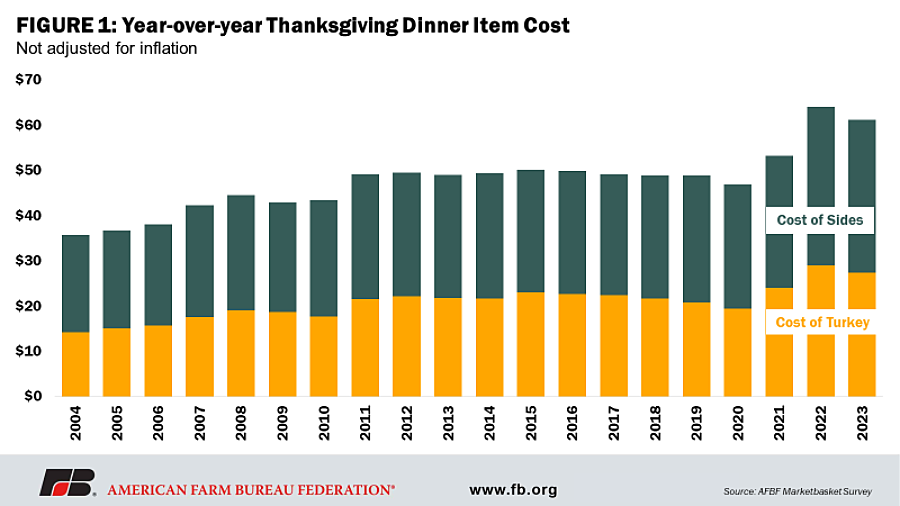

The price of a classic Thanksgiving feast for 10 people in the U.S. is estimated at $61.17 this year, marking a 4.5% drop from last year’s record highs according to an annual study done by the American Farm Bureau. Despite this decline, it’s important to note that this cost is still a staggering 25% higher than what it was back in 2019. The main contributor to this meal cost is the 16-pound frozen turkey, constituting 45% of the total expense at $27.35, a decrease of 5.6% from the previous year. While some items like whipping cream, cranberries, stuffing, and frozen peas have slightly decreased in price, others such as pumpkin pie mix, dinner rolls, and sweet potatoes have seen modest increases.

The regional differences in Thanksgiving meal expenses are notable, with individuals in the Northeast facing the highest average cost of $64.38 while those in the Midwest spend the least at $58.66. These price variations stem from a mix of factors including disruptions in supply chains, challenges in production due to avian influenza affecting turkey prices, weather-related impacts on crop yields, and escalating transportation and packaging costs.

Inflation remains a significant driver behind increased food prices, with consumer prices witnessing a 3.7% rise compared to the previous year, following a notable 9.9% increase in 2022. This inflation trend surpasses the Federal Reserve’s 2% target, particularly affecting food prices, which have surged beyond the set benchmark. Grocery prices have experienced a 2.1% uptick in the current year as of October, attributed to rising feed and fertilizer costs, supply chain disruptions, and an uptick in extreme weather events.

The correlation between increased government spending and inflationary pressures is a significant consideration. Heightened government expenditure can stimulate demand, potentially leading to inflation by bolstering consumer purchasing power. This relationship between elevated government spending and inflation is a key element in various economic models and theories. When government spending outpaces tax revenue and borrows funds to cover the deficit, it pumps more money into the economy, potentially driving up prices. While the deficit has decreased in the past year by 24% it still remains concerningly high, sitting at over $65 billion.

To counter the impact of escalating food costs, consumers can adopt various strategies. These include shopping closer to Thanksgiving for potential discounts, opting for items with lower prices or seeking cost-effective alternatives, and considering seasonal price fluctuations when planning their meals. Fresh produce, like cranberries and lettuce, might offer better value compared to canned goods due to price differentials. Consumers can anticipate price drops for certain items, such as sweet potatoes, as grocers vie more aggressively for shoppers’ dollars closer to Thanksgiving.

Retailers historically offer substantial turkey discounts in the lead-up to Thanksgiving to lure more shoppers into their stores, using these discounts as “loss leader” items to attract more sales and potentially generate higher profits from additional purchases made by shoppers enticed by discounted turkeys.

The reduction in turkey prices this year is attributed to increased production due to a decrease in avian influenza cases and decreased input costs such as reduced rates for refrigerated trucks transporting supplies across the country. Consequently, consumers may witness even more enticing turkey deals throughout November.

In essence, while the cost of a Thanksgiving meal has slightly declined compared to the previous year, it still stands significantly higher than pre-inflation levels from 2019. The intricate interplay of factors like supply chain disruptions, production hurdles, and inflation pressures contributes to these fluctuations. Understanding these dynamics and implementing savvy shopping strategies can assist consumers in navigating the complexities of rising food prices during the holiday season.