- Model legislation known as the “Only Pay for What You Get” Act would let utilities earn a profit on only the reliable portions of power plants

- Analysis showed that, given current expansion plans, Only Pay would result in substantial savings for North Carolinians

- Under Only Pay, the utility would favor more reliable power generation — which would restore its profitability, boost reliability, and still keep overall rate increases down from not overbuilding unreliable capacity

The previous research brief introduced model legislation to better align the interests of utilities with their customers regarding new power plants. It explained that, with utilities guaranteed full cost recovery and profits from building new power plants regardless of their reliability and productivity, the current incentives structure promotes overbuilding intermittent solar and wind, portending rapidly increasing power bills.

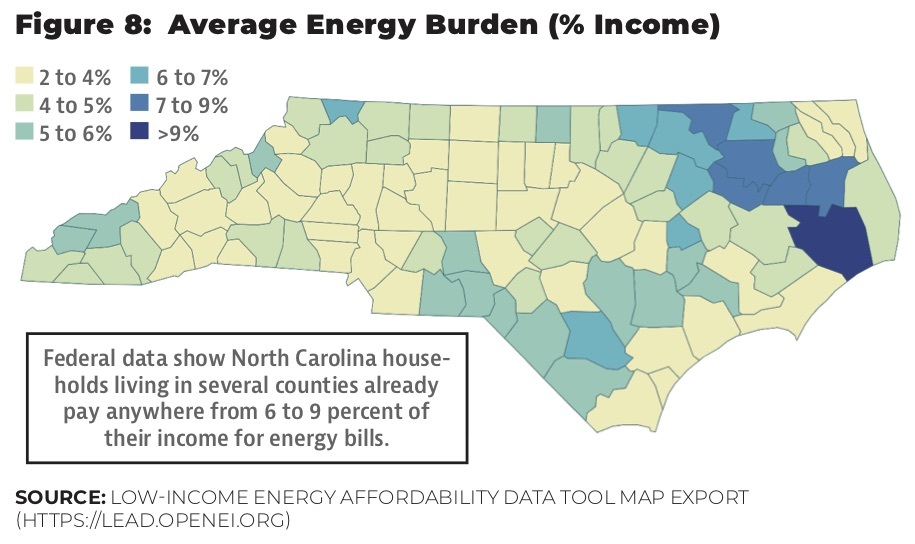

The problem is obvious. Electricity is a basic household need, and energy poverty is already a problem.

The model “Only Pay for What You Get” Ensuring Reliable and Affordable Electricity Act would change this structure to promote reliable productivity and keep power bills from large rate hikes from the utility overloading on unreliable power sources. It would do so by letting utilities earn a profit on only the reliable portions of power plants. Since reliability values vary significantly among power plants, with zero-emissions nuclear having the highest and solar and wind the lowest, under Only Pay utilities would have financial incentive to build more reliable power plants.

As proposed by Isaac Orr and Mitch Rolling of Center of the American Experiment, Only Pay would more faithfully uphold the least-cost and reliable principles in North Carolina utilities law. Orr and Rolling demonstrated how it could save North Carolinians on electricity bills.

How Only Pay Would Work in North Carolina

Orr and Rolling did extensive modeling of North Carolina electricity cost and reliability impacts for the John Locke Foundation’s Center for Food, Power, and Life in comments presented to the North Carolina Utilities Commission analyzing Duke Energy’s Carolinas Carbon Plan scenarios and presenting a least-cost decarbonization scenario.

Using their analysis of Duke’s proposed Portfolio 1 (out of four), Orr and Rolling showed how Only Pay could protect North Carolina electricity consumers “from paying for assets with a low capacity value,” thereby warding off significant power bill increases. While acknowledging that Duke has updated its proposals since, they showed how different the costs to electricity consumers would be with and without Only Pay principles.

