- Critics claim that benefits from North Carolina’s income tax cuts of the past decade have been concentrated largely at the top of the income brackets

- The data, however, show that everyone is benefitting, the poorest most of all

- Despite critics’ warning to the contrary, state revenues are soaring, and North Carolina is at the top of the list for inbound migration

Who has really been benefitting from North Carolina’s income tax cuts for the past decade? According to some, it’s been a classic case of the wealthy reaping all the benefits while the working class foots the bill. But the data say we’re all seeing the benefits, the poorest most of all.

NC Newsline editor Rob Schofield recently ran an article accusing the North Carolina General Assembly of having “fraudulent tax policies.” In the article, Schofield argued that the state legislature has been cutting taxes for over a decade now, but that those cuts have been concentrated among the wealthy and that lower-income North Carolinians have seen little impact from those cuts.

Schofield was reporting on a study by the left-leaning Institute on Taxation and Economic Policy (ITEP), which found that the poorest fifth of North Carolinians pay on average 10.5 percent of their income in state tax, while the middle quintile pay 9.3 percent, and the top 1 percent pay only 6 percent.

But right off the bat, those are misleading numbers for the arguments Schofield is making. The ITEP study looked at all state and local taxes, including sales taxes, which are based on consumption, not income. If you spend your entire income, then most or all of that income will be subject to income and sales taxation. On the other hand, if you spend only a portion of your income, then only the portion you spend will also be subject to sales tax. Remember, the income tax in North Carolina is a flat rate across all income levels.

For that reason, it should be no surprise that lower-income taxpayers — who devote much more of their incomes to spending — pay more of a percentage of their income in sales taxes. So when sales taxes are included, they would end up paying the higher overall percentage of their income in taxes.

But the ITEP study also left out the value of government benefits like Medicaid and food stamps that low-income households receive, therefore skewing the results of their survey to make the low-income households’ tax burden look worse than reality.

Moreover, Schofield used those statistics to argue that our tax system is heavily tilted in favor of the rich and that the General Assembly is responsible for it because of income tax cuts — despite their own flawed data placing the blame largely on the sales tax.

Thankfully, the state’s annual financial statements provide very useful data for this very discussion.

As the above table shows, “the rich” are paying a larger share of the state’s income tax burden a decade after the beginning of the tax reforms, which critics like Schofield had said would shift the burden onto the backs of the poor. For instance, the top 1.1 percent of filers paid 21.1 percent of taxes in 2021, up from 19.8 percent in 2012.

