When it comes to debates over tax reform or tax cuts (rarely for tax increases), it is quite typical for questions of fairness and justice to be part of the conversation. During and after deliberations over the 2013 tax reforms and cuts in North Carolina, opponents of the plan vociferously argued that the results were “unfair.” The same arguments are being made regarding recent cuts made at the federal level. While accusations of unfairness in the tax code are thrown around quite liberally in such debates, rarely, if ever, do they define or defend the meaning of “fairness.” Yet, without a clear definition of the concept, it cannot act as a meaningful guide to tax policy.

The nebulous “rich should pay more” standard

While those who embrace the rhetoric of tax fairness in their arguments regarding tax policy have not put forth a rigorously defined standard, there is one thing that tends to come through in nearly all of their arguments, namely that those who are making relatively higher incomes are not paying enough. (As an aside, it is rarely argued that lower-income people are paying too much.) Or, in the case of recent tax cut plans, the complaint is that those at higher incomes, i.e., the rich, are getting too large a cut relative to those at lower income levels. Complaints such as this one from The Guardian are typical:

If the tax plan were truly a plan for the middle class and not a plan for the rich, it wouldn’t lavish nearly as many benefits on the wealthiest Americans: phasing out the estate tax, eliminating the alternative minimum tax, cutting the business pass-through tax rate. The Trump-GOP plan would also chop the corporate income tax rate from 35% to 20% – a move that heavily favors affluent people because they own a disproportionate share of corporate stocks.

Leaving aside the accuracy of the statement, including (and maybe especially) the assumption that it is rich shareholders who benefit from corporate tax cuts primarily, the question that is not addressed, in this article or anywhere else in these writings, is why. Why should the issue of fairness be based on how much higher-income taxpayers pay, or, in this case, save, relative to lower income taxpayers? In fact, why should the fair treatment of one group depend on the fair treatment of another group?

I guess that, consciously or not, the typical “tax fairness” advocate sees the world through the lense of class struggle. The distribution of incomes is, at best, a zero-sum game where people do not receive higher incomes because they provide more desirable goods or services to society and therefore are rewarded for their greater contribution to social well-being. It is, instead, because they are simply able to exploit others because they are better at gaming the capitalist system. Therefore, the gains of higher income people come at the expense of lower-income people and are therefore unjustly acquired.

Taxation, particularly the income tax, is seen, not simply as a way to raise money to fund the government, but as a way to right a wrong or to correct an injustice. The tax system should be used to equalize incomes. That is, to coercively transfer revenues from higher income individuals, typically using a steeply progressive rate structure, to those with lower incomes. Typically, this is not done through tax reductions for lower-income families, which would allow them to keep more of their own money, but through government-run social programs. In other words, this concept of fairness is based on the ability of the state to use its coercive powers to reorganize the social outcomes that had been determined by the voluntary exchanges made in the market.

Unfortunately, those that continuously complain about the relative fairness of recent tax changes, at both the state and federal level, force us to speculate about the true foundations of their arguments because they are unwilling to make them explicit and defend them.

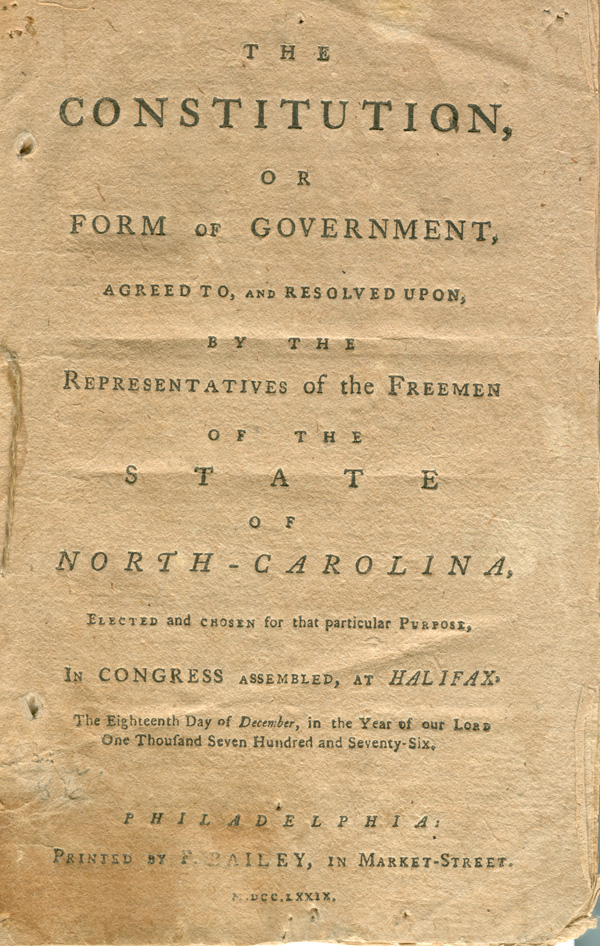

The N.C. Constitution: An Alternative Approach

So, is there an alternative way to think about the issue of tax fairness, one that is more consistent with individual liberty and the moral principles that form the foundation of American society? The answer is yes, and it is generally stated in Article 1, Section 1 of the North Carolina Constitution. The full section should sound mostly quite familiar. It states:

We hold it to be self-evident that all persons are created equal; that they are endowed by their Creator with certain inalienable rights; that among these are life, liberty, the enjoyment of the fruits of their own labor, and the pursuit of happiness. (emphasis added)

What is added to the familiar statement of rights, made explicit in the opening lines of the Declaration of Independence, is the idea that people have a Creator-endowed right to the enjoyment of the fruits of their labor. And in a free market economy such as ours, the fruits of one’s labor are their income. The N.C. Constitution simply makes explicit the obvious, namely that without the right to enjoy the fruits of one’s labor, the rights to life, liberty, and the pursuit of happiness really have no meaning. Clearly, to the extent that the government denies a person the right to his income, which is his means of pursuing his other rights, he is also denied the right to these other rights. Indeed, in the limit, slavery is the 100 percent denial of the right of someone to the enjoyment of the fruits of his labor – his income.

What is added to the familiar statement of rights, made explicit in the opening lines of the Declaration of Independence, is the idea that people have a Creator-endowed right to the enjoyment of the fruits of their labor. And in a free market economy such as ours, the fruits of one’s labor are their income. The N.C. Constitution simply makes explicit the obvious, namely that without the right to enjoy the fruits of one’s labor, the rights to life, liberty, and the pursuit of happiness really have no meaning. Clearly, to the extent that the government denies a person the right to his income, which is his means of pursuing his other rights, he is also denied the right to these other rights. Indeed, in the limit, slavery is the 100 percent denial of the right of someone to the enjoyment of the fruits of his labor – his income.

This leads to a very different perspective on tax fairness or justice. If what is fair or just is viewed through the lenses of the Creator-endowed rights as made explicit above, then a tax system is fair to the extent that it minimizes the injustice, i.e., the denial of rights to one’s income. The lighter the tax burden, the fairer the system. If a tax change increases the burden on some people, regardless of their income level, and reduces it on others, then the change can be said to increase the injustice on the former group and reduce it on the latter. Note that fairness is not about how one group is treated relative to the other. In this sense, it is an absolute standard of fairness of justice, not a relative one.

Also, it should be noted that embedded in this standard is the notion that all people have the same rights. In the case of their income, it is equality under the law. So, again, contrary to the more standard way of looking at fairness, based on an exploitation theory of income, a progressive rate structure should be viewed as unjust. This is because such a structure is based on the idea that higher-income people should have fewer rights to their income then lower-income taxpayers. As your income increases, your rights to that income are reduced. The concept of equality under the law suggests that the fairest or most just tax structure would be one that utilized a flat rate, similar to what North Carolina implemented in 2013.

The standard view of tax fairness, to the extent that it is explicitly defined at all, is inconsistent with America’s founding principles. Its implementation depends on a fundamental denial of rights. The entire approach depends on the justness of using government coercion to rearrange the distribution of incomes across individuals. In other words, it depends on the blatant denial of one’s right to life, liberty, the enjoyment of the fruits of one’s labor, and the pursuit of happiness. This perspective needs to be challenged, but not without offering an alternative, one based on the fundamental notions of justice upon which this country was built. The N.C. Constitution points us in that direction by recognizing that the right to one’s income is a fundamental right. And to the extent that that right is violated an injustice, an unfairness is perpetrated.