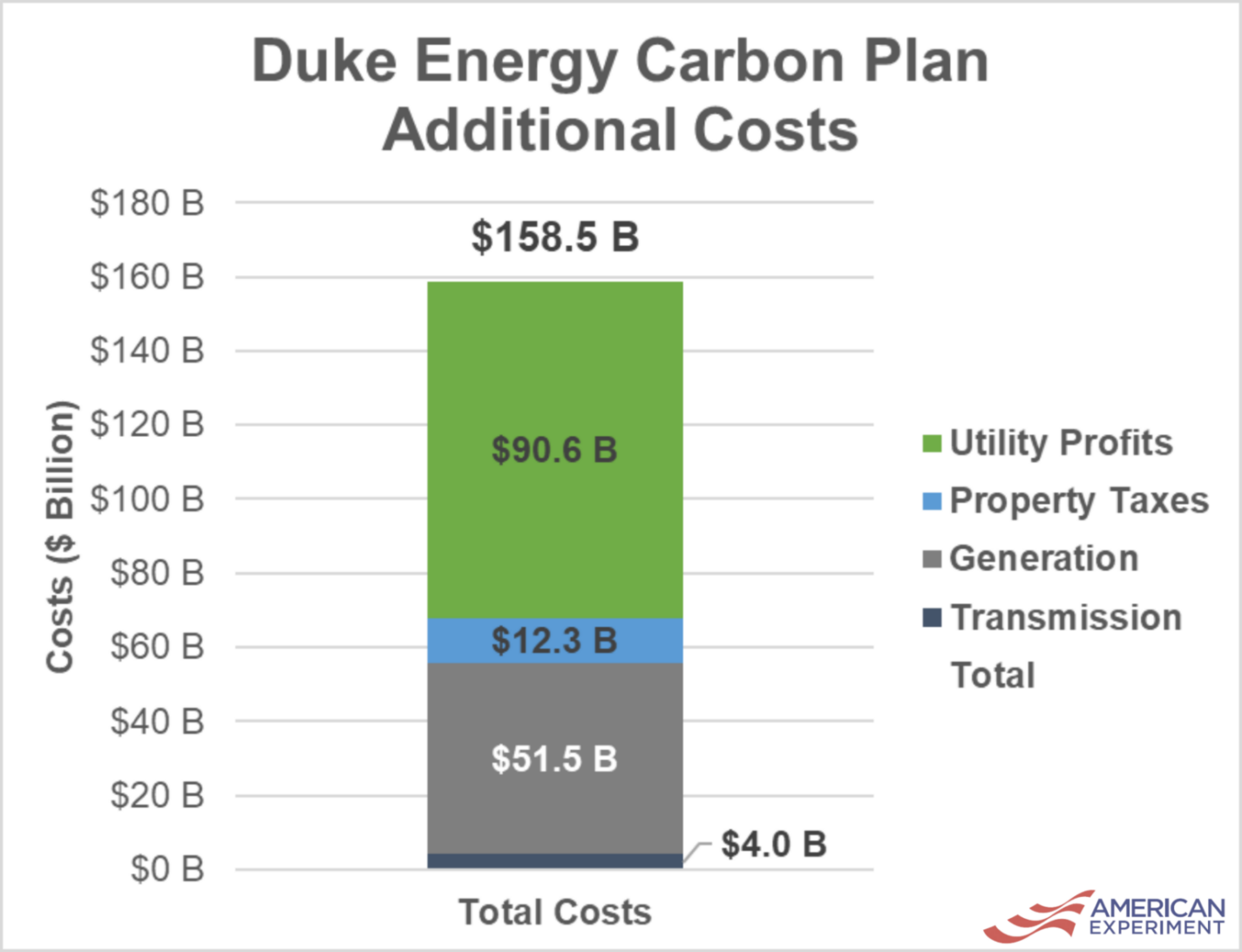

Along with retiring all 9,300 megawatts (MW) of coal-fired capacity, Duke’s Portfolio 1 by 2050 would have relied on overbuilding a lot of intermittent solar and wind, adding 19,900 MW of solar, 1,800 MW of onshore wind, and 800 MW of offshore wind, along with 7,400 MW of battery storage, 2,400 MW of combined cycle natural gas, 6,800 MW of combustion turbine natural gas/hydrogen, 9,900 MW of nuclear, and 1,700 MW of pumped storage. Orr and Rolling estimated that all that new installed capacity would cost $158.5 billion through 2050.

The largest expense of that portfolio would be utility profits — $90.6 billion (57 percent).

Source: Orr and Rolling

As Orr and Rolling explained, where Duke would earn the most in profits would be on “new nuclear plants, solar installations, battery storage facilities, and wind facilities.”