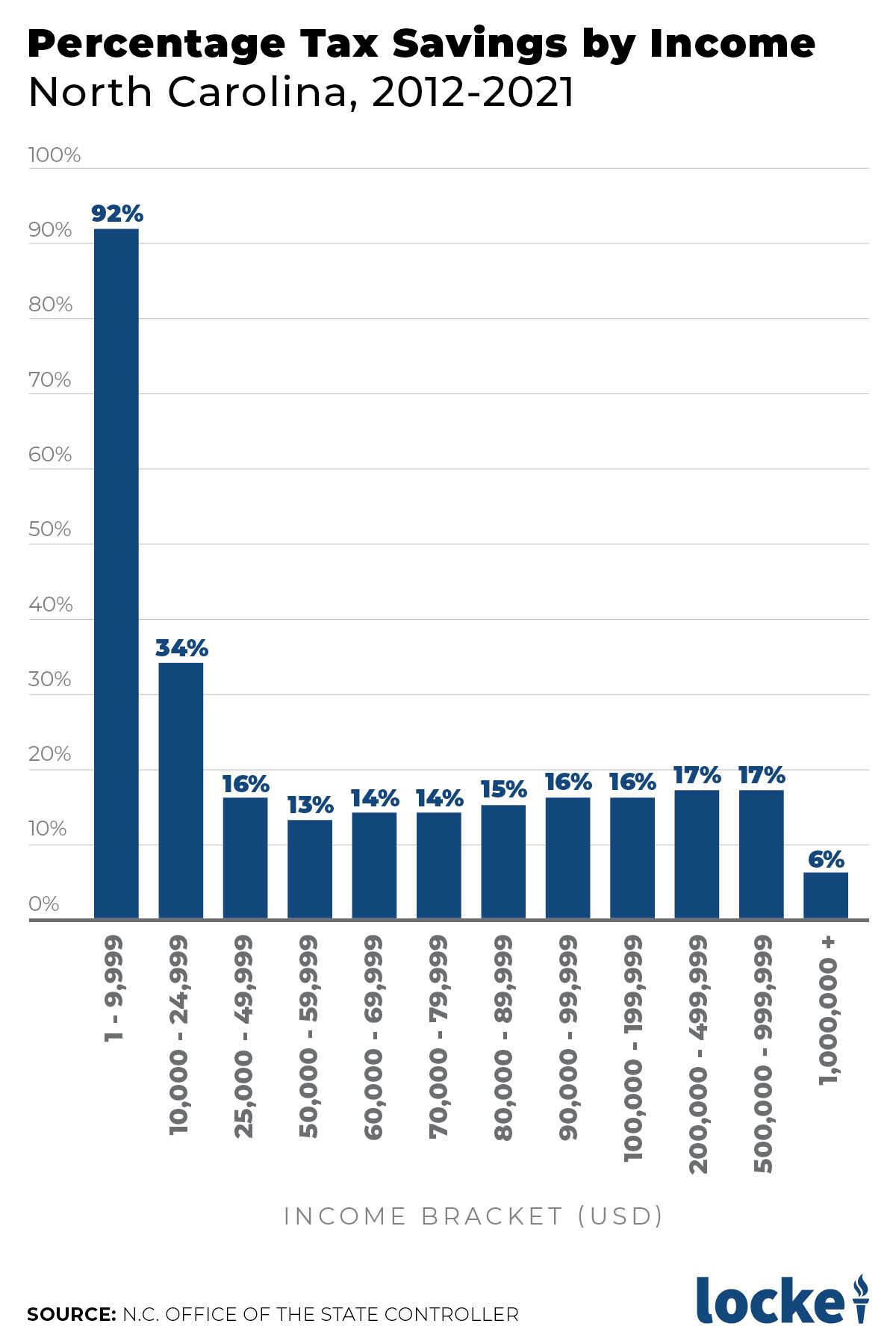

The reality is that the General Assembly has actually spread the tax savings across all brackets. A look at the data from the state shows that, when it’s broken down on a per-return basis, every single income bracket saved double-digit percentages except those with non-positive Federal Adjusted Gross Income (FAGI) (non-positive FAGI occurs when someone has deductions in excess of income — typically a business owner or investor with significant losses) and those with over $1 million in income.

For example, a look at the below table of tax returns by income on a per-return basis shows that a taxpayer with under $10,000 in income would have paid an average of $50 in 2012, but only $4 in 2021.

For 2018 to 2022, the US Census Bureau reported that the median household income for North Carolina was $66,186 (in 2022 dollars). A family earning the median household income of $66,186 would have seen a decrease in their state income tax burden of about 13.5 percent, or $320 on average.

The data showed that the tax savings for households earning from $50,000 in income and up did have a slightly regressive nature, meaning that the percentage of tax savings increased slightly as income rose. But income tax savings in the double digits is an excellent move in the right direction that the General Assembly has championed for over a decade and what their tax reforms delivered to every tax bracket except the very top.

Indeed, as shown in the following chart, the lowest tax bracket received an average tax reduction of 92 percent, and the second-lowest received an average reduction of 34 percent. Those reductions were far more significant than the 6.2 percent and 17.5 percent reductions received by the highest two tax brackets. The reality of these reductions is exactly the opposite of what one would expect if Schofield’s narrative were true.

There could be common ground in addressing whether lower-income taxpayers are still paying too much in taxes. The data from the ITEP’s study show, however, that most of the regressivity is not from the income tax, but the sales tax. To be clear, discussing a sales tax reduction would be welcome; even a sales tax rebate, similar to that proposed under the Fair Tax would be a proposal worth considering.

Strangely, however, it seems that when opponents like Schofield complain about the legislature’s tax policies harming low-income taxpayers, their solution is rarely that rates need to be cut on low-income taxpayers, but only that they must be raised higher on the wealthy.

This raises another question: should taxes be raised on the wealthy? The state’s $3 billion surplus over fiscal year 2022–23 suggests that revenues are doing just fine. Despite all the pontification about tax rates from either side, another metric speaks volumes about North Carolina’s tax levels: inbound migration. The surest way for people to express their approval or disapproval is by voting with their feet, and the results are overwhelmingly clear that North Carolina’s policies are working. People across the U.S. are moving to low-tax states, and North Carolina was number 3 for inbound migration in 2023.

In all, North Carolina’s tax climate is a far cry from where it was in 2012, and this fact should be celebrated by all North Carolinians. Every single income bracket has saved significant amounts of money in taxes, most of which saw comfortable double-digit savings percentages, which has undoubtedly led to much of the economic and population booms North Carolina has seen as millions have flocked to the state, bringing their checkbooks with them. The General Assembly should keep up the good work and continue pressing for more conservative economic reforms.