- Since 2016, the federal government has massively subsidized renewable sources of electricity — with wind receiving nearly 20 times more subsidies per unit of power generated than nuclear, and solar receiving nearly 100 times more

- The Biden administration boasts that incentives and credits for renewable energy under the Inflation Reduction Act will save people $38 billion in power bills

- Even if that were possible, energy research firm Wood Mackenzie has estimated that those incentives and credits could cost people in their role as taxpayers much, much more: nearly $3 trillion

This research brief continues the discussion started in the previous brief on cost issues of different electricity generation sources. It will consider more issues of cost with an understanding that taxpayers and electricity consumers are the same people, however novel the idea may seem to media and politicians. It will take a more comprehensive view of costs than merely that of new plant construction with federal subsidy offsets.

Federal subsidies by source

If you pay a monthly membership fee to join a gym, do you maintain that each visit to the gym is free? If your Airbnb rental is $100, but taxes and cleaning fees add another $100, do you still say your stay cost you $100? No. You may be paying for something in different roles, but you’re still the same person paying.

The same principle must apply to electricity generation sources. As already discussed, different sources have different building and operating costs. But they also get vastly different levels of subsidies from the federal government, as a recent report from the U.S. Energy Information Administration showed.

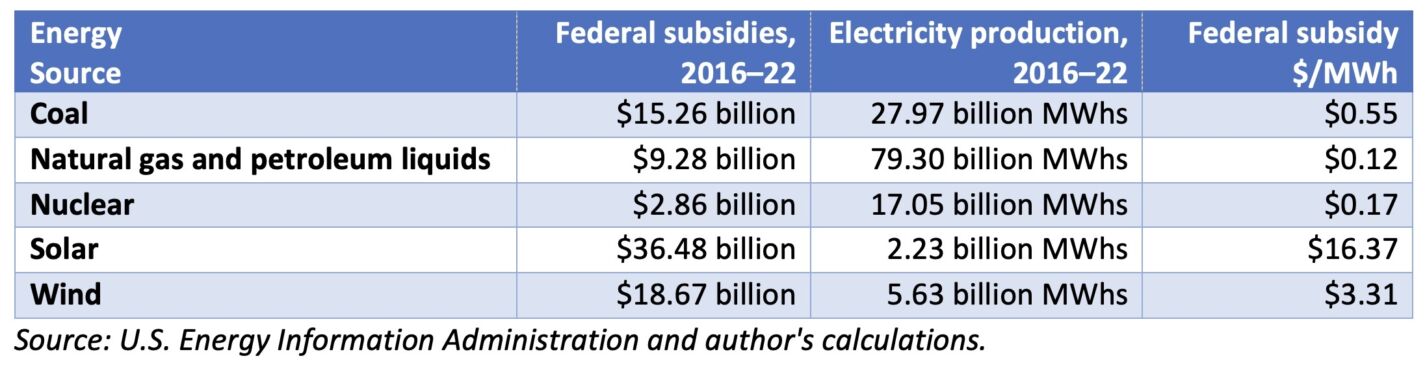

The report listed direct expenditures, tax expenditures, and spending on research and development from the federal government by energy source from 2016 to 2022. It also gave the energy production from those sources in those years.

Since 2016 wind power has received nearly 20 times more federal subsidies per unit of power generated than nuclear, and solar has received nearly 100 times more than nuclear.

Those data allow us to see not only how much taxpayers have been made to spend per energy source (on the federal level), but also how much productivity they have bought. That means we can learn how much productivity per subsidy dollar each source provides — about as close to a “bang for your buck” measure you can get.

Energy Bang for Your Buck:

Federal Subsidies and Productivity by Electricity Generating Source, 2016–2022

It is often assumed that the federal government gives more money to coal, natural gas, and nuclear than to intermittent renewable sources (solar and wind). The federal government’s report should put that misconception to rest. From 2016 to 2022, wind received more federal subsidies than either nuclear, natural gas, or coal. Solar received more federal subsidies than nuclear, natural gas, and coal combined, and by a comfortable margin.

At the same time, however, solar and wind produced mere fractions of what those other sources produced. So in terms of bang for your buck, federal taxpayers were getting one megawatt-hour (MWh) of production for pennies on the dollar from nuclear (17 cents), natural gas (12 cents), and coal (55 cents). But each MWh of production from wind cost federal taxpayers well over $3 — and each MWh of production from solar cost well over $16.

Huge increase in subsidies from the Inflation Reduction Act

In 2022, Congress passed Pres. Joe Biden’s signature legislation, the Inflation Reduction Act (IRA). Among other things, the IRA greatly increased federal incentives for intermittent renewable sources, offering $369 billion in incentive and tax credits purported to last for 10 years.

As typical with massive spending bills, however, the actual costs of the IRA are blowing up well beyond what voters were told they would be. How much the IRA will cost taxpayers at final reckoning is currently a matter of speculation by firms specializing in data analytics and risk management.

According to the Biden administration, one “impact” of the IRA is that it will “Save American families up to $38 billion on electricity bills” by “promoting clean, cost-effective electricity,” “reducing electricity bills” on the simplistic scan that “wind and solar are cheaper to operate once they’re built; unlike gas and coal plants, there are no fuel costs.”

