusting for a number of other changes, Brill estimates that the tax rate on corporate investment would drop from its current level of 31.6 percent all the way to 17.9 percent. As we have discussed many times in this space, a country that is a friendly place to locate investment is a friendly place to work. If you think wage growth has been disappointing since the recovery began, you should pop the champagne cork when this becomes law.