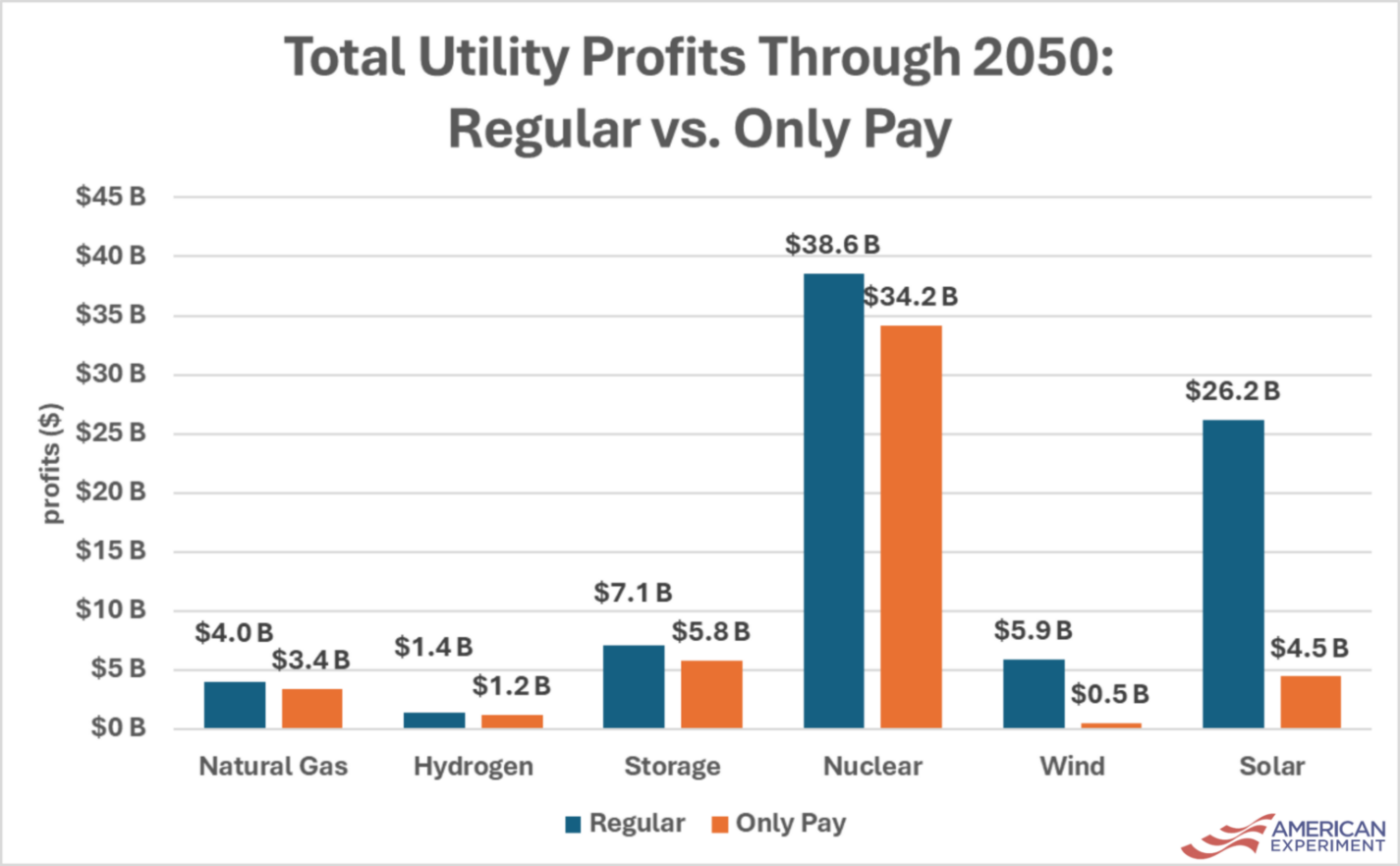

Under Only Pay, however, Duke’s expectations for profits would “shift substantially.” Since Only Pay would allow Duke to recover costs on only the reliable portions of assets, it means that Duke would be able to recover only “30 percent of the cost of solar, 15 percent for its onshore wind facilities, 30 percent for its offshore wind facilities, 90 percent for storage, and 90 percent for its thermal power plants.”

Assuming no change in building plans, then, under Only Pay “utility profits would drop by 28 percent to $65.3 billion through 2050.” Their graph showed the difference:

Source: Orr and Rolling

As they explained,

Profits earned on building 9,900 MW of nuclear would fall from $38.6 billion to $34.2 billion, reflecting nuclear’s high capacity value. Profits from building 19,900 MW of solar and solar plus storage would fall from $26.2 billion to $4.5 billion due to solar’s lower capacity value, and onshore and offshore wind profits would fall from $5.9 billion to $0.5 billion, resulting in substantial savings for North Carolina electricity consumers.

Given Only Pay’s change to the incentive structure, however, the utility would likely alter its building plans to favor more reliable power generation — which would restore profitability, boost reliability, and still keep overall rate increases down by not having to overbuild unreliable capacity.

