Health care is an important issue for voters. Not only is it important for an individual’s overall well-being, but the soul-crushing costs of health care also have severe impacts on employees’ wages and patients’ pocketbooks. Proponents of the Affordable Care Act (ACA), or Obamacare, claimed that it would fix many of these affordability issues. But for many who do not get insurance through their employer, the problems of high costs and limited access persists.

Section 1332 of the ACA allows states to apply to the federal government for waivers that would grant them exemptions from core ACA requirements. This is one option for states to pursue to try to provide some relief to patients who buy insurance in the individual or small group markets. I have written about this topic before, shortly after the Trump administration issued new guidance about this section:

For a section 1332 waiver to be approved, state officials would have to show HHS [U.S. Department of Health and Human Services] that their new alternative will function in accordance with the following guardrails: “provide coverage at least as comprehensive as that provided under the ACA; provide coverage and protection against excessive out-of-pocket expenditures at least as affordable as that provided under the ACA; cover a number of residents at least comparable to the number who would be covered under the ACA; and not increase the federal deficit.”

Several states have successfully applied for a 1332 waiver. Not every state’s waiver looks the same. These waivers are designed to be tailored to each state – the way health insurance markets should operate. In this research brief, I will examine the 1332 waivers for several states who have used them to set up reinsurance programs. Although North Carolina has not applied for a 1332 waiver, the purpose of this brief is to illustrate what other states are doing to address some of the affordability problems for those who purchase health insurance as an individual or a small group. To better accommodate those who are uninsured or struggle to afford insurance, North Carolina may find it necessary in the future to take back control of its insurance market.

State-Based Reinsurance

As of this writing, 13 states have successfully been granted waivers under section 1332 of the ACA. The majority of these waivers have focused on setting up state-based reinsurance programs. A reinsurance program is essentially stop-loss insurance for insurance companies. The details of how each program will work vary from state to state; however, Louise Norris from verywellhealth provides a brief description:

In a nutshell, the idea is that the reinsurance program lowers the cost of health insurance, which means that premium subsidies don’t have to be as large in order to keep coverage affordable, and that saves the federal government money (since premium subsidies are funded by the federal government). By using a 1332 waiver, the state gets to keep the savings and use it to fund the reinsurance program. That money is referred to as “pass-through” savings since it’s passed through to the state.

It’s widely accepted that a small portion of the population accounts for a substantial part of overall health care spending. Offsetting the costs of these folks is a possible way to bring down costs for everyone in the risk pool.

Success in Other States

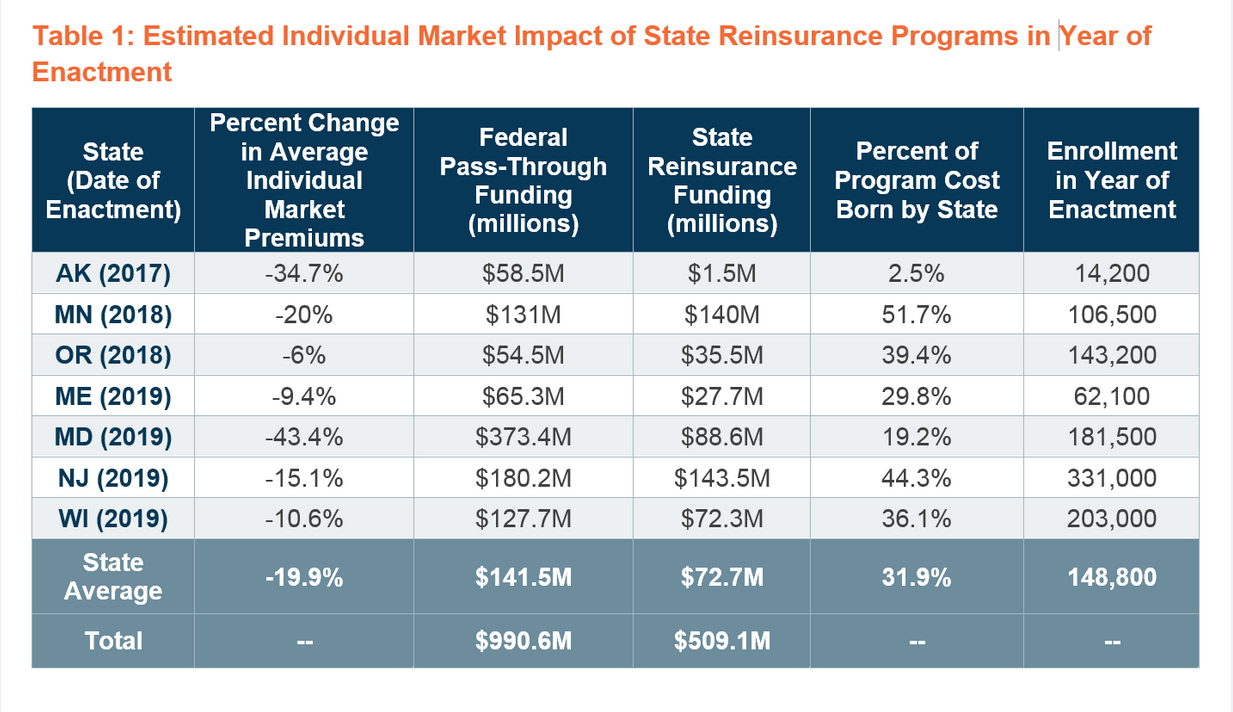

The chart posted below comes from Avalere, a health care consulting firm and shows the results of the states who have implemented a reinsurance program. On average, the states with an implemented reinsurance program were able to reduce premiums by 19.9 percent compared to what the premiums would have been in the absence of the waiver. Some states were able to reduce premiums at a much higher rate.

Would a reinsurance program work for North Carolina? It could. Is it the right idea? Maybe. A 1332 waiver would help North Carolina by allowing the state to set up an insurance market without all of the excessive burdens of Obamacare. If this included a reinsurance program as other states have implemented, the devil would be in the details. Funding would be a main point of concern. Some states fund their program by general fund revenues. Some states impose a small tax on insurers. A North Carolina based reinsurance program ideally would be one that is part of a more extensive 1332 waiver to lower premiums through risk adjustment, encourage competition among plans and insurers, and provides as many affordable options as possible to encourage the take-up of insurance by those who may not currently be insured.

Obamacare mandated that every insurer who participates in the exchanges must cover a prescribed set of benefits. Mandating coverage like this creates a disincentive for insurers to cover the sickest individuals because of the high cost. Using a reinsurance program (or another risk-adjustment program) is one method to try to reallocate existing funding to meet the needs of patients better and lower costs for everyone in the insurance market. The key here is that this type of program would reallocate funding that is already slated to come to the state. If properly set up, this type of program could spread risk without requiring any new federal funding.

As the Affordable Care Act remains the law of the land, states are looking for additional ways to provide relief for those who cannot afford or struggle to afford insurance. A 1332 waiver may be the way to do so.