- Under current law, a power utility in North Carolina can expect full cost recovery and profits on building new power plants, regardless of their reliability

- This structure incentivizes overbuilding the least reliable power sources, quickly raising rates on people

- New model legislation called “The Only Pay for What You Get Act” would let utilities earn a profit only on the reliable portions of new power plants, realigning incentives with people’s need for least-cost and reliable power

The previous research brief laid out the reasons behind North Carolina’s rising electricity costs. They stem from bad policy choices and incentives (read the brief for explanations):

- Closing down working power plants and building new ones

- Having to build even more new power plants to account for expensive policy choices

- Legally guaranteeing utility shareholders a profit for building new power plants

- Dealing with different productivities of various generation sources

- Needing to overbuild solar and wind plus construct their necessary backup power sources

- Powering up perverse incentives over least-cost and reliable electricity

In North Carolina, an electricity customer is given no choice in electricity provider and is therefore captive to whatever rate his monopoly provider gets to charge. Rapidly increasing power bills is not only obviously unjust, but also they run counter to the very idea behind the requirements in North Carolina law of least-cost and reliable electricity.

Those requirements are less protective than they would seem, however, when state policymakers create a need for more building (items 1 and 2), especially when their political preferences and their policies and incentives promote building expensive, unreliable sources that require overbuilding (item 5), given that all those costs are ultimately placed on electricity customers (item 3).

As the brief acknowledged, this problem requires action from the North Carolina General Assembly, and not just to enforce the least-cost and reliable guardrails. One way would be to adopt the top energy policy recommendation in the John Locke Foundation’s “Policy Solutions”:

Require that any retiring source of baseload power generation be replaced with an equal or greater amount of new baseload generation, commensurate with increased electricity demand.

Going further, however, the General Assembly “needs to find a way to align incentives in electricity provision with longstanding law — and people’s expectations — of least-cost and reliable service.”

Only Pay for What You Get

Smart new proposed legislation called the “Only Pay for What You Get” Ensuring Reliable and Affordable Electricity Act could provide that way. As proposed by Isaac Orr and Mitch Rolling of Center of the American Experiment, the Only Pay for What You Get Act would tie electricity costs to the proven reliability of a power plant, not merely its existence in the utility’s portfolio.

Orr and Rolling explained the problem their legislation would address:

A fundamental problem with the vertically integrated monopoly utility model is that utilities can recover the full cost of an asset, plus a five to ten percent rate of return, regardless of whether that asset contributes to grid reliability. … [T]his arrangement has allowed utilities to make billions building unreliable wind and solar facilities and the generators to back them up.

Only Pay “would protect electricity customers by only allowing utilities to earn a profit on the reliable portion of a power plant,” Orr and Rolling said (emphasis in original). “We believe this change would introduce important market signals to a utility planning process that lacks them.”

Only Pay “would protect ratepayers from paying billions of additional dollars for assets that may not show up when needed most.”

Under this reform, the more reliably productive the generating source, the more of its costs could be placed in the rate base for the utility to recover. It would overturn the current utility expectation of being able to recover 100 percent of the costs of new generating assets and earn a profit on them regardless of how reliable they are. That expectation incentivizes building more, which means building the least reliable sources, which entails more building of backup generation and redundancy, too (good for utility profits, but not for electricity customers).

The principle of Only Pay for What You Get would change the financial incentives from overbuilding expensive intermittent power sources to that of building reliable power sources. This change would obviously benefit captive ratepayers by promoting reliability and preventing huge, overbuild-based rate hikes.

Reliability Values and Generation Resources

Of course, Only Pay would need a proper way of measuring reliability in order to work. Fortunately, utilities already have that. Orr and Rolling explain that “each type of power plant offers a different reliability value to the grid during times of peak electricity demand” that are used “to determine whether there are enough reliable power plants on their system to meet their projected peak demand, plus a margin of safety.” (emphasis in original)

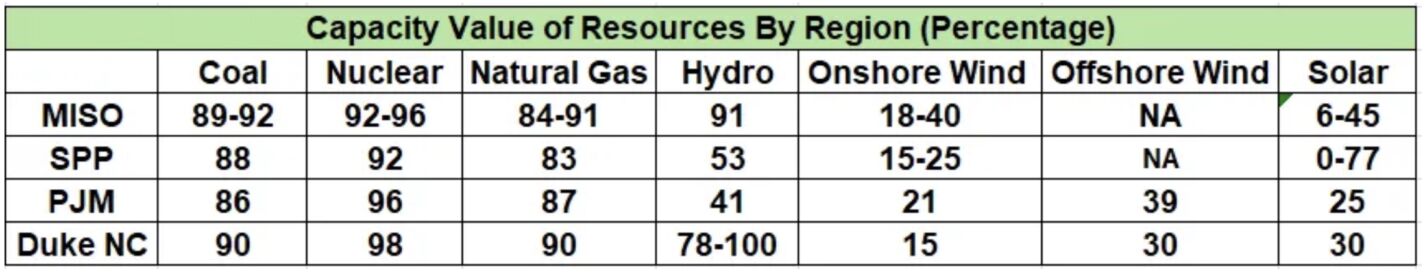

Here are the capacity values of different generation sources as given by different Regional Transmission Organizations (RTOs) and also Duke Energy:

The Only Pay for What You Get Act would use each source’s measured capacity value — what Orr and Rolling call the reliability value (i.e., “What You Get”) — to provide the percentage (the “Only” in “Only Pay For”) of its capital costs that can be charged to electricity customers on their bills.

For Duke, it would mean that 98 percent of new nuclear’s costs could be charged to customers, 90 percent of natural gas, but only 30 percent of solar and offshore wind, and just 15 percent of onshore wind. The utility would shoulder the remaining costs.

Under this reform, “utilities would only be able to earn a profit on the reliable portion of the asset.” Their profit would be “high” for zero-emissions nuclear, natural gas, and hydropower but “lower for wind and solar to reflect the lower reliability value they provide to ratepayers.” This change, Orr and Rolling write, “would also bring the incentives of ratepayers and shareholders into better alignment.”

Importantly, Only Pay “would not prevent any company from building wind or solar, but it would protect ratepayers from paying billions of additional dollars for assets that may not show up when needed most.”

This reform would place the risk of building intermittent resources on the utility in like proportion to their unreliability. Electricity customers would not be charged for the proportion of power plants that can’t reliably generate power.

Only Pay would make the most reliable power plants the safest investments, including zero-emissions nuclear, nearly all the costs of which could be put into the rate base. By incentivizing reliable productivity and not penalizing customers for overloading on unreliable power sources, it would uphold the principles of reliability as well as least-cost.

The next research brief in this series will discuss the proposal even further and show how it would save North Carolinians money.

See previous: “Rising Power Bills Stem from Bad Policy Choices and Incentives”

Next: “How ‘Only Pay for What You Get’ Would Help North Carolina Electricity Customers”