Last year Gov. Roy Cooper vetoed the state budget because it had a corporate tax cut. Specifically, it would have cut the franchise tax, a strange tax that only 15 other states have — it taxes all corporate assets or wealth above $200, regardless of whether it’s a money-making venture or an abject failure. When business capital expenditures are exempt from corporate income taxes, the franchise tax gets it. Economist Roy Cordato shows that it is, in fact, a double tax on business assets.

Cooper refused to cut this obsolete double tax on business assets, preventing businesses in the state (99.6 percent of which are small businesses) from retaining an estimated $255.2 million. The governor and media seemed indignant at the mere thought of corporations getting tax cuts. Then throughout last year, Cooper pledged $146 million in grants to select individual corporations, but that was OK, for some reason.

It was also last year, when the economy was doing well and entire industries — including especially the state’s hospitality industry, which comprises 13% of the state’s workforce — weren’t facing an existential crisis in which a large majority of businesses are either closed or soon may be. Last year, the phrase “closing tsunami” hadn’t entered the business press’ lexicon. Now nearly 170,000 people in the hospitality industry have lost their jobs just since March, owing to Cooper’s shutdowns and other economic restrictions on their employers all across the state.

Could Cooper callously continue to play favorites with individual corporations at the exact same time he was putting hundreds upon hundreds of small businesses at risk of closings, bankruptcies, and ruin?

Yes. Of course. At several levels worse than last year, even.

As of this writing, Cooper has pledged nearly $445 million in corporate welfare to just 22 corporations this year. That’s approaching half a billion dollars in corporate welfare in this year, of all years, and it’s still September.

Here is the list so far:

- Jan. 7: $90,000 to LL Flex (One North Carolina fund, “OneNC”)

- Jan. 13: $500,000 to Sara Lee Frozen Bakery (OneNC)

- Jan. 21: $8,689,500 to Eli Lilly and Company (Jobs Development Investment Grant fund, “JDIG”)

- Jan. 24: $50,000 to Pactiv Corporation (OneNC)

- Feb. 17: $60,000 to Nebraska Plastics, Inc. (OneNC)

- Feb. 17: $200,000 to Armorock, LLC (OneNC)

- Feb. 17: $250,000 to Atlantic Casualty Insurance Company (OneNC)

- Feb. 18: $3,725,100 to Audentes Therapeutics (JDIG)

- May 27: $500,000 to Unix Packaging (OneNC)

- May 27: $3,080,000 to Ontex Operations USA, LLC (JDIG)

- June 2: $5,200,000 to GRAIL, Inc. (JDIG)

- June 4: $150,000 to Ames Copper Group (OneNC)

- June 9: $5,161,500 to Grifols Therapeutics (JDIG)

- June 9: $2,430,000 to Prime Beverage Group (JDIG)

- June 15: $50,000 to Anthem Displays LLC (OneNC)

- June 18: $150,000 to Serioplast US LLC (OneNC)

- July 1: $387,890,250 to Centene Corporation (Transformative JDIG)

- Aug. 1: $2,106,000 to Prepac Manufacturing Ltd. (JDIG)

- Aug. 11: $3,237,750 to Beam Therapeutics (JDIG)

- Aug. 11: $3,267,000 to Retirement Clearinghouse, LLC (JDIG)

- Aug. 20: $100,000 to Continental Structural Plastics (OneNC)

- Sept. 9: $18,000,000 to United States Golf Association (JDIG, OneNC, and $14.4 million from some as-yet undetermined source)

The total corporate welfare pledged by Gov. Cooper so far this year: $444,887,100.

Cooper will pay them to film here and forbid us from watching it here

Beyond JDIG and OneNC, Cooper has even more cronyism starting up. His office announced Sept. 15 he’s planning to hand out over $26.6 million’s worth of grants to five out-of-state production companies to film in North Carolina.

Well, that’s just priceless.

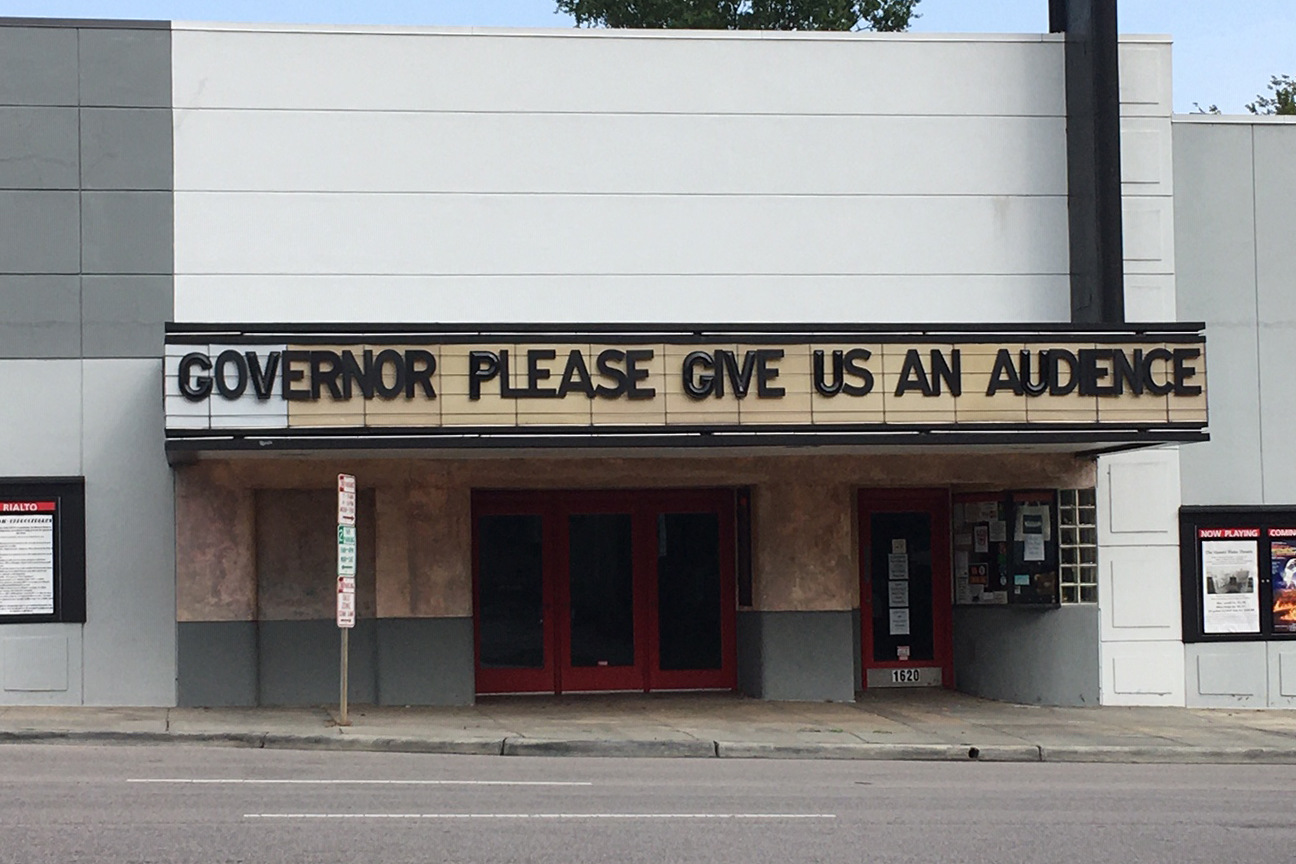

Cooper boasted that it’s “showcasing on a big stage what North Carolina has to offer.” Thing is, no big stage in NC is allowed to showcase squat. Movie theaters are closed, by Cooper’s orders.

But their owners, employees, and would-be customers are still on the hook for millions to pay Hollywood production companies to film here the movies they can’t show here. Let’s showcase that.

Film incentives can do very little beyond enrich out-of-state film production companies. They can’t be shown to boost a state’s economy or work as an economic-development tool. But a governor who habitually chooses to enrich out-of-state enterprises, one at a time, at the same time he uses the power of state government to force whole industries from even being able to open their doors and compete for business can’t be expected to worry about what’s best for North Carolinians.

The second part of this series will look at a few of Cooper’s corporate welfare giveaways in greater detail.

*16 more companies have been added to the list as of Nov. 12, 2020, bringing the list up to 38 corporations. The new corporations are as follows:

- Sept. 19: $120,000 to Pamlico Air (One North Carolina fund, “OneNC”)

- Sept. 30: $4,310,000 to Nestlé Purina PetCare Company (Jobs Development Investment Grant fund, “JDIG”)

- Sept. 30: $1,344,000 to Merchants Distributor, LLC (JDIG)

- Oct. 2: $210,000 to Triple Aught Design (One)

- Oct. 13: $10,320,000 to UPS (JDIG)

- Oct. 13: $1,212,000 to Benestar Brands (JDIG)

- Oct. 14: $50,000 to Hamilton Drywall Products (One)

- Oct. 15: $80,000 to RMC Advanced Technologies, Inc. (One)

- Oct. 22: $15,543,000 to Pratt & Whitney (JDIG)

- Oct. 26: $75,000 to Texwipe (One)

- Oct. 27: $1,078,2000 to Eastern Wholesale Fence, LLC (JDIG)

- Oct. 28: $60,000 to East Coast Steel Fabrication, Inc. (One)

- Oct. 29: $18,885,000 to BioAgilytix Labs, LLC (JDIG)

- Oct. 30: $1,173,750 to Nuvotronics (JDIG)

- Oct. 30: $100,000 to Cornerstone Building Brands, Inc. (One)

- Nov. 12: $200,000 to Wolf and Flow X-Ray (One)