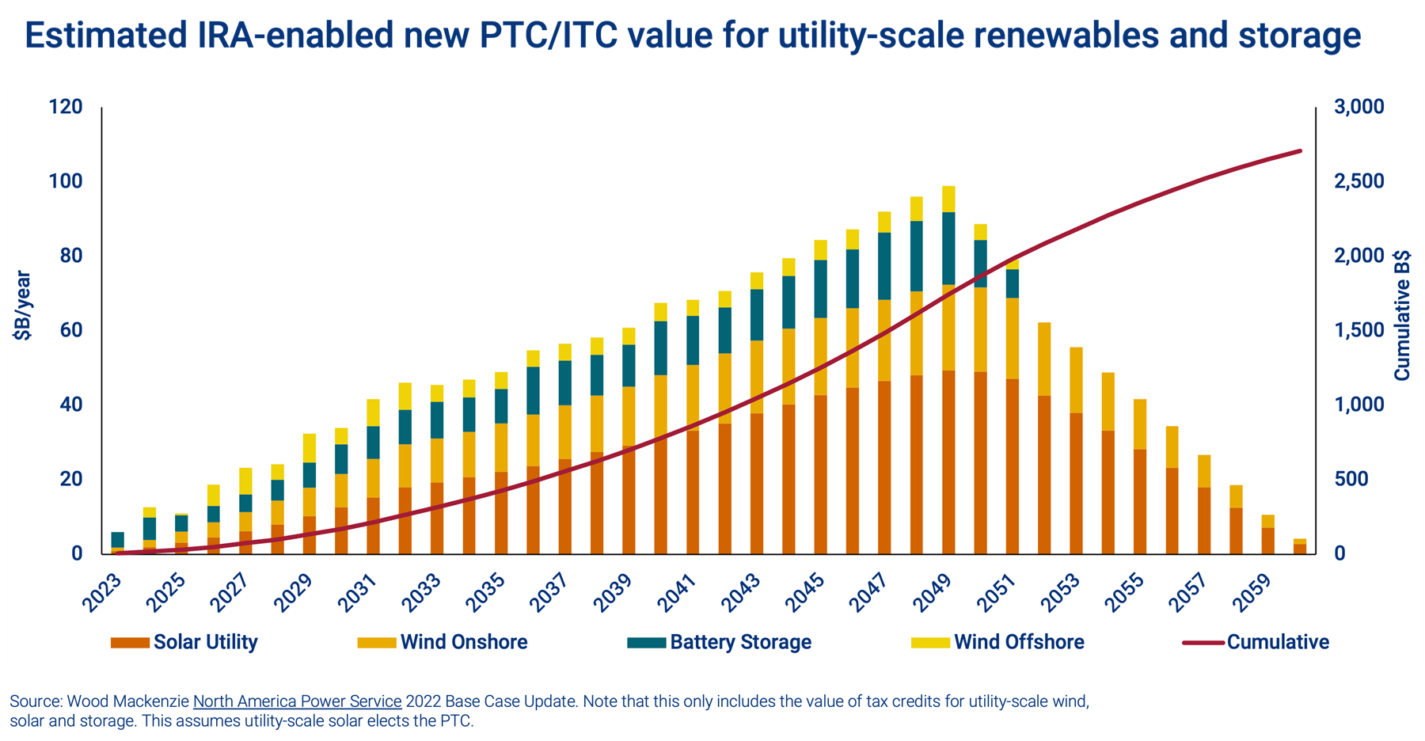

Even if the IRA will save people $38 billion on power bills, as the Biden administration wants you to believe, energy research firm Wood MacKenzie projects it would ultimately cost taxpayers $3 trillion in renewable energy subsidies.

The previous brief discussed the obvious fact that fuel costs are far from the only costs of power plants, and even MIT’s Climate Portal acknowledged that wind and solar make electricity more expensive. Nevertheless, let us assume for the sake of argument that the IRA would result in lowering our electricity bills by $38 billion. Would it mean our electricity costs had gone down by $38 billion?

The answer is an emphatic NO. At $369 billion, even the original cost to taxpayers of IRA clean energy subsidies was roughly ten times the amount of supposed savings on electricity bills. Only Pollyannas and propagandists would call One step forward, ten steps back progress.

In April 2023 the Joint Committee on Taxation (JCT) offered a higher estimate of $515 billion (i.e., 14 steps back). That same month Goldman Sachs estimated that the amount of incentives could reach $1.2 trillion (32 steps back).

Most recently, energy research firm Wood MacKenzie projected that the cumulative cost of IRA tax credits for utility-scale renewables and storage would be somewhere between $2.5 trillion and $3 trillion (66–79 steps back).

Energy economist Travis Fisher noted that the Wood MacKenzie estimates were based on their reading of the IRA language that the renewable energy tax credits could be extended indefinitely. Only repeal could stop it, the analysts stated, otherwise “instead of several hundred billion dollars in tax credits for new renewables and storage through 2032, the real money on the table is on the order of trillions of dollars over multiple decades.”

Fisher asked:

Did policymakers mean to subsidize low‐GHG [greenhouse gas] electricity production to the tune of $50–100 billion per year, ad infinitum — easily $2.5–3 trillion or more when all is said and done? Maybe not, but we’ll find out if policymakers want to keep accruing them when these costs start piling up.

Conclusion

The Public Staff of the North Carolina Utility Commission is already warning of power bills potentially doubling by 2030, in no small part because Duke Energy is being made to add so much new solar generation to their grid — and make significant changes to the grid to allow for interlinking so much new solar — while shutting down a large amount of (low-cost) baseload coal-fired power plants.

Higher power bills aside, the federal government has spent years massively subsidizing renewable sources of electricity. For example, wind received nearly 20 times more subsidies per unit of power generated than nuclear did, and solar received nearly 100 times more. Those rates will only worsen under the IRA.

Nevertheless, the impact of the IRA’s tax credits is having the desired rhetoric effect of politicians and pundits arguing that heavily subsidized sources are somehow “cheap.” Since we fill both roles, taxpayers and power customers, we know better.