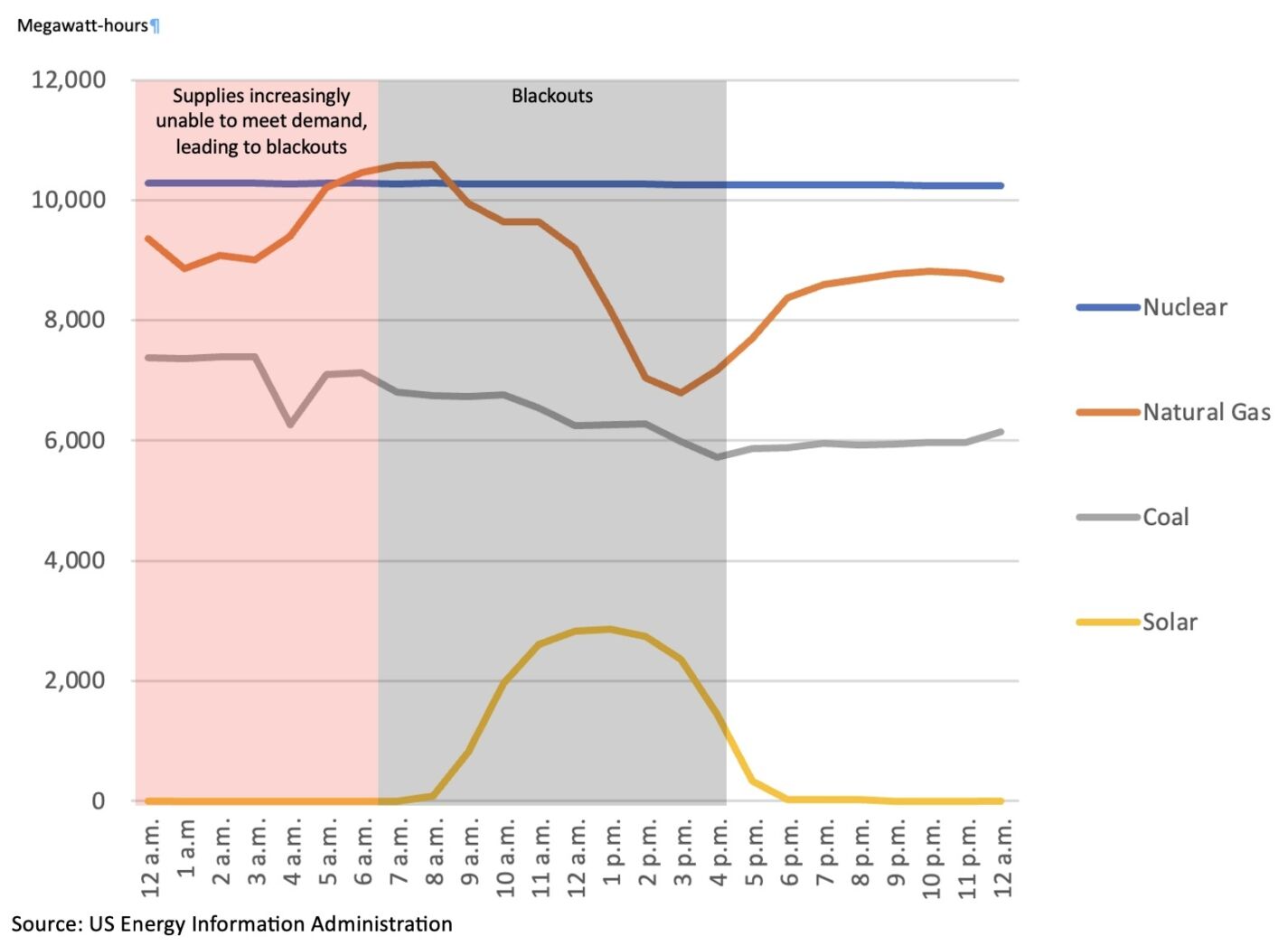

Orr and Rolling point out the importance of that change: “North Carolina has a winter peaking system. Winter peak electricity demand generally stems from home heating, which almost always occurs at night when temperatures are lowest and the sun isn’t shining.”

They referred to the Christmas Eve rolling blackouts of 2022 as an example of reliability problems for a winter peaking system. Bitter cold temperatures overnight caused electricity demand to spike, but technical problems at some coal and natural gas facilities combined with a loss of expected outside power purchases. Solar was incapable of helping because it was overnight. Supplies unable to meet demand led to the blackouts beginning at 6 a.m.

Timeline of the Christmas Eve 2022 Blackouts

Hourly electricity generation of Duke Energy Carolinas and Duke Energy Progress, select generation sources

Orr and Rolling noted that “solar, by definition, will not be available during future winter peaking events that will only become larger if the state experiences growing electricity demand for a growing population and vehicle electrification.” Only Pay would help avert this increasing risk:

By encouraging utilities to build more reliable and dispatchable nuclear and natural gas power plants on their systems, Only Pay will help prevent power outages caused by the inherent weaknesses of intermittent generation resources like wind and solar, which are currently the darling technologies of the energy transition.

Conclusion

Bad policy choices and an incentive structure favoring overbuilding unreliable solar and wind have North Carolinians facing a potential doubling of their power bills in the near future. To preserve least-cost and reliable power for people, the North Carolina General Assembly needs to take action.

The legislature should not only require that “any retiring source of baseload power generation be replaced with an equal or greater amount of new baseload generation,” but also find a way to align utility incentives with people’s great need for least-cost and reliable electricity. The Only Pay for What You Get Act offers a promising reform to do just that.

See previous: