As inflation continues to steam ahead, more consumers are turning to debt to stay afloat. Whether this is out of necessity or fiscal missteps, the fact remains: dollars are not going as far. Workers’ paychecks are being stretched and some are relying more on lines of credit.

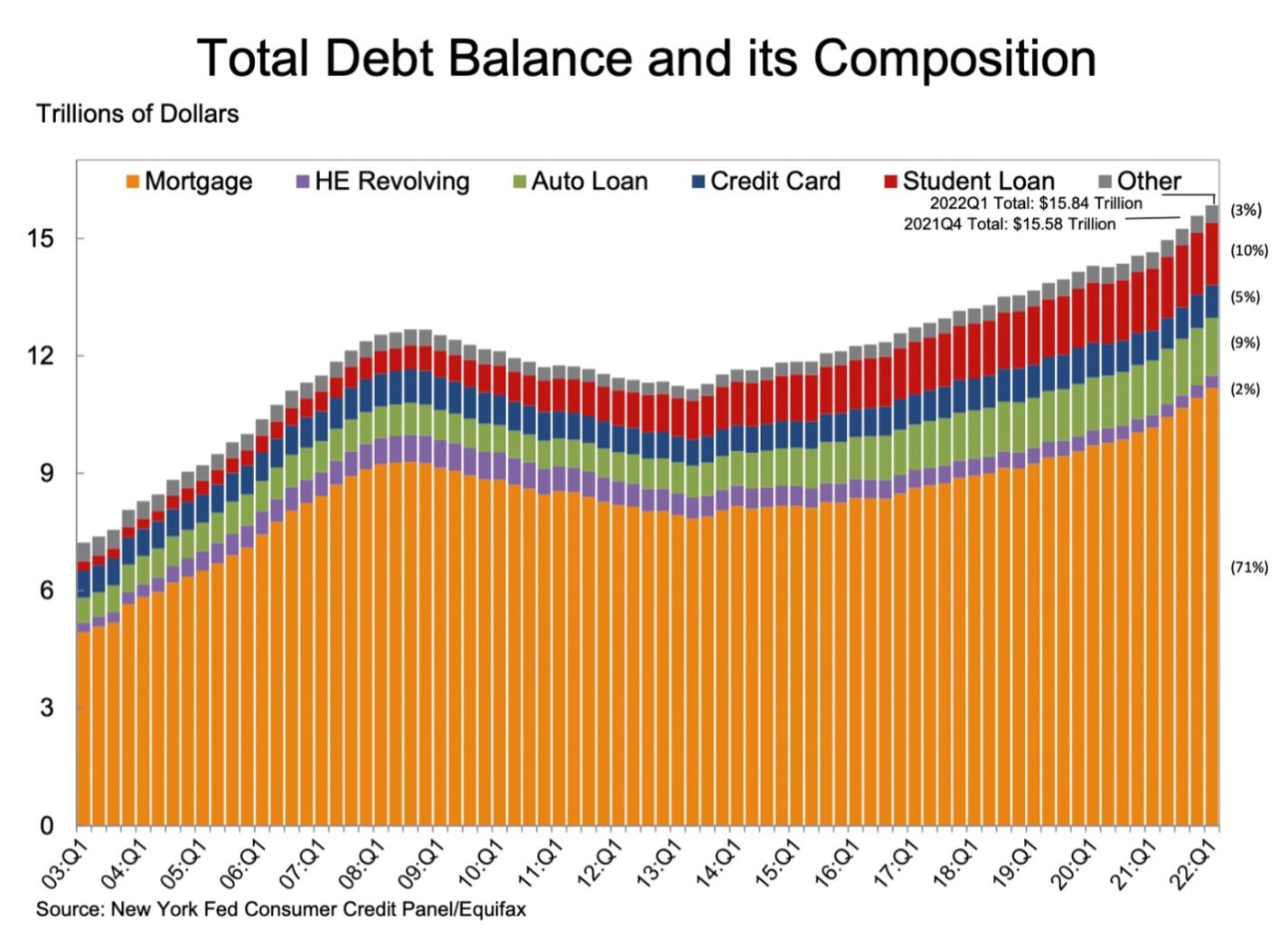

Household debt increased 1.7%, or $266 billion, in the first quarter of 2022 according to the latest data from the Federal Reserve Bank of New York. Total household debt is now $15.84 trillion total, $1.7 trillion higher than pre-pandemic levels. Most of this debt comes from mortgages, followed by student and auto loans and credit cards.

The first quarter of 2022 saw $859 billion in new mortgage debt.

Credit card balances alone are $71 billion higher in the first quarter of 2022 than the same period in 2021. Auto debt increased $87 billion over the year.

With gas prices at record highs, gas is taking up a higher percentage of credit card spending, crowding out other purchases or spilling over into debt.

Consumers will see higher interest payments on cars, mortgage, and credit cards as the Federal Reserve increases rates. Those already in debt will be hit hardest.

With personal savings tanking, it is clear some households have hit a wall.

Unfortunately, these financial woes affect more than your wallet. A survey from the American Psychological Association found that 87% of Americans say today’s rise in prices is a significant source of stress. Money stress overall is at the highest level since 2015.

American families are struggling with real problems and deserve real solutions. Working families must be able to put food on the table and gas in the tank without going into debt.

It’s no surprise that Washington, mired in its own debt that exceeds GDP by more than 125%, is offering little help.

In President Biden’s tone-deaf op-ed last month, he touts a Federal Reserve survey and claims, “families have increased their savings and have less debt,” misleadingly referring to a survey from the end of 2021 that leaves out the last several months of skyrocketing inflation and soaring household debt.

Just last week in a White House press conference journalist Peter Doocy asked an important question (11:55 on this YouTube clip): “What is the President’s message to somebody who might want to retire but their 401(k) is getting wiped out?”

Biden’s press secretary responded, “We know that the — that high prices are having a real effect on people’s lives. We get that.”

She continued, defensively: “But we are coming out of the strongest job market in American history, and that matters. And that — a lot of that is thanks to the American Rescue Plan, which only Democrats voted for that — Republicans did not — and it led to this economic boom — this historic economic boom that we’re seeing with jobs.”

Are you feeling the historic economic boom?